Fibonacci Retracement in Forex: Trading Guide And Strategies

Learn how to use Fibonacci retracement in forex trading. Complete beginner’s guide covering key levels, step-by-step drawing tutorial, and practical trading strategies.

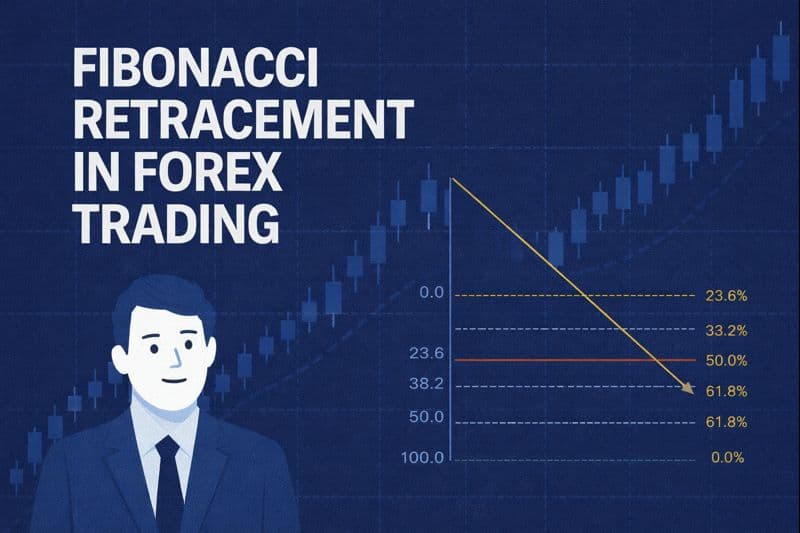

If you have spent any time looking at trading charts, you have probably seen mysterious horizontal lines at specific levels like 38.2%, 61.8%, or 78.6%. These are Fibonacci retracement levels, and they are one of the most widely used technical analysis tools in forex trading.

But here is what most beginners do not understand: Fibonacci retracement is not magic. It is not based on some hidden force in the market. And despite what you might read, it does not work 100% of the time.

In this guide, we are going to break down everything you need to know about Fibonacci retracement from the ground up. We will cover where it comes from, how the math actually works, how to draw the levels properly, and how to use them in real trading scenarios. By the end, you will understand exactly when Fibonacci can help your trading and when it cannot.

:max_bytes(150000):strip_icc()/Leonardo-Pisano-Fibonacci-f9d544e22fb147fea36f99b4dcd77f50.jpg)

What is Fibonacci Retracement? The Origin Story

Before we talk about trading, we need to go back about 800 years to a mathematician named Leonardo Fibonacci.

Leonardo Fibonacci and the Famous Sequence

Leonardo Pisano Bonacci (known as Fibonacci) was an Italian mathematician born in 1175. In his book Liber Abaci, published in 1202, he introduced Western Europe to a sequence of numbers that had already been known to Indian mathematicians for centuries.

The Fibonacci sequence goes like this: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, and so on.

Each number is the sum of the two numbers before it. So 1 + 1 = 2, then 1 + 2 = 3, then 2 + 3 = 5, and this pattern continues forever.

That sounds simple enough. But here is where it gets interesting.

The Golden Ratio: 1.618

As the Fibonacci sequence progresses, something remarkable happens. If you divide any number in the sequence by the number immediately before it, you get a ratio that converges toward approximately 1.618.

For example:

- 89 ÷ 55 = 1.618

- 144 ÷ 89 = 1.618

- 233 ÷ 144 = 1.618

This number (1.618) is called the golden ratio or phi (φ). It appears throughout nature: in spiral galaxies, seashells, flower petals, pine cones, and even in human facial proportions. The ancient Greek mathematician Euclid described it around 300 BCE as dividing a line “in extreme and mean ratio.”

Why Do These Ratios Appear in Markets?

Here is the uncomfortable truth: they probably do not.

Academic research has found no statistical evidence that markets naturally follow Fibonacci ratios. A peer-reviewed study published in Expert Systems with Applications found that the probability of prices bouncing on a Fibonacci zone is statistically indistinguishable from the probability of prices bouncing on any other randomly selected zone.

So why do traders use them?

The answer is a phenomenon called a self-fulfilling prophecy. Because so many traders around the world watch the same Fibonacci levels and place orders near those zones, those levels can actually become relevant support and resistance areas. If thousands of traders are planning to buy at the 61.8% retracement level, their combined orders can create enough buying pressure to push price back up.

It is not magic. It is collective behavior.

Key Fibonacci Retracement Levels Explained

When you use the Fibonacci retracement tool on your trading platform, it will automatically draw horizontal lines at specific percentages. Let us break down what each level means.

23.6% Retracement Level

This is the shallowest retracement level. It represents a very minor pullback in a strong trend. In very bullish markets, price may only retrace 23.6% before the uptrend resumes. This level is less commonly used than the deeper retracements, but it can be relevant in extremely strong trending markets.

38.2% Retracement Level

The 38.2% level comes from dividing a Fibonacci number by the number two positions to the right in the sequence (for example, 55 ÷ 144 = 0.382).

This is a commonly watched level. In strong trends, price often retraces about 38.2% before continuing in the original direction. Traders who want to enter a trend at a better price often place buy orders near this level in an uptrend or sell orders in a downtrend.

50% Retracement Level

Technically, 50% is not a Fibonacci ratio. It does not come from the Fibonacci sequence at all. However, it is included in Fibonacci retracement tools because markets have a tendency to retrace about half of a prior move.

The 50% level is based on a concept from Dow Theory and is widely watched by traders. Many consider it a psychological level where traders expect price to find support or resistance.

61.8% Retracement Level (The Golden Ratio)

This is the most important Fibonacci level. The 61.8% ratio is the true golden ratio derived from the Fibonacci sequence (dividing one number by the next number).

The 61.8% level is the most commonly cited and most widely watched Fibonacci retracement. When combined with the 50% level, traders refer to the zone between 50% and 61.8% as the “golden zone” because it represents a high-probability reversal area.

If price is going to reverse and continue the original trend, it often happens near the 61.8% level.

78.6% Retracement Level

The 78.6% level (the square root of 0.618) represents a very deep retracement. When price retraces this far, it suggests the original trend is weakening.

If price falls below the 78.6% retracement level, many traders consider the trend to be broken. At that point, you are no longer looking at a healthy pullback but potentially a full trend reversal.

Fibonacci Levels Explainer Video

The video guide below is a perfect overview of each of the fibonacci levels.

How to Draw Fibonacci Retracement: Step-by-Step Tutorial

Drawing Fibonacci retracement levels correctly is crucial. Many beginners get this wrong, and it leads to bad trades. Let us walk through the exact process.

Step 1: Identify the Trend

First, you need to determine whether the market is in an uptrend or a downtrend. Fibonacci retracement works best in clear trending markets, not in sideways or ranging conditions.

In an uptrend, you will see higher highs and higher lows. In a downtrend, you will see lower highs and lower lows.

If the market is moving sideways with no clear direction, Fibonacci retracement is not the right tool.

Step 2: Identify the Swing High and Swing Low

Next, you need to find the two extreme points of the recent price move.

A swing low is a low point where price bottomed out before moving higher. A swing high is a high point where price topped out before moving lower.

You want to identify the most recent significant move. Do not overthink this. You are looking for the obvious starting point and ending point of the trend you want to analyze.

Step 3: Apply the Fibonacci Tool

Now comes the most important part. How you draw the Fibonacci retracement depends on the trend direction.

For an uptrend (buying pullbacks): Click on the swing low and drag the tool to the swing high. You are measuring the upward move from bottom to top.

For a downtrend (selling rallies): Click on the swing high and drag the tool to the swing low. You are measuring the downward move from top to bottom.

Your trading platform (MT4, MT5, TradingView, etc.) will automatically draw horizontal lines at the key Fibonacci ratios.

Step 4: Choose Wick-to-Wick or Close-to-Close

This is where many traders make mistakes. You have two options when selecting your swing points:

- Wick-to-wick method: Use the extreme high and low points including the candlestick wicks (the thin lines above and below the candle bodies).

- Close-to-close method: Use only the closing prices of the swing high and swing low candles.

Both methods are valid. The key is to be consistent. If you use wicks for the swing low, use wicks for the swing high. Mixing reference points will give you inaccurate levels.

Step 5: Wait for Price to Retrace

After you have drawn your Fibonacci levels, you wait for price to retrace (pull back) toward those levels.

You are not looking to trade immediately. You are identifying zones where price might reverse and continue in the direction of the original trend.

Using Fibonacci in Uptrends vs Downtrends

Fibonacci retracement is used differently depending on whether you are trading an uptrend or a downtrend. Let us break down both scenarios.

Buying Pullbacks in an Uptrend

In an uptrend, the overall market direction is up. Price makes a strong move higher, then pulls back (retraces), and then ideally resumes moving up.

Your strategy is to wait for the pullback to reach a key Fibonacci level and then enter a buy trade when you see signs that price is reversing back up.

Here is the process:

- Identify a clear uptrend with higher highs and higher lows.

- Draw Fibonacci from the swing low to the swing high.

- Wait for price to pull back toward the 38.2%, 50%, or 61.8% levels.

- Look for confirmation that price is reversing (we will cover this in the next section).

- Enter a buy trade with a stop loss below the Fibonacci level.

In very strong trends, price may only retrace to the 23.6% or 38.2% level before resuming. In weaker trends or deeper pullbacks, you might see price reach the 50% or 61.8% level.

Selling Rallies in a Downtrend

In a downtrend, the overall market direction is down. Price makes a strong move lower, then rallies (retraces upward), and then ideally resumes moving down.

Your strategy is to wait for the rally to reach a key Fibonacci level and then enter a sell trade when you see signs that price is reversing back down.

Here is the process:

- Identify a clear downtrend with lower highs and lower lows.

- Draw Fibonacci from the swing high to the swing low.

- Wait for price to rally up toward the 38.2%, 50%, or 61.8% levels.

- Look for confirmation that price is reversing downward.

- Enter a sell trade with a stop loss above the Fibonacci level.

Bearish traders typically look for the same levels: 38.2%, 50%, and 61.8%. These are the zones where selling pressure may resume and push price back down. https://www.youtube.com/embed/h7FytGCTqCo

Combining Fibonacci with Other Indicators

Here is a critical point that most beginners miss: you should never trade based on Fibonacci retracement alone.

Academic research and backtesting show that Fibonacci levels do not provide statistically significant trading advantages when used in isolation. You need confirmation from other technical analysis tools.

Support and Resistance Levels

When a Fibonacci level aligns with a previous support or resistance level, it becomes much more significant. This is called confluence.

For example, if the 61.8% Fibonacci retracement level lines up with a horizontal support level where price bounced multiple times in the past, that zone has a higher probability of holding.

Look at your chart history. If you see that price respected a certain level before, and that level now coincides with a Fibonacci ratio, you have found a high-probability setup.

Moving Averages

Moving averages provide dynamic support and resistance that often align with Fibonacci levels.

For instance, if the 50-period or 200-period moving average coincides with a 61.8% retracement level, it strengthens the case for a reversal at that zone. The combination of two different technical tools pointing to the same area increases your confidence.

Candlestick Patterns

Candlestick patterns give you real-time confirmation that price is reversing at a Fibonacci level.

Look for reversal candlestick patterns such as:

- Hammer or inverted hammer: Suggests buyers are stepping in

- Engulfing pattern: A strong reversal signal

- Doji: Indicates indecision and potential reversal

- Pin bar: Shows rejection of lower (or higher) prices

When you see one of these patterns form right at a key Fibonacci level, it is a much stronger signal than the Fibonacci level alone.

RSI and Oscillators

The Relative Strength Index (RSI) and other oscillators help you identify overbought or oversold conditions.

If price retraces to a Fibonacci level and the RSI is showing oversold conditions (below 30), it adds weight to the likelihood of a reversal. Similarly, if price rallies to a Fibonacci resistance level and the RSI shows overbought (above 70), it suggests selling pressure may resume.

Use oscillators to confirm that the market is stretched and ready for a reversal at your Fibonacci zone.

Common Mistakes Beginners Make with Fibonacci Retracement

Even experienced traders make these errors. Avoid them and you will dramatically improve your Fibonacci trading.

Mistake 1: Using Fibonacci as a Standalone Tool

This is the biggest mistake. Traders draw Fibonacci levels and immediately start placing trades without any other confirmation.

Remember: Fibonacci levels are alert zones, not hard buy and sell signals. You need additional evidence from other indicators, price action, or candlestick patterns before entering a trade.

Mistake 2: Drawing from Wrong Swing Points

Identifying the correct swing high and swing low is subjective. Different traders looking at the same chart might pick different points.

There is no perfect answer, but here is a guideline: focus on the most recent significant move. Do not go back too far in history. You want to measure the trend that is relevant to current market conditions.

Also, be consistent. If you are analyzing a 4-hour chart, use swing points from the 4-hour chart. Do not mix timeframes.

Mistake 3: Mixing Reference Points

Using the high wick for your swing high but the closing price for your swing low will produce inaccurate Fibonacci levels.

Pick one method (wick-to-wick or close-to-close) and stick with it consistently.

Mistake 4: Ignoring the Bigger Trend

Many beginners zoom in on a short-term chart and try to measure every little move with Fibonacci. This creates confusion.

Always check the bigger picture. Look at the daily chart or the 4-hour chart to identify the overall trend direction. Then use Fibonacci on shorter timeframes to time your entries within that larger trend.

Mistake 5: Expecting Fibonacci to Always Work

Fibonacci levels do not work 100% of the time. Sometimes price will blow right through a Fibonacci level without any reaction.

This is normal. Markets are driven by countless factors: economic data, geopolitical events, central bank decisions, and trader sentiment. Fibonacci is just one tool in your toolbox, not a crystal ball.

Mistake 6: Using Fibonacci in Ranging Markets

Fibonacci retracement is designed for trending markets. If the market is moving sideways with no clear direction, Fibonacci will not help you.

In ranging markets, price is bouncing between horizontal support and resistance levels. Use those levels instead of trying to force Fibonacci onto a chart where it does not apply.

Practical Forex Trading Examples with Fibonacci

Let us walk through some real-world scenarios to show you how Fibonacci retracement works in practice.

Example 1: EUR/USD Uptrend Pullback

Imagine EUR/USD has been in a strong uptrend. Price rallies from 1.0800 to 1.1000, a 200-pip move.

You draw Fibonacci retracement from the swing low at 1.0800 to the swing high at 1.1000. The tool plots the following levels:

- 23.6% retracement: 1.0953

- 38.2% retracement: 1.0924

- 50% retracement: 1.0900

- 61.8% retracement: 1.0876

- 78.6% retracement: 1.0843

Price begins to pull back. It drops down and approaches the 50% level at 1.0900. At this level, you notice:

- A hammer candlestick forms, showing buyers stepping in

- The 50-period moving average is sitting right at 1.0900, adding confluence

- RSI has dropped to 35, indicating oversold conditions

This is a high-probability buy setup. You enter long at 1.0905 with a stop loss at 1.0885 (below the 61.8% level) and target the previous high at 1.1000.

Example 2: GBP/JPY Downtrend Rally

GBP/JPY has been in a downtrend. Price falls from 185.00 to 183.00, a 200-pip drop.

You draw Fibonacci from the swing high at 185.00 down to the swing low at 183.00. The levels are:

- 23.6% retracement: 183.47

- 38.2% retracement: 183.76

- 50% retracement: 184.00

- 61.8% retracement: 184.24

- 78.6% retracement: 184.57

Price rallies back up and reaches the 61.8% level at 184.24. At this level, you see:

- A bearish engulfing candlestick pattern forms

- The 200-period moving average is acting as resistance at 184.20

- RSI reaches 68, approaching overbought territory

This is a high-probability sell setup. You enter short at 184.20 with a stop loss at 184.45 (above the 78.6% level) and target the previous low at 183.00.

Example 3: USD/CAD Range-Bound Market (What NOT to Do)

USD/CAD has been bouncing between 1.3500 and 1.3600 for the past two weeks with no clear trend.

A beginner might try to draw Fibonacci retracement on every little move within this range. This is a mistake.

In a ranging market, you should focus on the horizontal support at 1.3500 and resistance at 1.3600. Buy near support, sell near resistance, and forget about Fibonacci until a clear trend emerges.

Fibonacci Retracement and Expert Advisors (EAs)

Many forex traders use Expert Advisors (automated trading robots) to trade Fibonacci retracements automatically.

How Fibonacci EAs Work

Fibonacci EAs for MetaTrader 4 and MetaTrader 5 typically use algorithms to automatically detect swing highs and lows, draw Fibonacci levels, and execute trades when price reaches specific retracement zones.

These tools can monitor multiple currency pairs simultaneously and react faster than manual trading. Some popular Fibonacci EAs include AutoFibo EA, Ultimate Fibonacci EA, and various custom-coded robots available on the MQL5 marketplace.

Why Forex VPS is Critical for Fibonacci EAs

If you run a Fibonacci-based Expert Advisor, you need your trading platform to be online 24/7. If your home computer shuts down or loses internet connection, your EA stops working and you miss trading opportunities.

This is where a forex VPS becomes essential. A VPS (Virtual Private Server) runs your trading platform on a remote server that stays online continuously with guaranteed uptime and ultra-low latency to your broker.

At NYCServers, we offer MT4 VPS and MT5 VPS hosting specifically designed for automated trading. With servers located in major financial hubs (New York, London, Tokyo) and latency under 1ms to most popular brokers, your Fibonacci EA can execute trades with precision timing.

If you want to learn more about automated trading, check out our guide on what are forex expert advisors.

Frequently Asked Questions

What is Fibonacci retracement in forex trading?

Fibonacci retracement is a technical analysis tool that uses horizontal lines to identify potential support and resistance levels where price may reverse. The levels are derived from the Fibonacci sequence and include key ratios: 23.6%, 38.2%, 50%, 61.8%, and 78.6%. Traders use these levels to identify where a trending market might pause or reverse during a pullback.

Which Fibonacci level is most reliable for forex trading?

The 61.8% level (the golden ratio) is generally considered the most reliable Fibonacci retracement level. Academic studies show it receives the most attention from traders. However, the 38.2% and 50% levels are also widely watched. The most reliable approach is to use multiple levels together with other technical indicators for confirmation rather than relying on any single level.

How do you draw Fibonacci retracement correctly?

To draw Fibonacci retracement: 1) Identify the trend direction (uptrend or downtrend). 2) For uptrends, click on the swing low and drag to the swing high. 3) For downtrends, click on the swing high and drag to the swing low. 4) The tool automatically plots horizontal lines at the key Fibonacci ratios. 5) Use consistent reference points (either wick-to-wick or close-to-close) throughout your analysis.

Does Fibonacci retracement actually work in forex?

Academic research shows Fibonacci retracement does not provide statistically significant trading advantages when used alone. However, it can work as part of a complete trading strategy when combined with other technical indicators. The effectiveness comes from the self-fulfilling prophecy effect. Because so many traders watch the same levels, they can become relevant support and resistance zones where price reacts.

What is the golden ratio in Fibonacci trading?

The golden ratio is approximately 1.618 (also written as phi or φ). In Fibonacci retracement, the 61.8% level is derived from dividing one Fibonacci number by the next number in the sequence. This ratio appears frequently in nature, art, and architecture. In trading, the 61.8% retracement level is considered one of the strongest potential reversal zones.

Can I use Fibonacci retracement with Expert Advisors?

Yes, many Expert Advisors (EAs) for MetaTrader 4 and 5 include Fibonacci auto-detection capabilities. These EAs automatically identify swing highs and lows, draw retracement levels, and can execute trades when price reaches specific Fibonacci zones. When running Fibonacci-based EAs, you need reliable 24/7 uptime which is why traders typically use a forex VPS to keep their automated strategies running continuously.

What are common mistakes when using Fibonacci retracement?

The most common Fibonacci mistakes include: 1) Using it as a standalone tool without confirmation from other indicators. 2) Drawing from incorrect swing points or mixing reference points (using both wicks and closes). 3) Ignoring the long-term trend and only focusing on short-term charts. 4) Expecting price to always reverse at Fibonacci levels. 5) Using Fibonacci in ranging or sideways markets instead of clear trends.

Final Thoughts: Should You Use Fibonacci Retracement?

Fibonacci retracement is a useful tool, but it is not a holy grail.

The academic evidence shows that Fibonacci levels do not have any inherent predictive power. They work because traders believe they work, creating a self-fulfilling prophecy. When enough market participants watch the same levels and place orders at those zones, the levels become relevant.

Does that mean you should ignore Fibonacci? No. It means you should use it intelligently.

Here is how to approach Fibonacci retracement:

- Use it only in clear trending markets, not in ranges

- Always combine it with other technical tools for confirmation

- Look for confluence with support/resistance, moving averages, and candlestick patterns

- Be consistent in how you draw your levels

- Accept that it will not work every time, and manage your risk accordingly

If you are running automated strategies based on Fibonacci retracement, make sure you have a reliable infrastructure. A professional forex VPS ensures your trading platform and Expert Advisors run 24/7 with minimal latency, giving your strategies the best chance to execute properly.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.