Tickmill Review 2026: Spreads, Fees, Pros & Cons Tested

Complete Tickmill review covering Raw account spreads from 0.0 pips, FCA/CySEC regulation, 620+ instruments, and who this ECN broker is best for.

Quick Verdict: Is Tickmill Worth Your Time?

Tickmill is a well-regulated ECN/STP broker that stands out for one thing above all else: cost-efficiency. With Raw account spreads averaging just 0.10 pips on EUR/USD and a $6 round-turn commission, it consistently ranks among the cheapest brokers for active forex traders.

Founded in 2014 and headquartered in London, Tickmill holds licenses from the FCA (UK) and CySEC (Cyprus)—both Tier-1 regulators with strict oversight and compensation schemes. The broker serves over 490,000 clients across 180+ countries and has executed more than 91 million trades.

But Tickmill isn’t for everyone. The instrument range is narrower than multi-asset giants like IG or Saxo Bank, and the 2026 removal of tools like Autochartist and Capitalise.ai left some traders looking elsewhere. If you’re after a broad product portfolio with stocks, options, and crypto, you’ll find Tickmill limiting.

Best for: Cost-conscious forex traders, scalpers, algo traders, and anyone running EAs on MetaTrader who prioritizes execution speed and tight spreads over product variety.

Tickmill at a Glance

| Feature | Details |

|---|---|

| Founded | 2014 |

| Headquarters | London, UK |

| Regulation | FCA (Tier-1), CySEC (Tier-1), FSCA (Tier-2), FSA Seychelles (Tier-3) |

| Minimum Deposit | $100 |

| Spreads | From 0.0 pips (Raw), from 1.6 pips (Classic) |

| Commission | $3 per lot per side (Raw account) |

| Platforms | MT4, MT5, TradingView, Tickmill Trader |

| Instruments | 620+ (62 forex pairs, 490 stocks, 22 indices, 19 commodities, 15 crypto) |

| Trustpilot Rating | 3.6/5 (1,058 reviews) |

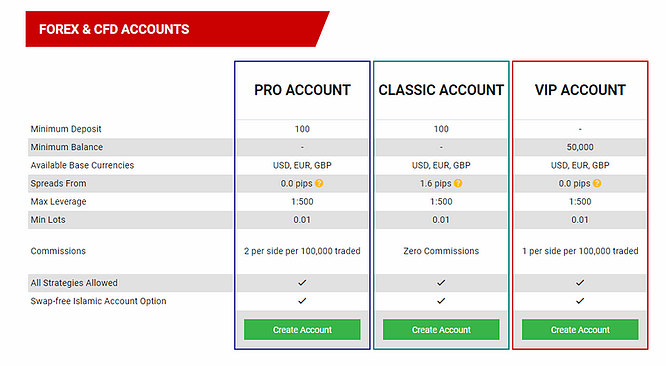

Account Types: Classic vs Raw vs TradingView Raw

Tickmill keeps things simple with three account types. Each targets a different trading style, but they all share the same $100 minimum deposit and access to the full instrument range.

Classic Account

The Classic account is commission-free but comes with wider spreads starting from 1.6 pips. At an average of 1.70 pips on EUR/USD, it’s not competitive compared to other spread-only brokers. This account makes sense only if you trade infrequently and prefer the simplicity of no per-trade fees.

Raw Account

This is Tickmill’s flagship offering and where the broker truly shines. Spreads start from 0.0 pips—averaging just 0.10 pips on EUR/USD—with a commission of $3 per lot per side ($6 round-turn). The all-in cost works out to roughly 0.70 pips equivalent, making it one of the cheapest options in the industry for active traders.

Note: In 2026, the Raw account replaced the former “Pro” account and increased commissions from $2 to $3 per side. Still competitive, but worth knowing if you’re comparing older reviews.

TradingView Raw Account

Same raw spreads from 0.0 pips, but with a slightly higher commission of $3.50 per lot per side. The trade-off is direct access to TradingView’s charting platform with 400+ built-in indicators and 110+ drawing tools, plus cross-platform access through Tickmill Trader.

Account Comparison Table

| Feature | Classic | Raw | TradingView Raw |

|---|---|---|---|

| Spreads From | 1.6 pips | 0.0 pips | 0.0 pips |

| Commission | None | $3/lot/side | $3.50/lot/side |

| Min Deposit | $100 | $100 | $100 |

| Max Leverage | 1:1000* | 1:1000* | 1:1000* |

| Platforms | MT4, MT5 | MT4, MT5 | TradingView, Tickmill Trader |

| Islamic Option | Yes | Yes | Yes |

*Leverage varies by regulation. FCA/CySEC clients are limited to 1:30 for retail accounts.

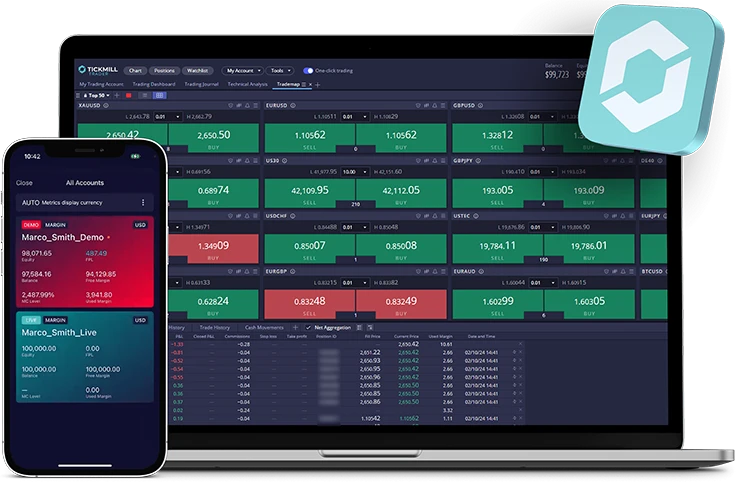

Trading Platforms: MT4, MT5, TradingView, and Tickmill Trader

Tickmill offers four trading platforms, covering both desktop power users and mobile-first traders.

MetaTrader 4 (MT4)

The industry standard for forex trading. MT4 supports Expert Advisors (EAs), custom indicators, and one-click trading. Tickmill’s MT4 implementation includes all standard features plus access to their liquidity pool for fast execution. Available on Windows, macOS, iOS, Android, and as a WebTrader.

MetaTrader 5 (MT5)

The upgraded version with additional order types, a built-in economic calendar, and improved backtesting for algo traders. MT5 also supports more timeframes and depth-of-market data. If you trade indices or stocks alongside forex, MT5 is the better choice.

TradingView

A relatively new addition to Tickmill’s platform lineup. TradingView brings its renowned charting capabilities—400+ indicators, 110+ drawing tools, and a massive community of trading ideas. The catch: you need a TradingView Raw account, which has slightly higher commissions.

Tickmill Trader

Tickmill’s proprietary mobile app with 60+ technical indicators and secure biometric login. It’s designed for on-the-go trading and syncs with the TradingView Raw account. Not as feature-rich as MT4/MT5 but clean and responsive for mobile monitoring.

For traders running automated strategies 24/7, consider pairing Tickmill with a dedicated forex VPS to ensure your EAs execute without interruption. Tickmill partners with BeeksFX for VPS services (20% discount for clients), but third-party providers offer sub-1ms latency to Tickmill’s servers.

Regulation and Safety: How Secure Is Your Money?

Regulation is where Tickmill earns serious trust points. The broker operates under multiple entities, each overseen by different authorities:

Tier-1 Regulators (Strongest Protection)

- FCA (UK) — Tickmill UK Ltd, Register No. 717270. Clients receive FSCS protection up to 85,000 GBP if the broker becomes insolvent. Retail leverage capped at 1:30 with mandatory negative balance protection.

- CySEC (Cyprus) — Tickmill Europe Ltd, License 278/15. ICF compensation up to 20,000 EUR per client. Full MiFID II compliance with segregated client funds.

Tier-2 Regulators (Moderate Protection)

- FSCA (South Africa) — FSP No. 49464. Provides regulatory oversight for African clients but with less stringent compensation schemes.

- DFSA (Dubai) — Representative office under Tickmill UK Ltd. Reference F0076630.

Tier-3 Regulators (Basic Oversight)

- FSA Seychelles — Tickmill Ltd, License SD008. Higher leverage (up to 1:1000) but minimal investor protection. Best avoided unless you specifically need high leverage and accept the risks.

Key safety features across all entities:

- Segregated client funds kept separate from company operating capital

- Negative balance protection for retail traders

- Regular financial audits and reporting requirements

Bottom line: If you’re in the UK or EU, open your account with the FCA or CySEC entity for maximum protection. The Seychelles entity offers higher leverage but trades away meaningful investor safeguards.

What Can You Trade? Instruments Breakdown

Tickmill offers 620+ instruments across multiple asset classes. Here’s what’s available:

| Asset Class | Count | Examples |

|---|---|---|

| Forex | 62 pairs | EUR/USD, GBP/JPY, USD/ZAR, exotic crosses |

| Stock CFDs | 490+ | Apple, Tesla, Amazon, European stocks |

| Indices | 22 | S&P 500, DAX 40, FTSE 100, Nikkei 225 |

| Commodities | 19 | Gold, silver, crude oil, natural gas, copper |

| ETFs | 25 | SPY, QQQ, sector ETFs |

| Crypto CFDs | 15 | Bitcoin, Ethereum, Litecoin, Ripple |

| Bonds | 4 | German Bund, UK Gilt |

The good: Solid forex coverage with 62 pairs including exotics. Excellent stock CFD selection with 490+ shares from US, UK, and European markets. Competitive commodity offerings.

The gap: Crypto selection is limited (only 15 coins compared to 50+ at some rivals). No physical share dealing—everything is CFDs. If you want real stock ownership or extensive crypto, look elsewhere.

Fees and Costs: The Full Picture

Tickmill’s fee structure is straightforward and transparent—one of its biggest selling points.

Trading Costs

- Raw Account: Average 0.10 pip spread + $6 round-turn commission = ~0.70 pip all-in cost on EUR/USD

- Classic Account: Average 1.70 pip spread, no commission

- Gold spreads: Average 9 cents on XAU/USD

For context, Tickmill won ForexBrokers.com’s “Best in Class” award for Commissions & Fees in 2026. The Raw account’s all-in cost undercuts most competitors.

Non-Trading Fees

- Deposits: Free for all methods

- Withdrawals: Free (bank wire, e-wallets, cards)

- Currency conversion: No internal fees; your bank may charge

- Inactivity fee: $10/quarter after 12 months of no trading

The zero-fee deposit and withdrawal policy is a standout. Many brokers charge $25-50 for bank wires; Tickmill doesn’t. For wire transfers over $5,000, Tickmill even covers transaction fees up to $100.

Swap/Overnight Fees

Standard swap rates apply for positions held overnight. Islamic (swap-free) accounts are available for all account types upon request.

Deposits and Withdrawals: Methods, Speed, and Limits

Tickmill supports a broad range of funding options:

Deposit Methods

- Bank wire transfer (SWIFT)

- Credit/debit cards (Visa, Mastercard)

- E-wallets: Skrill, Neteller, SticPay, FasaPay

- Crypto: Bitcoin, Ethereum, USDT

- Local bank transfers (varies by region)

Withdrawal Processing

- E-wallets: Same day to 24 hours

- Credit/debit cards: 1-8 working days

- Bank wire: 3-7 working days

Tickmill processes withdrawal requests within one working day on their end. The total time depends on your payment provider’s processing speed.

Important Notes

- Minimum withdrawal: $25

- Deposits made by card must be refunded to the same card before profits can be withdrawn elsewhere (AML compliance)

- Base currencies: USD, EUR, GBP, ZAR only. Other currencies get auto-converted.

VPS and Automated Trading Support

Tickmill is well-suited for algorithmic traders and EA users. Both MT4 and MT5 fully support Expert Advisors, and the broker’s infrastructure is optimized for automated execution.

Execution Quality

- Average execution time: ~59 milliseconds

- No dealing desk interference (NDD/STP model)

- Deep liquidity from tier-1 providers

- No requotes under normal market conditions

VPS Options

Tickmill partners with BeeksFX, offering clients a 20% discount on VPS hosting. This keeps your EAs running 24/7 on servers located near Tickmill’s infrastructure for minimal latency.

For traders who want even lower latency or more control, specialized forex VPS providers offer servers in Equinix NY4 (New York), LD4 (London), and TY3 (Tokyo)—data centers where many major brokers house their matching engines. A properly configured Tickmill VPS can reduce execution latency to under 1ms, which matters for scalping and high-frequency strategies.

What Could Be Better: Honest Drawbacks

No broker is perfect. Here’s where Tickmill falls short:

Limited Product Range

620 instruments sounds like a lot, but compared to IG (17,000+) or Saxo Bank (40,000+), Tickmill is narrow. Only 15 cryptocurrencies. No options trading. No physical share dealing. If you want a one-stop shop for all asset classes, this isn’t it.

2026 Tool Removals

Tickmill discontinued Autochartist, Pelican, and Capitalise.ai in 2026. These were popular third-party tools for pattern recognition and no-code strategy building. Their removal frustrated traders who relied on them.

Withdrawal Complaints

While most traders report smooth withdrawals, a minority have experienced delays or complications—particularly those using the Seychelles entity. Some forum complaints mention week-long waits that should take 24 hours. The FCA and CySEC entities seem to have fewer issues.

Classic Account Spreads

At 1.70 pips average on EUR/USD, the commission-free Classic account isn’t competitive. If you’re avoiding commissions for simplicity, other brokers offer tighter spread-only accounts.

Commission Increase

The 2026 switch from $2 to $3 per side on the Raw account was a 50% hike. Still competitive, but long-time clients noticed the bump.

Who Should (and Shouldn’t) Use Tickmill

Tickmill Is a Great Fit For:

- Active forex traders who prioritize low trading costs over product breadth

- Scalpers who need tight spreads and fast execution

- Algo traders and EA users looking for a MetaTrader-friendly broker with solid infrastructure

- Cost-conscious beginners who want a regulated broker with a $100 minimum deposit

- UK and EU traders seeking Tier-1 regulation with proper investor protection

Tickmill Is NOT Ideal For:

- Multi-asset investors wanting stocks, options, crypto, and forex under one roof

- Crypto-focused traders who need extensive coin selection

- Traders who relied on removed tools like Autochartist or Capitalise.ai

- Those seeking commission-free trading with competitive spreads (the Classic account isn’t the answer)

Final Verdict: A Focused Broker That Excels at What It Does

Tickmill isn’t trying to be everything to everyone. It’s a focused forex and CFD broker that does a few things exceptionally well: tight spreads, low commissions, multi-tier regulation, and reliable execution.

The Raw account remains one of the best value propositions in the industry for active forex traders. An all-in cost of around 0.70 pips on EUR/USD, zero deposit/withdrawal fees, and FCA/CySEC oversight make it a strong contender in 2026.

However, the narrow product range, removed third-party tools, and occasional withdrawal complaints with the offshore entity mean Tickmill isn’t a universal recommendation. Know what you’re getting—a cost-efficient forex specialist—and it delivers.

Our rating: 4.2/5

For traders running automated strategies around the clock, pair Tickmill with a low-latency trading VPS to maximize execution quality. The difference between executing from home (100-300ms latency) versus a properly located forex VPS (under 1ms) can be significant for strategies sensitive to fill prices.

Frequently Asked Questions

Is Tickmill a safe broker?

Yes. Tickmill holds licenses from the FCA (UK) and CySEC (Cyprus), both Tier-1 regulators with strict oversight. UK clients are protected up to 85,000 GBP by the FSCS, while EU clients have ICF coverage up to 20,000 EUR. Client funds are segregated, and negative balance protection is standard for retail accounts.

What is the minimum deposit for Tickmill?

The minimum deposit is $100 for all account types (Classic, Raw, and TradingView Raw). There’s also a VIP tier requiring $50,000 for enhanced conditions, but it’s not mandatory.

What are Tickmill’s spreads on EUR/USD?

On the Raw account, EUR/USD spreads average 0.10 pips with a $3 per side commission. The all-in cost is approximately 0.70 pips. On the Classic account, spreads average 1.70 pips with no commission.

Does Tickmill offer a free VPS?

Tickmill partners with BeeksFX and offers clients a 20% discount on VPS hosting. However, it’s not completely free. Some traders prefer third-party VPS providers for lower latency or different pricing structures.

What platforms does Tickmill support?

Tickmill offers MetaTrader 4, MetaTrader 5, TradingView (for TradingView Raw accounts), and its proprietary Tickmill Trader mobile app. MT4 and MT5 are available on Windows, macOS, iOS, Android, and as WebTrader versions.

Can US traders use Tickmill?

No. Tickmill does not accept clients from the United States. US residents need to use brokers registered with the NFA/CFTC, such as OANDA, Forex.com, or TD Ameritrade.

How long do Tickmill withdrawals take?

Tickmill processes withdrawal requests within one working day. E-wallet withdrawals typically arrive the same day. Card withdrawals take 1-8 working days, and bank wires take 3-7 working days depending on your bank’s processing time.

Does Tickmill allow scalping and EAs?

Yes. Tickmill explicitly permits all trading strategies including scalping, hedging, and automated trading via Expert Advisors. The NDD execution model means no dealing desk interference with your trades.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.