ZeroMarkets Review 2026: Spreads, Fees, Platforms & Verdict

Honest ZeroMarkets review for 2026. We break down ASIC regulation, Super Zero spreads from 0.0 pips, MT4/MT5 platforms, copy trading, and VPS compatibility.

ZeroMarkets in 2026: What Traders Actually Need to Know

Picking a forex broker shouldn’t feel like gambling. You want tight spreads, solid regulation, and a platform that doesn’t choke when volatility spikes. ZeroMarkets has been operating since 2017, and they’ve built a reputation around raw pricing and Australian regulatory oversight.

But reputation only goes so far. This ZeroMarkets review digs into every detail that matters: regulatory licensing, account types, real trading costs, platform performance, deposit and withdrawal options, and how well the broker handles automated trading setups. We’re not here to sell you on anything. We’re here to lay out the facts so you can make a decision that fits your trading style.

Whether you’re running EAs around the clock, scalping London sessions, or managing multiple accounts through MAM/PAMM structures, the details matter. Let’s get into them.

Regulation and Safety: Who’s Watching ZeroMarkets?

Your broker holds your money. That’s reason enough to care about regulation. ZeroMarkets doesn’t operate in a regulatory vacuum. They hold multiple licenses across different jurisdictions, which tells you something about their commitment to compliance.

ASIC Regulation (Australia)

ZeroMarkets’ Australian entity, Zero Securities Pty Ltd, holds AFS Licence 244040 issued by the Australian Securities and Investments Commission (ASIC). This is one of the world’s most respected financial regulators, known for strict enforcement and regular audits.

Under ASIC oversight, ZeroMarkets must comply with several non-negotiable requirements:

- Segregated client funds — Your trading capital sits in separate bank accounts, isolated from the broker’s operating funds. If the broker faces financial trouble, your money stays protected.

- Regular financial reporting — ZeroMarkets submits detailed financial disclosures to ASIC and maintains adequate capital reserves.

- External dispute resolution — As a member of the Australian Financial Complaints Authority (AFCA), unresolved complaints get referred to independent arbitration.

- No misleading promotions — ASIC banned deposit bonuses years ago. You won’t find “200% bonus” traps with impossible withdrawal conditions here.

FSC Mauritius and FMA New Zealand

Beyond Australia, ZeroMarkets also holds licensing through the Financial Services Commission (FSC) of Mauritius under License No. GB21026308 through Zero Financial Ltd. Their New Zealand entity, Zero Markets (NZ) Limited, is regulated by the Financial Markets Authority (FMA).

This multi-jurisdictional approach means ZeroMarkets serves clients globally while maintaining regulatory standards in each region. Leverage limits differ by jurisdiction — up to 1:30 under ASIC rules, and up to 1:500 through their Mauritius entity. Traders outside Australia can access higher leverage if their risk appetite warrants it.

How This Compares to the Industry

Many brokers operate through a single offshore entity with minimal oversight. Having ASIC, FSC, and FMA licenses means ZeroMarkets faces scrutiny from three different regulators. That’s not common, and it’s a positive signal for traders concerned about fund safety. Compared to brokers licensed only in SVG or Vanuatu, the difference in investor protection is significant.

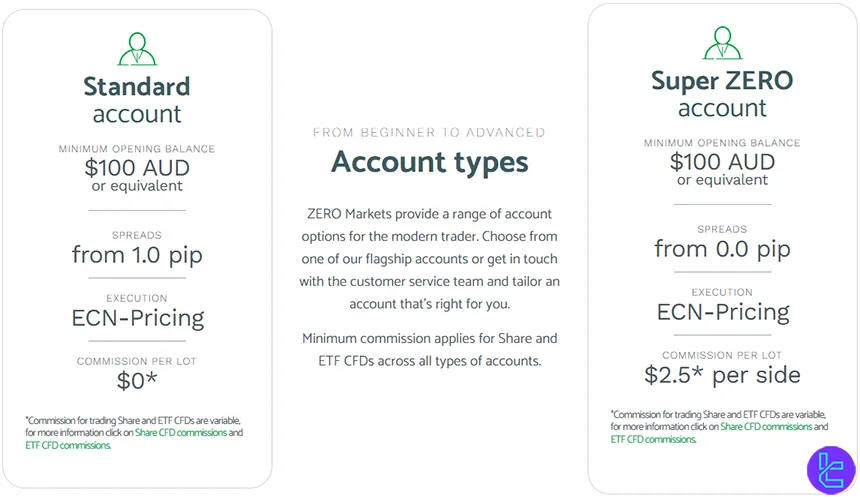

Account Types: Standard vs Super Zero

ZeroMarkets keeps their account structure straightforward with two main options. No confusing tiers or hidden VIP levels. Just two accounts designed for different trading styles.

Standard Account

The Standard Account is the commission-free option. Here’s what it includes:

| Feature | Details |

|---|---|

| Minimum Deposit | $100 AUD (or equivalent) |

| Spreads | From 1.0 pips on EUR/USD |

| Commission | $0 (built into spread) |

| Leverage | Up to 1:500 (varies by jurisdiction) |

| Platforms | MT4, MT5, WebTrader |

| Execution | ECN/STP |

| Base Currencies | AUD, USD, EUR, GBP, CAD, JPY, NZD, SGD |

The Standard Account works well for traders who prefer simple cost calculations. No per-lot commissions to track. Just the spread. It’s a good fit for swing traders and position traders who hold trades for longer periods where the slightly wider spread has minimal impact on overall profitability.

Super Zero Account

The Super Zero Account is where ZeroMarkets really differentiates itself. This is the raw pricing option designed for active traders.

| Feature | Details |

|---|---|

| Minimum Deposit | $100 AUD (or equivalent) |

| Spreads | From 0.0 pips on EUR/USD |

| Commission | $2.50 per side ($5.00 round turn per lot) |

| Leverage | Up to 1:500 (varies by jurisdiction) |

| Platforms | MT4, MT5, WebTrader |

| Execution | ECN with Tier-1 liquidity |

| Base Currencies | AUD, USD, EUR, GBP, CAD, JPY, NZD, SGD |

That $5.00 round turn commission is competitive. Many brokers charge $6.00 to $7.00 for equivalent raw spread accounts. When you’re executing dozens of trades per day, that $1-2 per lot difference adds up fast. Scalpers and high-frequency EA traders should run the numbers — the Super Zero Account often works out cheaper on a total-cost basis despite the visible commission.

Islamic Accounts

ZeroMarkets also offers swap-free Islamic accounts for traders who need Sharia-compliant trading. Both Standard and Super Zero account types are available in Islamic format, with swap charges replaced by an administration fee on positions held overnight. The same spreads and commissions apply.

Which Account Should You Choose?

The decision comes down to trade frequency and style. If you’re placing 5-10 trades per week on higher timeframes, the Standard Account keeps things simple. If you’re scalping, day trading, or running EAs that execute frequently, the Super Zero Account saves money on every single trade. Calculate your average monthly lot volume and compare the total cost under each structure. The math will make the answer obvious.

Trading Costs Breakdown

Spreads and commissions are just the starting point. Smart traders evaluate total trading costs, including swaps, deposits, withdrawals, and inactivity fees.

Spreads in Practice

ZeroMarkets advertises 0.0 pip spreads on the Super Zero Account, but that’s the minimum during optimal market conditions. Here are more realistic average spreads for popular pairs:

| Currency Pair | Standard Avg | Super Zero Avg |

|---|---|---|

| EUR/USD | 1.0-1.3 pips | 0.0-0.3 pips |

| GBP/USD | 1.5-2.0 pips | 0.3-0.8 pips |

| USD/JPY | 1.0-1.5 pips | 0.1-0.5 pips |

| AUD/USD | 1.2-1.6 pips | 0.2-0.6 pips |

| EUR/GBP | 1.5-2.0 pips | 0.3-0.8 pips |

During major news releases and thin liquidity windows (like the Asian session rollover), spreads will widen on both account types. That’s standard ECN behavior. The key metric is how quickly spreads snap back to normal — and ZeroMarkets generally performs well here thanks to their Tier-1 liquidity provider network.

Swap Rates

Overnight swap charges on ZeroMarkets are standard for the industry. Triple swaps apply on Wednesdays for forex pairs. If you’re running carry trade strategies or holding positions for more than a day, factor swaps into your total cost analysis. Islamic accounts eliminate swaps but charge an administration fee instead.

Deposit and Withdrawal Fees

ZeroMarkets doesn’t charge fees on deposits or withdrawals from their side. That’s a nice touch, especially for traders who move funds frequently. For deposits over $10,000 USD, ZeroMarkets covers international transfer fees up to $50 USD. The minimum withdrawal amount is just $0.01, which means you’re not forced to keep excess capital in your account.

However, your bank or payment provider might charge their own fees for international transfers. That’s not something ZeroMarkets controls, but it’s worth checking with your bank before initiating wire transfers.

Inactivity Fees

ZeroMarkets charges a $30 monthly inactivity fee on accounts that have had no trading activity for 6 consecutive months. If you’re an active trader, this won’t affect you. But if you tend to take extended breaks from trading, either close your account or make at least one trade within every 6-month window to avoid the charge.

Trading Platforms: MT4 and MT5

ZeroMarkets supports both MetaTrader 4 and MetaTrader 5 across every device format you’d expect. Desktop (Windows and Mac), mobile (iOS and Android), and browser-based WebTrader. No proprietary platform to learn, which is fine — most serious traders prefer MetaTrader anyway.

MetaTrader 4

MT4 remains the industry workhorse. It’s stable, lightweight, and has the largest ecosystem of Expert Advisors and custom indicators. ZeroMarkets’ MT4 implementation supports:

- One-click trading execution

- All pending order types (limit, stop, stop-limit)

- 30+ built-in technical indicators

- 9 timeframes

- Full EA compatibility via MQL4

- Push notifications and email alerts

For traders running legacy EAs that were built for MT4, this matters. Porting to MT5 isn’t always straightforward, and many profitable algorithmic trading strategies run exclusively on MT4. ZeroMarkets keeps both platforms available without pushing you toward one or the other.

MetaTrader 5

MT5 offers everything MT4 does, plus additional features that matter for multi-asset traders:

- 21 timeframes (vs 9 on MT4)

- 38 technical indicators (vs 30 on MT4)

- Market depth display (DOM)

- Economic calendar built into the platform

- Netting and hedging account modes

- MQL5 programming with faster backtesting engine

- Multi-threaded strategy tester

If you’re trading stocks, indices, and crypto alongside forex, MT5 is the better choice. The multi-threaded strategy tester alone is worth the switch if you’re developing and optimizing EAs. Backtests that take hours on MT4 can finish in minutes on MT5.

WebTrader

The WebTrader version runs directly in your browser with no installation required. It’s useful for checking positions or placing quick trades when you’re away from your main setup. But don’t rely on it for EA execution or intensive charting — it lacks the full functionality of the desktop platforms. Think of it as a convenience tool, not a replacement.

Trader Toolbox and Plugins

ZeroMarkets offers advanced MT4/MT5 plugins through their Trader Toolbox. These include correlation matrices, session maps, sentiment indicators, and enhanced order management tools. These plug-ins add functionality that MetaTrader doesn’t provide natively, and they’re available free to all ZeroMarkets clients. It’s a genuine value-add, not just a marketing checkbox.

Available Instruments

ZeroMarkets offers over 2,000 tradable instruments across multiple asset classes. Here’s the breakdown:

| Asset Class | Instruments | Details |

|---|---|---|

| Forex | 60+ pairs | Majors, minors, exotics |

| Stocks (CFDs) | 800+ | US, AU, EU equities |

| Indices | 15+ | AS200, US30, EURO50, NAS100 |

| Commodities | 20+ | Gold, silver, oil, natural gas |

| Crypto | 22 pairs | BTC, ETH, LTC + altcoins (up to 1:100 leverage) |

| ETFs | 50+ | Major global ETFs |

The instrument range is solid. Sixty forex pairs cover most trading strategies, and 800+ stock CFDs give you access to equity markets without needing a separate broker. The crypto offering at 22 pairs is decent but not exceptional — some brokers offer 100+ crypto pairs. However, for most traders, the major coins are what matter, and those are well covered.

One thing worth noting: indices are available on margins as low as 1%, which means you can trade global benchmarks with relatively small position sizes. That’s useful for portfolio diversification or hedging.

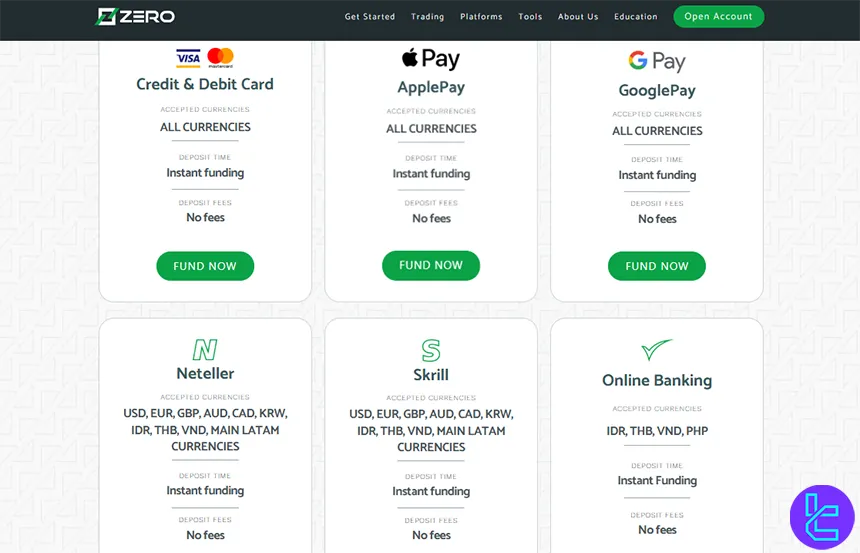

Deposit and Withdrawal Options

Getting money in and out of your trading account should be fast and painless. ZeroMarkets supports a wide range of payment methods:

Deposit Methods

- Bank Wire Transfer — Standard 1-3 business days processing

- Credit/Debit Cards — Visa and Mastercard, instant processing

- Skrill — Instant e-wallet deposits

- Neteller — Instant e-wallet deposits

- USDT (Tether) — Cryptocurrency deposits

- SticPay — Instant processing

- POLi — Australian online banking

- Pix/TED/Boleto — Brazilian payment methods

The minimum deposit is $100 AUD or equivalent across all methods. ZeroMarkets charges no deposit fees. For international transfers exceeding $10,000 USD, they’ll cover up to $50 in bank fees — a small but appreciated gesture.

Withdrawal Methods

Withdrawals follow the same-method rule: money goes back via the same channel it came in. Processing times are typically 1-3 business days for bank wires and up to 24 hours for e-wallets. There are no withdrawal fees from ZeroMarkets’ side, though your bank or payment provider may charge their own fees.

The minimum withdrawal amount is just $0.01 — effectively no minimum. That’s unusual and appreciated. Many brokers set arbitrary minimums that force you to keep capital in your account longer than you’d like.

Copy Trading and Social Features

ZeroMarkets has invested heavily in their social trading ecosystem. They were awarded “Best Copy and Social Trading Platform” by FX Empire, which speaks to the quality of their implementation.

Copy Trading

The copy trading feature lets you follow and automatically replicate trades from experienced traders. You choose a strategy provider based on their track record on platforms like Myfxbook, set your allocation, and trades execute automatically in your account. The minimum to get started is just $100 USD.

What sets ZeroMarkets’ copy trading apart is the customization. You can adjust lot sizes, set maximum drawdown limits, and choose which instruments to copy. Most copy trading platforms offer basic mirroring. ZeroMarkets gives you granular control over how trades are replicated.

MAM/PAMM Accounts

For fund managers and money managers, ZeroMarkets offers MAM (Multi-Account Manager) and PAMM (Percentage Allocation Management Module) structures. The PAMM system distributes trade sizes across sub-accounts based on allocation percentages. The manager’s account acts as the main account, with trades automatically replicated proportionally.

This is relevant for traders managing capital for clients or family members. The allocation happens at the server level, ensuring consistent execution across all sub-accounts. If you manage money professionally, this infrastructure matters.

VPS Trading and Automated Strategy Support

Running automated strategies requires more than just a good broker. You need reliable infrastructure. This is where the combination of a quality broker and a proper trading VPS becomes critical.

Why VPS Matters with ZeroMarkets

ZeroMarkets’ Super Zero Account with 0.0 pip spreads is built for automated trading. But those tight spreads only matter if your orders reach the broker’s server fast enough to capture them. A home internet connection introduces latency, disconnection risks, and power outage vulnerabilities that can turn a profitable EA into a losing one.

A trading VPS positioned close to your broker’s execution servers eliminates these variables. You get consistent sub-millisecond execution, 24/7 uptime, and the peace of mind that your strategies keep running even when your home power goes out or your ISP has issues.

Platform Compatibility

ZeroMarkets supports both MT4 and MT5, which means any VPS running Windows Server can host your trading setup. Both platforms support Expert Advisors, custom indicators, and automated order management. The setup process is straightforward: install MetaTrader on your VPS, log in with your ZeroMarkets credentials, and your EA runs 24/7 without touching your local machine.

For traders using multiple strategies or monitoring several pairs simultaneously, a VPS with adequate RAM and CPU resources keeps everything running smoothly. The Standard plan from most VPS providers handles 2-3 MetaTrader instances without breaking a sweat.

Latency Considerations

ZeroMarkets routes orders through their liquidity providers. For optimal execution, your VPS should be located as close as possible to the broker’s matching engine. Use a latency checker tool to measure your connection speed. New York and London data centers typically offer the best latency for forex execution, as most Tier-1 liquidity providers maintain infrastructure in these financial hubs.

If you’re running a scalping EA that captures 2-3 pip moves, the difference between 1ms and 50ms latency can be the difference between profit and breakeven. Your strategy, your broker, and your infrastructure all need to work together.

Customer Support and Education

Support Channels

ZeroMarkets provides 24/5 multilingual customer support through:

- Live chat (available during market hours)

- Email support

- Phone support

- Online help center with detailed FAQs

Response times are generally reasonable during market hours. The support team handles account-related inquiries, technical platform issues, and general trading questions. For complex issues, expect escalation to a specialist team with a slightly longer resolution time.

Educational Resources

ZeroMarkets provides educational videos, market analysis articles, and webinars. However, their educational offering is not their strongest feature. If you’re a beginner looking for comprehensive trading courses, you’ll likely need to supplement with third-party educational content.

For experienced traders, the available market analysis and economic commentary are useful for staying informed. But don’t expect the kind of structured learning academy that some larger brokers provide. ZeroMarkets seems to target traders who already know what they’re doing — the account types and pricing confirm this positioning.

Pros and Cons Summary

What ZeroMarkets Gets Right

- Competitive raw spreads — 0.0 pips on EUR/USD with the Super Zero Account is among the tightest in the industry.

- Low commissions — $5.00 round turn per lot undercuts many competitors charging $6.00-$7.00.

- Strong regulation — ASIC, FSC Mauritius, and FMA New Zealand provide multi-layered oversight.

- No deposit or withdrawal fees — Straightforward fee structure with no hidden charges.

- Copy trading platform — Award-winning social trading with real customization options.

- MT4 and MT5 support — Both platforms fully supported with advanced plugins.

- 2,000+ instruments — Broad market access across forex, stocks, indices, commodities, crypto, and ETFs.

- Low minimum deposit — $100 AUD to get started on any account type.

Where ZeroMarkets Falls Short

- Education is limited — Not the best choice for complete beginners needing structured learning.

- Inactivity fee — $30/month after 6 months of no activity can catch casual traders off guard.

- No proprietary platform — If you don’t like MetaTrader, your options are limited.

- Higher minimum deposit than some competitors — $100 AUD is reasonable but not the lowest in the industry.

- Crypto selection — 22 pairs is adequate but trails brokers focused on crypto diversity.

Who is ZeroMarkets Best For?

Not every broker suits every trader. Here’s who will get the most value from ZeroMarkets:

Scalpers and day traders — The Super Zero Account with 0.0 pip spreads and $5.00 round turn commissions provides the tight pricing active traders need. Every fraction of a pip counts when you’re opening and closing positions within minutes.

EA and algorithmic traders — Full MT4/MT5 support with ECN execution means your automated strategies get the reliable execution they need. Pair this with a VPS for 24/7 uninterrupted operation.

Fund managers — MAM/PAMM account structures are well-implemented and allow professional-grade allocation management across multiple client accounts.

Multi-asset traders — With 2,000+ instruments across multiple asset classes, you can diversify your portfolio without opening additional broker accounts.

Regulation-conscious traders — ASIC oversight provides serious investor protections. If fund safety is your top priority, ZeroMarkets’ regulatory profile delivers confidence.

ZeroMarkets vs the Competition

How does ZeroMarkets stack up against other brokers in the same category? Here’s a quick comparison on the metrics that matter most:

| Feature | ZeroMarkets | Industry Average |

|---|---|---|

| Min Spread (EUR/USD) | 0.0 pips | 0.1-0.6 pips |

| Commission (per lot RT) | $5.00 | $6.00-$7.00 |

| Regulation | ASIC, FSC, FMA | 1-2 licenses typical |

| Min Deposit | $100 AUD | $50-$200 |

| Instruments | 2,000+ | 500-1,500 |

| Platforms | MT4, MT5 | MT4/MT5 + proprietary |

| Copy Trading | Yes (awarded) | Varies |

| Deposit/Withdrawal Fees | $0 | $0-$25 |

On pricing and regulation, ZeroMarkets beats the industry average. Where they fall behind is platform diversity — having only MetaTrader means traders who prefer cTrader or TradingView-based platforms need to look elsewhere. But for the MetaTrader-centric majority, it’s a non-issue.

Final Verdict: Is ZeroMarkets Worth It?

ZeroMarkets isn’t trying to be everything to everyone. They’ve focused on doing a few things well: tight spreads, strong regulation, and reliable MetaTrader execution. That focus shows in the Super Zero Account’s pricing, which genuinely competes with the best raw spread offerings in the industry.

The ASIC regulation is a major trust factor. Combined with segregated funds, AFCA membership, and multi-jurisdictional licensing, ZeroMarkets offers a level of security that many competing brokers cannot match. Your capital is protected by real regulatory frameworks, not just marketing promises.

For automated traders, the combination of raw ECN spreads, full EA support, and MetaTrader platform availability makes ZeroMarkets a strong choice. Pair it with a properly configured VPS for optimal execution, and you’ve got an infrastructure setup that can handle serious trading volume.

The weaknesses — limited education, MetaTrader-only platform options, and the inactivity fee — are genuine but manageable. If you’re an experienced trader who knows what you’re looking for, these won’t be deal-breakers.

Bottom line: ZeroMarkets delivers institutional-grade pricing with retail accessibility. If tight spreads, strong regulation, and reliable execution are your priorities, this broker deserves serious consideration.

Frequently Asked Questions

Is ZeroMarkets regulated and safe to trade with?

Yes. ZeroMarkets holds licenses from ASIC (Australia), FSC (Mauritius), and FMA (New Zealand). ASIC is one of the most respected financial regulators globally. Client funds are held in segregated bank accounts, and the broker is a member of the Australian Financial Complaints Authority (AFCA) for independent dispute resolution.

What is the minimum deposit to open a ZeroMarkets account?

The minimum deposit is $100 AUD (or equivalent in other currencies) for both Standard and Super Zero account types. This applies regardless of the deposit method you choose. Multiple base currencies are supported including AUD, USD, EUR, GBP, CAD, JPY, NZD, and SGD.

How do ZeroMarkets’ spreads compare to other brokers?

The Super Zero Account offers spreads from 0.0 pips on EUR/USD with a $5.00 round turn commission per lot. This is competitive — many equivalent raw spread accounts at other brokers charge $6.00-$7.00 in commissions. On a total cost basis, ZeroMarkets ranks among the most affordable ECN brokers.

Does ZeroMarkets support automated trading and Expert Advisors?

Yes, fully. Both MT4 and MT5 platforms support Expert Advisors, custom indicators, and automated order management. For best results with automated strategies, run your EAs on a VPS to ensure 24/7 uptime and minimal latency to the broker’s execution servers.

What payment methods does ZeroMarkets accept?

ZeroMarkets accepts bank wire transfers, Visa and Mastercard, Skrill, Neteller, USDT, SticPay, POLi, Pix, TED, and Boleto. There are no deposit or withdrawal fees from ZeroMarkets’ side, though your bank or payment provider may charge their own fees for international transfers.

Can I use ZeroMarkets for copy trading?

Yes. ZeroMarkets offers an award-winning copy trading platform where you can follow and replicate trades from experienced strategy providers. The minimum to start copy trading is $100 USD. You can customize lot sizes, set maximum drawdown limits, and select which instruments to copy.

Does ZeroMarkets charge an inactivity fee?

Yes. Accounts with no trading activity for 6 consecutive months incur a $30 monthly inactivity fee. To avoid this, ensure you execute at least one trade within every 6-month period or close your account if you plan an extended trading break.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.