Waka Waka EA Review 2026: 70+ Months Profitable or Risky Grid System?

Honest Waka Waka EA review examining its 70+ month track record, grid trading strategy, $2,500 price tag, and real drawdown risks. Is it worth it for your trading?

Is Waka Waka EA Worth the $2,500 Investment?

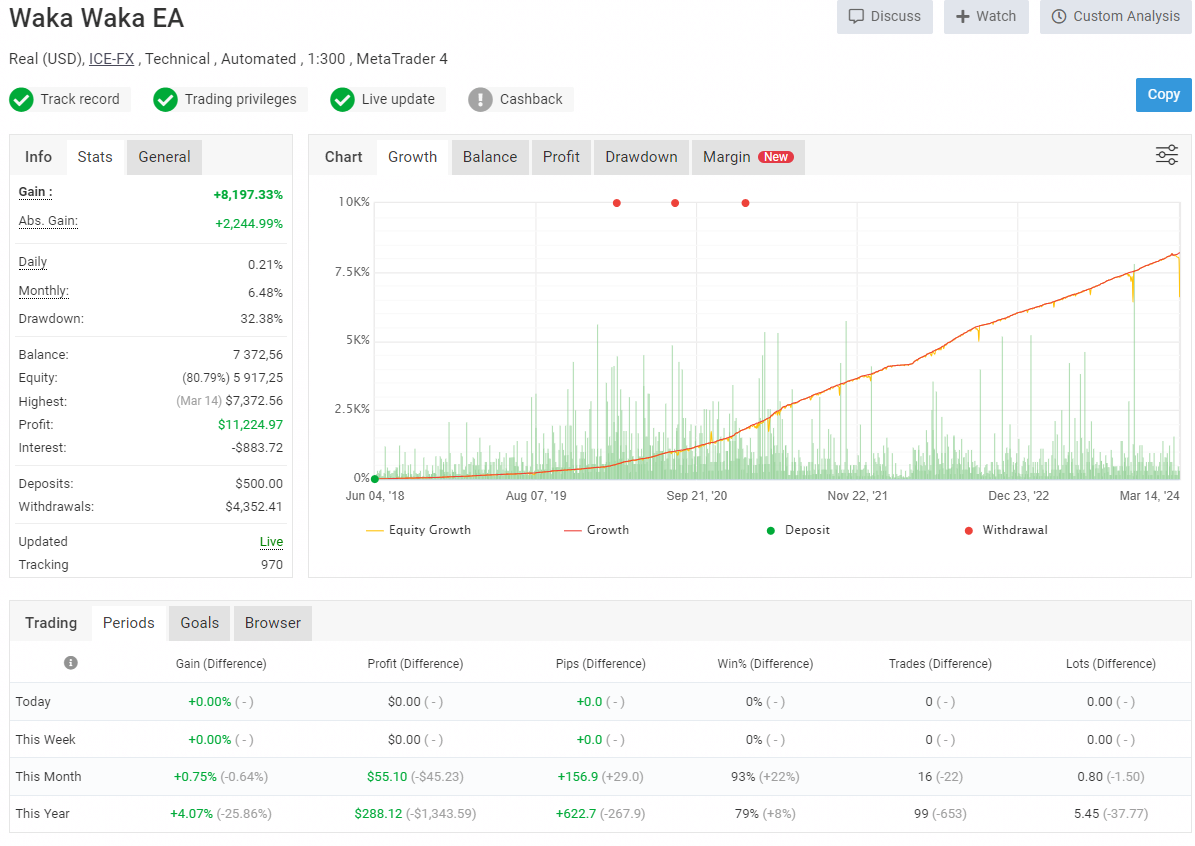

Waka Waka EA holds one of the longest verified track records in the retail forex robot market—over 70 consecutive profitable months with returns exceeding 8,000% since 2018. Those numbers sound exceptional, and they are. But the headline performance hides a critical reality: this is a grid trading system, and grid systems can produce devastating drawdowns when markets trend strongly against open positions.

This review cuts through the marketing to examine what Waka Waka actually delivers. We’ll analyze the strategy, verify the performance claims, and assess whether the $2,500+ price tag makes sense for different types of traders. The verdict isn’t black and white—Waka Waka can be highly profitable with proper risk management, but it’s not suitable for everyone.

Waka Waka EA at a Glance

| Specification | Details |

|---|---|

| Developer | Valeriia Mishchenko |

| Price | $2,520 (lifetime license) |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Currency Pairs | AUDCAD, AUDNZD, NZDCAD |

| Timeframe | M15 (15-minute) |

| Strategy | Grid + RSI + Bollinger Bands |

| Activations | 10 accounts |

| Verified Track Record | 70+ consecutive profitable months |

| MQL5 Rating | 4.13/5 (44 reviews) |

| Refund Policy | 30-day money-back guarantee |

How Waka Waka EA Actually Works

Understanding Waka Waka’s strategy is essential before deciding whether to use it. The EA combines technical analysis for entry signals with grid-based position management—a approach that generates consistent profits in ranging markets but creates significant risk during strong trends.

Entry Signal Logic

Waka Waka uses RSI (Relative Strength Index) and Bollinger Bands to identify potential reversal points. When price reaches oversold or overbought conditions near Bollinger Band extremes, the EA opens its initial position expecting mean reversion. This works well for the AUD and NZD crosses it trades, as these commodity currency pairs historically exhibit strong mean-reverting behavior.

Grid Position Management

Here’s where the strategy gets controversial. If the initial trade moves against the position, Waka Waka opens additional trades at predetermined intervals. The EA uses ATR (Average True Range) to dynamically adjust these grid distances—wider spacing in volatile conditions, tighter spacing when markets are calm.

This isn’t pure martingale (the EA doesn’t double position sizes), but it does multiply exposure during drawdowns. When the market eventually reverses, all positions close in profit. When it doesn’t reverse quickly enough, drawdowns compound rapidly.

Why AUD/NZD Pairs?

The three supported pairs—AUDCAD, AUDNZD, and NZDCAD—share characteristics that favor grid trading:

- High correlation: All three involve commodity currencies with similar economic drivers

- Range-bound tendency: These pairs spend more time in consolidation than trending compared to majors like EUR/USD

- Moderate volatility: Enough movement for profits without extreme directional runs

The developer’s pair selection isn’t arbitrary—it’s optimized for the strategy’s strengths. Attempting to run Waka Waka on trending pairs like GBP/JPY would likely produce poor results.

Verified Performance Analysis

Waka Waka’s performance claims are backed by Myfxbook verified accounts, which adds credibility compared to EAs showing only backtests. However, the numbers require context.

The Headline Numbers

- Track record: 70+ consecutive profitable months

- Total return: 8,100%+ since 2018

- Monthly average: Varies significantly, typically 3-8% on moderate risk

- Win rate: High (grid systems typically close most trades profitably)

The Drawdown Reality

What the marketing emphasizes less prominently is drawdown behavior. Users report experiencing 40-50% drawdowns on medium risk settings during adverse market conditions. The official developer account showed drawdowns exceeding 40% in early 2024, with some user accounts being completely depleted during this period.

Grid trading produces an unusual equity curve: long periods of steady gains punctuated by sharp drawdowns during trending markets. The win rate appears excellent because most grid sequences close profitably. But the losing sequences—when they occur—can wipe out months of accumulated profit in days. This asymmetric risk profile is fundamental to grid strategies, not a flaw specific to Waka Waka.

One documented recovery period lasted over 80 days—nearly three months of being stuck in drawdown before positions closed profitably. If you can’t stomach watching your account sit at -40% for months, Waka Waka isn’t for you regardless of its long-term profitability.

Broker Dependency

Multiple users note that results vary significantly between brokers—even between different servers at the same broker. Grid EAs are particularly sensitive to spread widening, slippage, and execution speed. Running Waka Waka on a dedicated forex VPS with a low-spread ECN broker is effectively mandatory for replicating the developer’s results.

Pricing and What You Get

At $2,520, Waka Waka sits at the premium end of the forex EA market. Here’s what the license includes:

- Lifetime license: No recurring fees or subscriptions

- 10 account activations: Enough for multiple live and demo accounts

- MT4 and MT5 versions: Both platforms included

- Free updates: All future versions at no additional cost

- Prop firm set files: Pre-configured settings for FTMO and similar challenges

- User dashboard: Online portal for license management

- Developer support: Direct assistance from Valeriia Mishchenko’s team

Is the Price Justified?

The value proposition depends on your capital base. For a $10,000 account generating 5% monthly returns, the EA pays for itself in roughly 5 months. For a $1,000 account, that payback period extends to years—assuming no account-ending drawdown occurs first.

The 30-day refund policy and free demo provide risk mitigation. Test thoroughly on demo before committing real capital, and verify the EA performs acceptably with your specific broker before the refund window closes.

Setup and Configuration

Waka Waka’s setup process is notably streamlined compared to many EAs. The one-chart installation feature allows running all three currency pairs from a single chart attachment, reducing resource usage and simplifying management.

Basic Requirements

- Platform: MetaTrader 4 or MetaTrader 5

- Account type: Hedging account (mandatory)

- Minimum balance: $1,000 recommended ($3,000+ for safer risk settings)

- Leverage: 1:100 minimum recommended; 1:30 workable with larger capital

- Broker: ECN with low spreads on AUD/NZD pairs

- VPS: Required for 24/7 operation

Risk Presets

The EA includes multiple risk configurations:

- Low risk: Smaller position sizes, wider grid spacing, lower returns but survivable drawdowns

- Medium risk: Balanced approach, the developer’s recommended setting for most users

- High risk: Aggressive sizing for maximum returns—and maximum drawdown potential

Conservative traders should start with low risk settings regardless of backtest results. The backtests use perfect historical data; live trading introduces slippage, spread variations, and execution delays that compound grid system risks.

Running Waka Waka on a VPS

Grid EAs like Waka Waka require uninterrupted operation. Missing a grid level due to connection issues can turn a recoverable drawdown into an account-ending event. A MetaTrader VPS provides the stability and low latency necessary for consistent execution.

VPS Requirements for Grid Trading

- Uptime: 99.9%+ guaranteed—grid systems can’t afford downtime during open positions

- Latency: Under 10ms to your broker’s servers for accurate grid level fills

- Resources: 2GB RAM minimum; Waka Waka is relatively lightweight but needs headroom

- Location: Choose a server location near your broker’s data center

Running Waka Waka from a home computer with intermittent connectivity is asking for problems. The monthly cost of a quality VPS is negligible compared to the potential losses from missed trades or disconnection during drawdown recovery.

Who Waka Waka EA Is For

Waka Waka suits a specific trader profile. Misalignment between your expectations and the EA’s behavior leads to poor outcomes—either abandoned strategies or emotional interference with settings.

Good Fit If You:

- Have patience for drawdowns: Can watch -30% to -50% without panicking or disabling the EA

- Understand grid risk: Accept that one bad sequence can erase months of gains

- Have adequate capital: $3,000+ to run conservative settings with survivable drawdowns

- Want passive income: Prefer set-and-forget automation over active trading

- Can afford the price: $2,500 doesn’t represent a significant portion of your trading capital

Poor Fit If You:

- Trade prop firm challenges: Most prop firms have 5-10% max drawdown rules—incompatible with grid systems

- Need consistent monthly returns: Grid profits come in bursts, not steady streams

- Have limited capital: Small accounts can’t survive the drawdowns

- Want low-risk automation: Grid trading is inherently higher risk than trend-following or scalping EAs

Waka Waka EA: Honest Pros and Cons

Strengths

- Exceptional track record: 70+ profitable months is rare and verified

- Active development: Regular updates, version 4.56 as of 2025

- Easy setup: One-chart installation, clear documentation

- Responsive support: Developer maintains active presence on MQL5

- Transparent performance: Myfxbook verification, not just backtests

- NFA/FIFO compliant: Works with US brokers

Weaknesses

- Grid system risks: Severe drawdowns during trending markets

- High price point: $2,500+ is significant for retail traders

- Broker sensitive: Results vary by execution quality

- Limited pairs: Only three currency pairs supported

- Recovery time: Drawdown periods can last months

- Account losses reported: Some users lost accounts in 2024 despite following settings

Alternatives to Consider

If Waka Waka’s risk profile or price doesn’t fit, consider these alternatives in the grid/recovery EA space:

- Happy Gold EA: Lower price point, gold-focused grid system

- Forex Fury: Non-grid scalping approach, lower drawdowns but smaller returns

- Night Hunter Pro: Same developer, night scalping strategy instead of grid

Each alternative involves different trade-offs between risk, return potential, and price. No EA eliminates risk—they just structure it differently.

Final Verdict: Should You Buy Waka Waka EA?

Waka Waka EA delivers what it promises: a grid trading system with an exceptional long-term track record. The 70+ months of verified profitability isn’t fabricated, and the strategy logic is sound for the pairs it trades. Properly configured with adequate capital and realistic expectations, it can generate consistent returns over time.

However, the grid approach means accepting drawdown periods that would terrify most traders. Watching your account sit at -40% for two months tests psychological limits. Some users in 2024 didn’t survive those drawdowns. The strategy works until it doesn’t, and when it fails, it fails hard.

Buy Waka Waka if: You have $5,000+ capital, understand grid risks, can emotionally handle extended drawdowns, and want a proven long-term automation system.

Skip Waka Waka if: You’re undercapitalized, risk-averse, trading prop firm challenges, or expect smooth equity curves.

The free demo and 30-day refund policy let you test before committing. Use them. Run the EA on demo for at least a month, experience a drawdown cycle, and decide whether you can live with the strategy’s behavior before risking real capital.

Frequently Asked Questions

Is Waka Waka EA a martingale system?

Waka Waka uses a grid system that opens additional positions during drawdowns, but it doesn’t double position sizes like pure martingale. The EA uses fixed or proportional lot sizing for grid levels. However, total exposure still increases during drawdowns, which creates similar risk dynamics.

What is the minimum deposit for Waka Waka EA?

The developer recommends $1,000 minimum, but $3,000+ provides more comfortable drawdown tolerance. Running aggressive settings on minimum capital significantly increases the risk of account loss during extended drawdown periods.

Can I use Waka Waka EA for prop firm challenges?

Not recommended for most prop firms. Grid systems can produce 30-50% drawdowns, exceeding typical prop firm limits of 5-10%. The EA includes “prop firm” set files, but these reduce profitability significantly to stay within drawdown constraints. Verify your firm’s rules before attempting.

What broker works best with Waka Waka EA?

ECN brokers with tight spreads on AUD/NZD pairs perform best. IC Markets, Pepperstone, and FP Markets are commonly recommended by users. Avoid brokers with wide spreads or frequent requotes—grid systems are sensitive to execution quality.

Does Waka Waka EA need a VPS?

Effectively yes. Grid systems require 24/7 operation to manage open positions properly. Running from a home computer with potential disconnections can result in missed grid levels and unmanaged drawdowns. A forex VPS with 99.9%+ uptime is strongly recommended.

How often does Waka Waka EA trade?

Trade frequency varies with market conditions. During ranging markets, the EA may open and close multiple grid sequences per week. During strong trends, it may hold positions for weeks or months while waiting for recovery. Expect periods of both high activity and extended holds.

Is there a free trial for Waka Waka EA?

Yes. A free demo version is available on MQL5 for testing on demo accounts. Additionally, the paid version includes a 30-day money-back guarantee, allowing real-account testing with refund protection.

About the Author

Thomas Vasilyev

Writer & Full Time EA Developer

Tom is our associate writer, and has advanced knowledge with the technical side of things, like VPS management. Additionally Tom is a coder, and develops EAs and algorithms.