Duplikium Review 2026: Cloud Trade Copier Worth It?

In-depth Duplikium review for 2026 covering features, pricing, setup, and real user feedback. See if this cloud trade copier fits your trading workflow.

What Is Duplikium?

Duplikium is a cloud-based trade copier built by Swiss banking engineers that mirrors trades across MT4, MT5, cTrader, and several other platforms. It has been around since 2013, and the company behind it operates from Switzerland under the domain trade-copier.com.

The core pitch is simple: connect a master account, connect one or more slave accounts, and every trade on the master gets replicated on the slaves in real time. Internal latency sits between 1 and 3 milliseconds according to the company, with servers spread across Frankfurt, London, New York, and Singapore.

As of 2026, the platform reports over 25,000 connected accounts and more than 6 million orders copied every week. Those are not small numbers for a niche tool. In this review we break down every angle that matters, from setup speed to pricing traps, so you can decide whether Duplikium belongs in your trading stack.

Supported Platforms and Brokers

Platform coverage is one of Duplikium’s strongest selling points. The copier works with:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- DXtrade

- TradingView (via webhooks)

- FXCM Trading Station

- LMAX

- Tradovate

- NinjaTrader

- Fortex

Cross-platform copying is fully supported. You can send signals from an MT4 master to a cTrader slave, or from TradingView to MT5. If you want to understand the technical details of cross-platform copying, our guide to copying trades between MetaTrader and cTrader covers the fundamentals. Symbol mapping handles discrepancies like “EURUSD” on MT4 versus “EUR.USD” on cTrader automatically, though you may need to adjust some exotic pairs manually.

Broker compatibility is equally broad, with over 5,000 broker servers supported. Whether you trade with IC Markets, Exness, FTMO, or a smaller regional broker, chances are Duplikium already has the server details in its database.

Key Features

Multi-Master and Multi-Slave Architecture

Duplikium lets you connect multiple master accounts feeding into multiple slave accounts. There is no hard cap on combinations, which makes it attractive for money managers running signal groups or traders splitting strategies across prop firm accounts.

Risk Management Controls

Each slave account can have its own risk factor. You define the lot size relationship to the master through a multiplier, a fixed lot, or an equity-based ratio. Beyond sizing, the platform includes:

- Account-level equity protection that stops copying if drawdown hits a threshold

- Symbol blacklists and whitelists

- Maximum open trade limits per slave

- Spread filters to skip trades when spreads spike

Reverse Trading

A niche but interesting feature. If you have a strategy that consistently loses, Duplikium can flip every signal. When the master buys, the slave sells, and vice versa. It sounds gimmicky, but a handful of users in Trustpilot reviews mention using it to salvage an otherwise unprofitable signal source.

Order Type Support

The copier handles market orders, pending orders (both limit and stop), stop-loss and take-profit modifications in real time, and partial closes. That last point matters more than people realize. Many cheaper copiers either skip partial closes entirely or handle them with long delays.

Cloud-Based Operation

Everything runs in the cloud. You do not install software on your computer, and you do not need a VPS running 24/7 just for the copier itself. You manage everything through a web dashboard. This is a significant operational advantage compared to local EA-based copiers that crash when your machine restarts or your internet drops.

That said, if you run Expert Advisors on the master account, you still need a VPS or dedicated server for the EA itself. Duplikium only replaces the copier infrastructure, not the execution environment.

Setup Process

Getting started is straightforward. The whole process takes roughly two to five minutes depending on your platform:

- Register at trade-copier.com. You get a free trial credit worth 30 EUR without entering a credit card. SMS verification is required.

- Add your master account. For MT4 and MT5, you enter the broker server, account number, and investor password. For cTrader, you authenticate through Spotware’s OAuth flow.

- Add slave accounts the same way.

- Configure copy settings. Choose your risk factor, enable or disable specific order types, set up symbol mappings if needed.

- Run a test trade. Place a small order on the master and verify it appears on the slave within seconds.

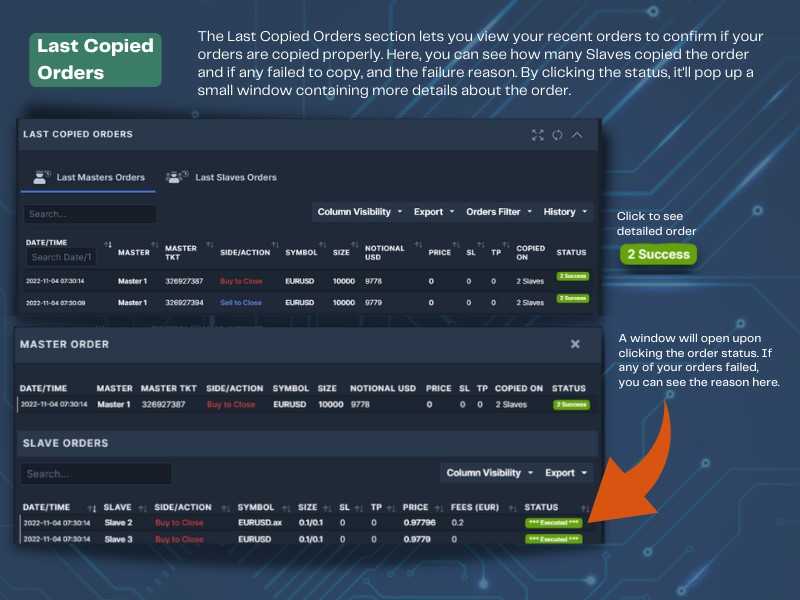

The dashboard itself is dense with options. First-time users often feel overwhelmed, and Trustpilot reviews confirm this. But once you learn the layout, the depth becomes an asset rather than a problem.

Pricing Breakdown

Duplikium offers three pricing structures. Understanding the differences saves you from sticker shock.

Free Plan

One master account and one slave account with full functionality. No time limit. This is genuinely useful for testing the platform or for solo traders copying between two personal accounts. The catch is the one-account limit. The moment you need a third connection, you move to paid.

Prepay Plan (Pay-as-You-Go)

Billed daily based on connected accounts. Rates start at 0.50 EUR per account per day for 1 to 10 accounts and decrease with volume:

Prepay pricing tiers: 1-10 accounts: 0.50 EUR/day | 11-25 accounts: 0.42 EUR/day | 26-100 accounts: 0.33 EUR/day | 101-500 accounts: 0.27 EUR/day | 1000+ accounts: 0.20 EUR/day

For a trader running 5 accounts, that works out to roughly 75 EUR per month. Not cheap, but you only pay for the days accounts are connected.

Subscription Plan

Fixed monthly billing with slightly lower per-account rates. The base rate is 9 EUR per account per month for 1 to 10 accounts, dropping to 6 EUR per account per month at 1,000+ accounts.

Where pricing gets tricky is the small-volume tier. A trader with 7 accounts on the subscription plan pays around 63 EUR per month. Some user reviews flag this as expensive compared to flat-rate alternatives. The value equation improves dramatically at scale: 50 accounts on a subscription costs roughly 375 EUR per month, which is competitive for institutional-level copying.

Optional Add-Ons

Shared static IP: 2 EUR per month. Dedicated static IP: 5 EUR per month. These matter if your broker requires IP whitelisting.

Performance and Latency

Duplikium claims 1 to 3 milliseconds of internal latency. That is the time between the copier detecting a trade on the master and sending the instruction to the slave broker. It does not include broker execution time, which varies wildly depending on the broker, market conditions, and server distance.

In practice, users report total copy-to-fill times ranging from under one second during normal conditions to a few seconds during high-volatility events like NFP releases. That is competitive with most cloud copiers and faster than most EA-based local solutions.

Server locations in Frankfurt, London, New York, and Singapore give decent coverage for most broker server locations. If your broker runs servers in Tokyo, the Singapore node is the closest option, which might add a few extra milliseconds compared to a Frankfurt-to-Frankfurt route. For latency-sensitive setups, pairing Duplikium with a low-latency VPS in the right datacenter keeps the master account side as fast as possible.

Duplikium for Prop Firm Traders

One of the fastest-growing use cases for trade copiers in 2026 is prop firm account management. Traders who pass challenges with firms like FTMO, The Funded Trader, or MyFundedFX often want to replicate their strategy across multiple funded accounts without manually executing each trade.

Duplikium handles this well. You connect your primary trading account as the master and each prop firm account as a slave. The risk management controls let you adjust lot sizes per account, which is critical since prop firms have different balance levels and drawdown rules.

The equity protection feature adds a layer of safety. If a slave account approaches its maximum drawdown limit, copying stops automatically. This alone can prevent blown challenges.

Keep in mind that some prop firms have rules about using trade copiers. Always check the terms of service before connecting a funded account to any copier.

Real User Feedback

Duplikium holds a 4.7 out of 5 rating on Trustpilot across 116 reviews as of early 2026. That is a strong score, but the distribution tells a more nuanced story: 83% of reviews are 5-star, while 10% are 1-star with very little in between.

What Users Like

- Speed: Multiple reviews describe copying as “instant” or “lightning-fast” across platforms.

- Support: Customer service gets consistently high marks. Users mention quick response times and staff who genuinely understand the product.

- Cross-platform flexibility: The ability to copy between MT4, MT5, and cTrader in any direction is a repeated highlight.

- Free tier: Several reviewers note that the free plan is more functional than competitors’ paid tiers.

What Users Dislike

- Pricing at small scale: Traders with 3 to 10 accounts find the per-account pricing steep compared to flat-rate copiers.

- Dashboard complexity: The sheer number of settings can intimidate new users. The learning curve is real.

- Occasional cTrader issues: A few reviews report hiccups with cTrader account connections, though support typically resolves these quickly.

Duplikium vs. Alternatives

The trade copier market has several options. Here is how Duplikium stacks up against common alternatives:

| Feature | Duplikium | Local EA Copiers | TradersConnect |

|---|---|---|---|

| Infrastructure | Cloud | Local (VPS needed) | Cloud |

| Latency | 1-3 ms internal | Varies by VPS | Cloud-based |

| Platforms | MT4, MT5, cTrader, + 7 more | Usually MT4/MT5 only | MT4, MT5, cTrader |

| Free Plan | Yes (1 master + 1 slave) | Some free EAs exist | No |

| Pricing Model | Per account | One-time or free | Per account |

| Reverse Trading | Yes | Rare | No |

| Setup Time | 2-5 minutes | 15-60 minutes | 5-10 minutes |

Local EA copiers win on cost since many are free or one-time purchases, but they require a VPS running 24/7 and only work within the MetaTrader ecosystem. Our roundup of the best MT4 trade copier software covers several of these options in detail. Cloud copiers like Duplikium and TradersConnect eliminate the infrastructure overhead but charge ongoing fees.

Duplikium’s edge over TradersConnect and similar cloud copiers is platform breadth. Supporting TradingView, DXtrade, Tradovate, and LMAX alongside the MetaTrader/cTrader ecosystem gives it the widest compatibility of any copier on the market in 2026.

When Duplikium Makes Sense

Duplikium fits best when you need cross-platform copying, manage multiple accounts, or want to avoid running a VPS for copier software. Specific scenarios where it shines:

- Copying trades from your personal MT5 account to prop firm cTrader accounts

- Running a signal service where subscribers use different brokers and platforms

- Managing client accounts as a money manager across varied setups

- Replicating TradingView strategies to live broker accounts

It makes less sense if you only copy between two MT4 accounts on the same broker. In that case, a free local EA copier does the same job without monthly fees.

VPS Considerations for Duplikium Users

Since Duplikium is cloud-based, the copier itself does not need a VPS. But your trading setup might still need one. If you run Expert Advisors, custom scripts, or any automation on the master account, that master account needs a stable, always-on environment.

Running an EA on a home computer and relying on Duplikium to copy the trades still creates a single point of failure. If your home internet drops or your PC restarts, the EA stops, and so does the signal to Duplikium. A trading VPS eliminates that risk by keeping your EA running in a datacenter with enterprise-grade uptime.

The ideal setup for most traders: run your EA or manual trading on a forex VPS, let Duplikium handle the copying from that master to all slave accounts. You get the reliability of dedicated infrastructure for execution and the flexibility of cloud copying for distribution.

Frequently Asked Questions

Is Duplikium free to use?

Yes, Duplikium offers a permanent free plan that includes one master account and one slave account with full feature access. There is also a free trial credit of 30 EUR for testing with additional accounts. Paid plans start when you need more than two connected accounts.

Does Duplikium work with cTrader?

Duplikium fully supports cTrader, including cross-platform copying to and from MT4, MT5, and other platforms. Connection uses Spotware’s OAuth authentication. Some users report occasional connection hiccups with cTrader, but support typically resolves these within a day.

How fast does Duplikium copy trades?

The company claims 1 to 3 milliseconds of internal latency. Total execution time including broker processing varies but generally stays under one second during normal market conditions. High-volatility events may add a few seconds due to broker-side delays.

Can I use Duplikium with prop firm accounts?

Yes, and this is one of the most popular use cases in 2026. You connect your main trading account as the master and prop firm accounts as slaves. The equity protection feature helps prevent blown challenges. Always verify your prop firm’s terms of service regarding trade copier usage before connecting.

Do I need a VPS to use Duplikium?

You do not need a VPS for the copier itself since it runs entirely in the cloud. However, if your master account runs Expert Advisors or automated scripts, a VPS is recommended to ensure the master stays online 24/7. The copier can only copy trades that actually happen on the master.

What happens if the connection drops?

Duplikium sends email alerts when connections drop and when they recover. Trades placed during a disconnection are not copied retroactively. The platform does not queue missed trades, so maintaining a stable connection on the master account side is important.

Is Duplikium worth the price for small accounts?

For traders with only two accounts, the free plan covers the need completely. For those managing 3 to 10 accounts, the per-account pricing can feel steep compared to flat-rate alternatives. The value proposition improves significantly at scale. Evaluate your specific account count against the pricing tiers before committing to a paid plan.

Final Verdict

Duplikium is a mature, well-supported trade copier with the widest platform compatibility available in 2026. The cloud infrastructure removes the hassle of running copier software on a VPS, the latency numbers hold up in practice, and the risk management tools are thorough enough for professional use.

The main drawback is pricing at low account volumes. If you manage fewer than 10 accounts, calculate your monthly cost carefully and compare it to simpler alternatives. At higher volumes, the per-account rate becomes competitive and the platform’s reliability justifies the spend.

For traders running EAs on a master account, pairing Duplikium with a reliable forex VPS gives you the best of both worlds: stable execution on the master side and flexible cloud copying to every slave account, regardless of platform or broker.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.