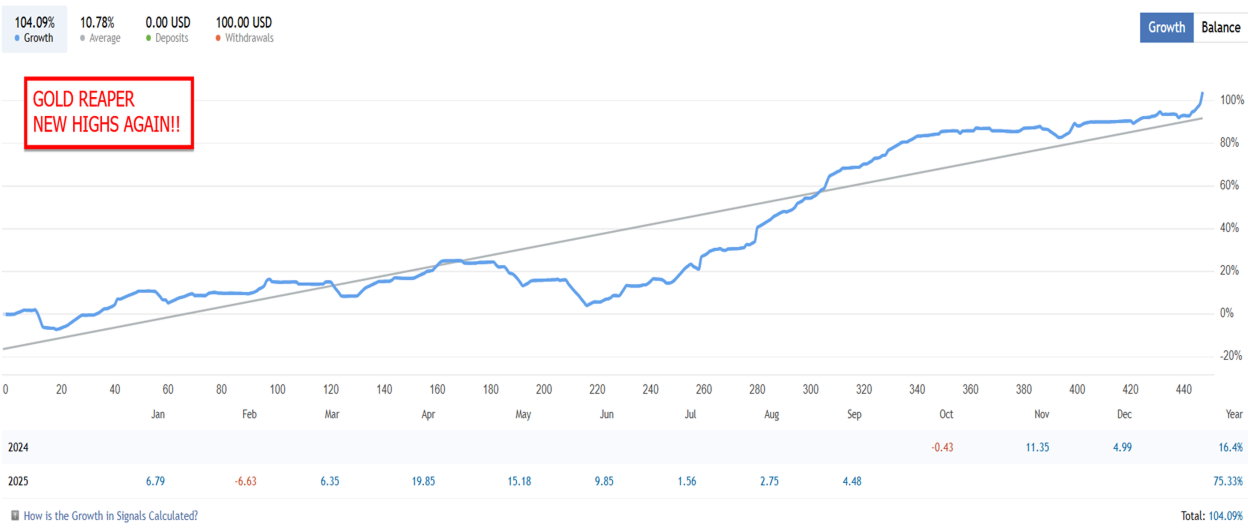

The Gold Reaper EA Review 2026: Best Gold Breakout Robot at $599?

Honest Gold Reaper review with Myfxbook data, MQL5 user feedback & real drawdown analysis. Is Wim Schrynemakers’ breakout EA worth it for XAUUSD trading?

Gold has been on a historic run, making all-time highs throughout 2024-2025. Naturally, gold trading EAs have flooded the market—most using dangerous grid/martingale tactics that eventually blow accounts when gold corrects.

The Gold Reaper takes a different approach. Developed by Wim Schrynemakers (coding EAs since 2005), it uses breakout strategies with proper stop losses on every trade. No martingale, no grid, no hidden risks.

But the live results tell a more nuanced story than the marketing. This review examines whether The Gold Reaper delivers on its promises—or joins the graveyard of gold EAs that couldn’t survive real market conditions.

The Gold Reaper at a Glance

| Developer | Wim Schrynemakers (Profalgo Limited) |

| Platform | MetaTrader 4 / MetaTrader 5 |

| Instrument | XAUUSD (Gold) |

| Strategy | Multi-timeframe breakout (9 strategies) |

| Risk Management | No martingale/grid, SL/TP on all trades |

| MQL5 Rating | 4.46/5 (92 reviews) |

| Price | $599 (rentals from $299) |

| Licenses | 10 activations |

| Minimum Balance | $300 |

| Prop Firm Ready | Yes, set files included |

How The Gold Reaper Works

Multi-Timeframe Breakout Strategy

The Gold Reaper identifies support and resistance levels across multiple timeframes, then trades breakouts when price moves beyond these levels with momentum. The EA runs 9 different breakout strategies simultaneously, each optimized for different market conditions.

Key mechanics:

- Support/resistance identification: Automatically calculates key levels

- Breakout confirmation: Waits for momentum before entering

- False breakout filter: Reduces whipsaw entries

- Multi-timeframe analysis: Confirms signals across timeframes

Risk Management Features

Every trade includes:

- Stop loss: Defined maximum loss per trade

- Take profit: Target exit level

- Trailing stop: Locks in profits as trade moves favorably

- Trailing take profit: Extends winners during strong moves

- NFP filter: Avoids trading during high-impact news

What It Doesn’t Use

- No martingale: Lot sizes don’t increase after losses

- No grid: Doesn’t average down during drawdowns

- No hedging: Clean directional trades only

- No latency arbitrage: Works with any broker

Verified Performance Analysis

The Backtest vs. Live Reality

The Gold Reaper’s backtests look impressive:

- Net profit: $196,397 (2020-2024)

- Win rate: 81.48%

- Profit factor: 2.72

- Max drawdown: 12.43%

But live Myfxbook results tell a different story. The moderate-risk account shows:

- Total gain: +14.98%

- Maximum drawdown: 41.66%

- Profit factor: 1.08

- Win rate: 72%

- Average win: $20.94

- Average loss: -$51.05

The Drawdown Problem

The gap between backtest (12% drawdown) and live (41% drawdown) is significant. This is common with breakout EAs—they perform well in trending backtests but struggle with the chop and false breakouts of live markets.

The developer is refreshingly honest about this:

“I understand that most cannot handle this type of long-term strategy…they require a stronger stomach. But all I can guarantee is that all the straight-line EAs all end the same: margin call.”

Translation: expect painful drawdowns, but at least you won’t blow your account like you would with martingale systems.

MQL5 Review Analysis

With 92 reviews averaging 4.46/5, sentiment is generally positive but polarized:

Positive themes:

“My live results are in perfect agreement with the backtests. The developer is trustworthy. This EA is by far the best.” — Daichi Matsuki, April 2025

“Wim Schrynemakers is one of those ‘1%’ Good People. He is honest and upright.” — Verified buyer

Negative themes:

“The bot makes 30-45% drawdown swings every other month… unreliable. I’m never giving it any real money.” — Critical reviewer

Our Assessment

The Gold Reaper is a legitimate EA from an experienced developer who’s been in the game since 2005. It won’t blow your account with hidden martingale. But live performance is modest compared to backtests, and drawdowns are substantial.

This is an EA for patient traders who can stomach 30-40% drawdowns without panicking. If that’s not you, look elsewhere.

Developer Profile: Wim Schrynemakers

Understanding the developer helps set expectations:

- Experience: Developing EAs since 2005 (~20 years)

- Company: Profalgo Limited

- Philosophy: Long-term stability over quick gains

- Other products: Gold Trade Pro, Ultimate Breakout System

- Support reputation: Consistently praised as responsive and honest

Wim doesn’t promise unrealistic returns. His marketing emphasizes controlled risk over explosive gains—a refreshing approach in a market full of “10,000% profit” claims.

The Gold Reaper vs. Gold Trade Pro

Wim offers two gold EAs. Here’s how they compare:

| Feature | The Gold Reaper | Gold Trade Pro |

|---|---|---|

| Strategy | 9 multi-timeframe breakout systems | Daily S/R breakout |

| Complexity | Higher (more strategies) | Simpler (single approach) |

| Reported Live Gain | ~15-40% (varies by account) | +169% (best account) |

| Drawdown | 30-41% | ~15% |

| Price | $599 | Higher |

| Trade Frequency | Higher | Lower |

Gold Trade Pro appears to have better risk-adjusted returns based on public Myfxbook data. Gold Reaper trades more frequently at lower cost. Consider your preference for trade frequency and budget.

Pros and Cons

Pros

- No martingale/grid: Won’t blow your account on a single bad run

- Experienced developer: 20 years of EA development

- Honest marketing: Developer acknowledges drawdown reality

- Strong support: Responsive, helpful developer

- Recent updates: November 2025 update shows active development

- Prop firm compatible: Set files included

- Reasonable price: $599 with rental options from $299

- High win rate: 72% in live trading

Cons

- High drawdowns: 30-41% in live accounts

- Backtest/live gap: Live results significantly worse than backtests

- Low profit factor: 1.08 in live trading (barely profitable)

- Average loss > average win: Needs high win rate to stay profitable

- Requires patience: Not for traders who panic during drawdowns

- Gold only: No diversification across instruments

- Recent YTD decline: -1.21% in recent period despite gold’s rally

VPS Requirements

Breakout strategies benefit from consistent execution, though they’re less latency-sensitive than scalping:

- Latency: Under 50ms is sufficient for breakout trading

- Uptime: 24/5 operation essential—breakouts can happen anytime

- Memory: Moderate requirements for multi-timeframe analysis

A forex VPS ensures you don’t miss breakout entries due to home internet issues. Our NY4 VPS provides reliable connectivity to major brokers running gold trading.

Should You Buy The Gold Reaper in 2025?

Consider The Gold Reaper If:

- You can handle 30-40% drawdowns without panicking

- You want gold exposure without martingale risk

- You appreciate honest developers over hype

- $599 fits your EA budget

- You’re looking for prop firm-compatible gold trading

- You understand backtests don’t equal live results

Avoid The Gold Reaper If:

- You expect backtest-level performance (12% drawdown, 2.7 profit factor)

- 30%+ drawdowns will cause you to turn off the EA

- You need consistent monthly returns

- You want diversification beyond gold

Alternatives to Consider

- Gold Trade Pro: Same developer, simpler strategy, better reported live results, higher price

- Forex Gold Investor: Different approach to gold, longer track record

- EA Gold Stuff: Grid-based (higher risk, higher potential returns)

Frequently Asked Questions

Is The Gold Reaper profitable in 2025?

Marginally. Live accounts show profit factor around 1.08 with 72% win rate. Returns are modest relative to drawdowns experienced. Success depends on using appropriate lot sizing and surviving drawdown periods.

Does it use martingale or grid?

No. Pure breakout strategy with stop-loss, take-profit, and trailing stops on every trade. No lot size increases after losses.

What’s the typical drawdown?

30-41% in live accounts, despite backtests showing ~12%. Plan for substantial drawdowns and size positions accordingly.

Can I use it for prop firms?

Yes, prop firm set files are included. Users report passing challenges, though you’ll need conservative settings to stay within drawdown limits.

How does it compare to Gold Trade Pro?

Both from Wim Schrynemakers. Gold Trade Pro shows better live results but costs more. Gold Reaper offers more complexity at lower price. Consider starting with Gold Trade Pro if budget allows.

Final Verdict

The Gold Reaper is a legitimate gold trading EA from an honest, experienced developer. It won’t blow your account with hidden martingale tactics, and Wim Schrynemakers provides excellent support.

But let’s be realistic: live performance doesn’t match the impressive backtests. Expect 30-40% drawdowns, a profit factor barely above 1.0, and periods of negative returns even when gold is rallying. This is not a set-and-forget money printer.

At $599 (or $299 rental), it’s reasonably priced for what you get—a non-martingale gold EA with proper risk management and active development. Just calibrate your expectations to live results, not backtest fantasies.

Our recommendation: start with the 3-month rental ($299) to test on your broker before committing to full purchase. Run it alongside demo to verify performance matches official accounts. And whatever you decide, use a reliable VPS—breakout strategies need to be online when the market moves.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.