Quantum Emperor EA Review: Best-Seller or Hidden Martingale Risk?

Critical Quantum Emperor review analyzing the MQL5 best-seller’s hidden grid tactics. See real drawdown data, Myfxbook analysis, and why 565 positive reviews may be misleading.

Quantum Emperor EA: The Controversial Best-Seller

Quantum Emperor is the best-selling EA in MQL5 history. With over 5,000 purchases, an estimated $5M+ in sales revenue, and a 4.87/5 rating from 567 reviews, it dominates the marketplace. The marketing shows smooth equity curves and 90%+ win rates that make it irresistible to traders seeking passive income.

But independent analysts tell a different story. They call it “a dangerous and cleverly disguised martingale-grid system.” The EA experienced a 70% drawdown in June 2024 that wiped out months of gains in days. Signal accounts show deposits during drawdowns that may mask true risk levels.

This review cuts through the marketing hype to examine what Quantum Emperor actually does—and whether the best-selling EA is a legitimate trading system or a ticking time bomb waiting to explode.

Quantum Emperor at a Glance

| Developer | Bogdan Ion Puscasu |

| Platform | MetaTrader 4 / MetaTrader 5 |

| Currency Pair | GBPUSD only |

| Timeframe | H1 (1-hour charts) |

| MQL5 Rating | 4.87/5 (567 reviews) |

| Estimated Sales | 5,000+ purchases, ~$5M revenue |

| Current Price | $799 (increases to $1,999) |

| Minimum Deposit | $1,000 |

| Claimed Strategy | “Sophisticated risk management” |

| Actual Strategy | Grid/averaging (see analysis below) |

How Quantum Emperor Actually Works

The Marketing Description

According to the official MQL5 listing, Quantum Emperor is “a groundbreaking expert advisor developed by a team of experienced traders with trading experience of over 13 years.” The description claims sophisticated position management through these mechanics:

- Splits each trade into 5-6 smaller positions for “sophisticated risk management”

- Uses profits from winning trades to gradually close losing positions

- Features a 250-pip stop loss protection on each position

- Is explicitly “NOT a martingale” according to the developer

What This Actually Means

Let us decode that marketing language into plain trading terminology:

“Splits trades into multiple positions” — This is opening a grid of positions instead of single trades. Grid trading is a well-known high-risk strategy that compounds exposure as price moves against you.

“Uses profits to close losing positions” — This is averaging down. The EA keeps losing positions open while hoping winners bail them out. Classic martingale behavior dressed in different language.

“250-pip stop loss” — An extremely wide stop that rarely triggers, allowing massive floating drawdowns to accumulate before any protection kicks in. For context, GBPUSD moves 250 pips only during major trend days or news events.

This is textbook grid/martingale behavior regardless of what the marketing claims. The telltale mathematical signatures are impossible to hide:

- 90%+ win rate: The classic martingale signature—high win frequency masking catastrophic tail risk

- Average loss 6x larger than average win: $14.05 average loss vs $3.80 average win on the signal account

- Trades held for weeks: Positions stay open waiting for price to reverse rather than taking stops

- Catastrophic drawdown events: 70%+ drawdowns when the grid inevitably fails to recover

The June 2024 Drawdown Event

In June 2024, Quantum Emperor experienced what independent analysts called “the biggest loser” among top MQL5 EAs that month. The damage was severe:

- Drawdown: 70%+ on many user accounts

- Worst cases: 85% drawdown reported by some users

- Cause: GBPUSD moved strongly against open grid positions without recovery

- Recovery time: Months of gains wiped in days

This is exactly what happens when grid systems fail. They win 50 small trades over weeks, building trader confidence and positive reviews. Then they lose everything accumulated—and often more—in 2-3 bad trades when the market trends without reverting.

One independent analyst noted: “The author keeps printing the same strategies that bump into a 70% drawdown sooner or later… strategies from this author seem to be working for some time and then fail.” This pattern repeats across the developer’s entire product line.

Myfxbook Analysis: Following the Money

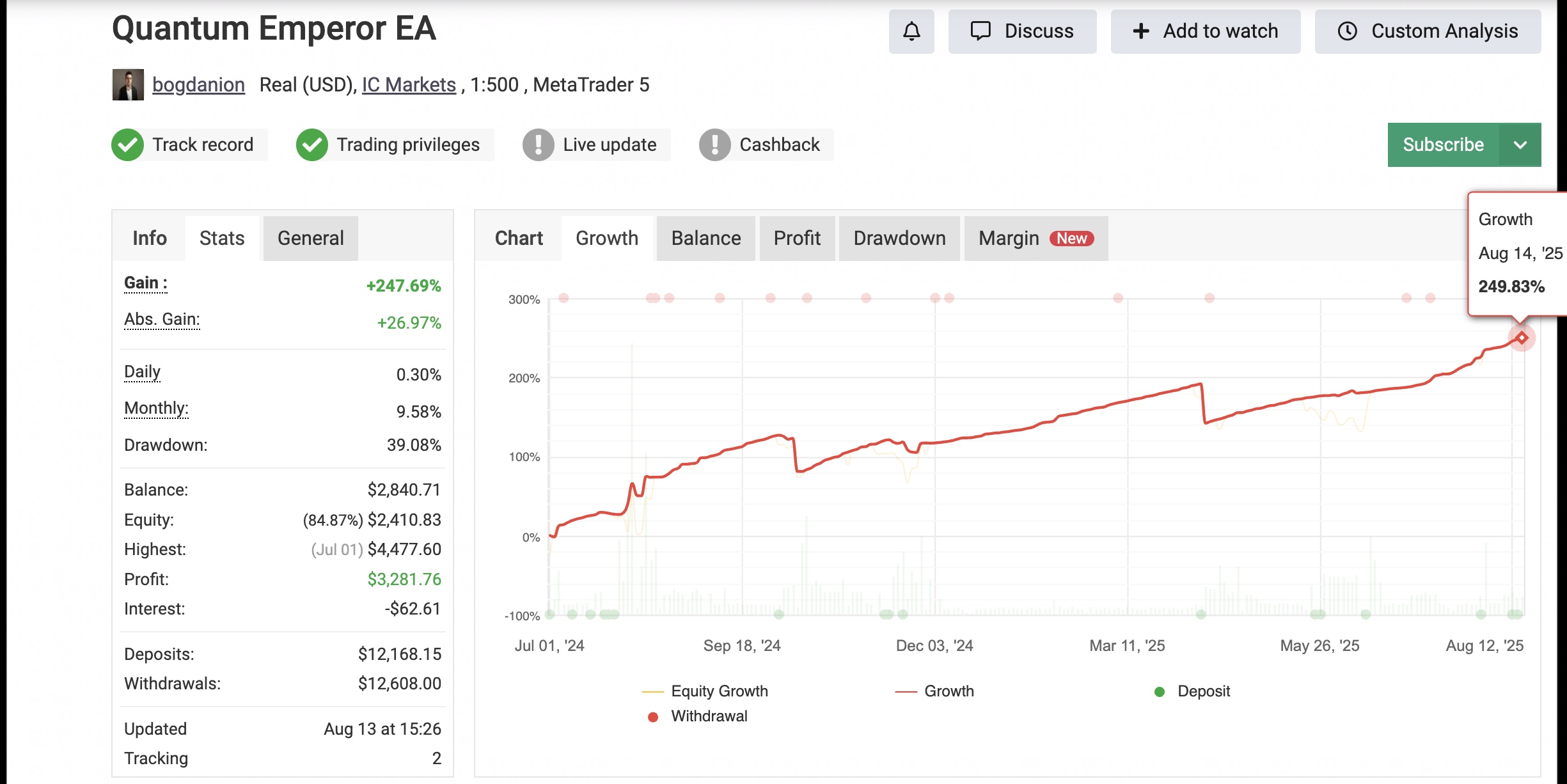

The official Myfxbook signal for Quantum Emperor reveals patterns that every prospective buyer should understand before committing $799+.

The Headline Numbers

- Total gain: +329.48%

- Absolute gain: +30.84%

- Starting balance: $1,000

- Total deposits: $12,168.15

- Total withdrawals: $14,758.00

- Current balance: $1,185.80

- Maximum drawdown: 39.08%

What These Numbers Actually Mean

The gap between “total gain” (329%) and “absolute gain” (30%) is the first red flag. Total gain is inflated by deposits adding to the account balance. The real performance—what the trading actually generated—is closer to 30%.

More concerning: $12,168 was deposited into an account that started with $1,000. Why add 12x the starting capital to a system marketed as “profitable”?

Independent analysts suggest these deposits occurred during drawdown periods to maintain margin and prevent stop-outs. This tactic artificially keeps accounts alive and makes statistics look better than they would under normal conditions. Without those deposits, the account may have stopped out entirely during the June 2024 drawdown.

The Trade Statistics

- Win rate: 90-91%

- Average win: 10.67 pips / $3.80

- Average loss: -65.33 pips / -$14.05

- Average trade duration: 20 hours

The average loss being 6x the average win confirms grid behavior mathematically. You need to win 6 consecutive trades just to recover from 1 loss. The 90% win rate barely covers this math—and when drawdowns hit multiple losing trades in sequence, they devastate account equity.

Why 567 Positive Reviews Can Be Misleading

With 4.87/5 stars from 567 reviews, how can this EA be considered risky? Several psychological and structural factors explain the disconnect:

Survivorship Bias

Traders who blow accounts often abandon them without leaving reviews. Those who caught winning streaks during favorable market conditions leave glowing reviews. The sample is inherently skewed toward survivors—you never hear from the accounts that stopped out.

The High Win Rate Illusion

A 90% win rate feels incredible. Traders experience 9 wins for every loss, building psychological confidence and positive associations. They leave positive reviews during the winning streak, convinced they have found the holy grail. Then when the inevitable drawdown hits, they have already reviewed or abandoned hope.

Affiliate Incentives

MQL5’s affiliate program pays commissions for referrals. Some positive reviews may come from affiliates rather than genuine users with skin in the game. There is no way to verify which reviews are from actual traders versus marketers.

The Recency Effect

Recent reviews after the 2024 drawdown are positive because the EA recovered. But recovery does not erase the 70% drawdown that happened. Traders reviewing during recovery periods overlook that the same catastrophic drawdown will happen again—grid systems mathematically guarantee it.

The Developer’s Track Record

Bogdan Ion Puscasu has created multiple “Quantum” branded EAs on MQL5:

- Quantum Emperor (GBPUSD)

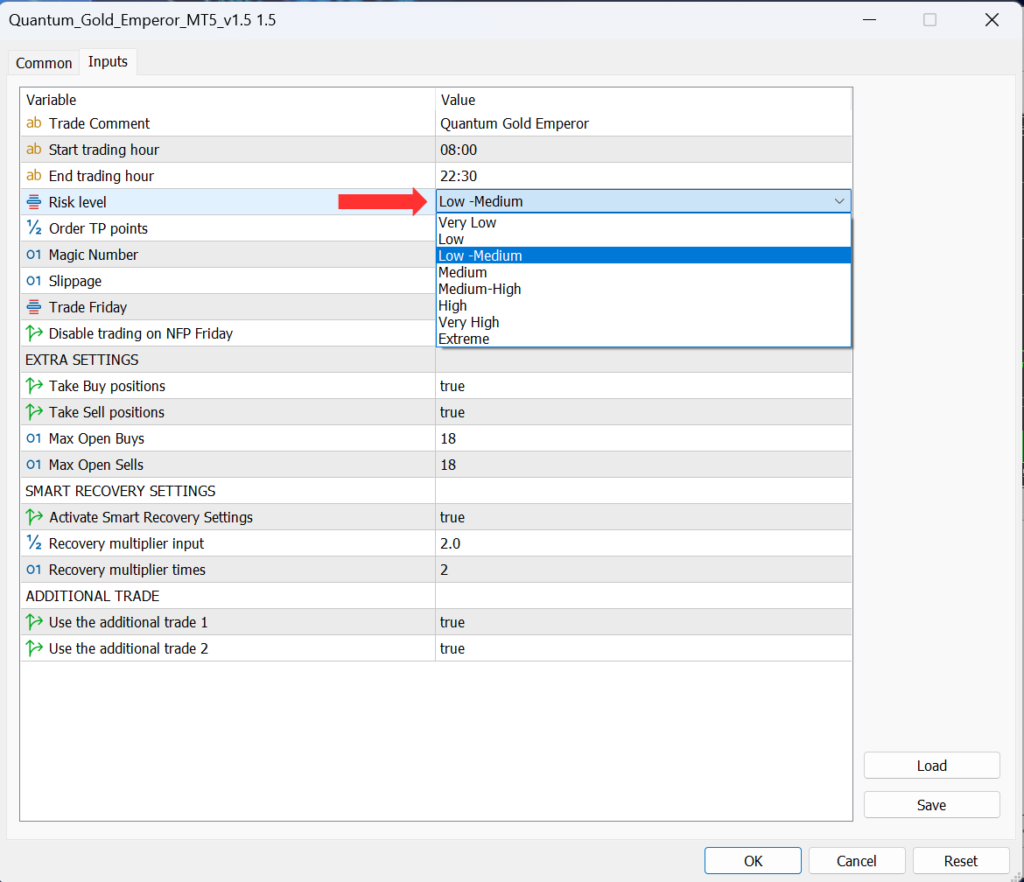

- Quantum Gold Emperor (XAUUSD)

- Quantum Queen (multiple pairs)

- Quantum King (grid/martingale hybrid)

- Quantum Bitcoin

Notably, Quantum King EA is explicitly described as “a smart, adaptive Grid + Martingale hybrid” in its own marketing—confirming the developer does create martingale systems under the Quantum brand.

User feedback on Quantum Gold Emperor shows the pattern: “Small wins day by day, then one big loss swept all previous profits. Happened once in Feb 2024, happened again in Apr 2024, even with very low risk on a big balance account.”

This pattern—steady small wins followed by catastrophic losses—repeats across the product line. It is the mathematical certainty of grid/martingale mechanics, not bad luck.

VPS and Broker Requirements

If you choose to run Quantum Emperor despite the documented risks, proper infrastructure is essential:

Broker Requirements

The developer recommends ECN, Raw, or Razor account types with tight GBPUSD spreads. IC Markets is specifically mentioned in the documentation. High spreads will erode the already-thin profit margins from the small average wins.

- Minimum leverage: 1:100 (1:500 recommended)

- Account type: ECN/Raw spreads essential

- Server time: GMT+2 with DST preferred

VPS Requirements

A forex VPS is highly recommended by the developer and essentially mandatory for this EA. Grid systems are especially vulnerable to disconnections during recovery phases when multiple positions are open and averaging.

- Latency: Not critical for this EA—it is not a scalper

- Uptime: Essential—trades can remain open for weeks during drawdowns

- Reliability: Any disconnection during a recovery phase could prevent proper position management

Our IC Markets VPS provides optimized connectivity for the recommended broker with 99.9% uptime guarantees.

Pros and Cons

Pros

- High win rate: 90%+ wins feel psychologically rewarding

- Smooth equity curve: Between drawdown events, growth appears consistent

- Active development: Regular updates and version improvements

- Large user community: 5,000+ users for support and discussion

- Responsive developer: Answers questions in MQL5 comments

- Detailed documentation: Setup guide provided after purchase

Cons

- Grid/martingale mechanics: Despite marketing denials, the math confirms it

- 70%+ drawdown events: Documented in June 2024, will repeat

- Average loss 6x average win: Classic martingale risk signature

- Questionable signal deposits: $12K added to $1K account raises concerns

- Single pair only: GBPUSD offers no diversification

- $799+ price: Expensive for a high-risk system

- Pattern of failures: Developer’s other EAs show similar blowup patterns

Who Should (and Should Not) Use Quantum Emperor

May Work For:

- Traders who fully understand grid/martingale risks and accept them

- Those with capital they can afford to lose entirely without financial hardship

- Users who will withdraw profits regularly rather than letting them compound

- Traders who can stomach 70%+ drawdowns without emotional trading decisions

Avoid If:

- You believe the “not martingale” marketing at face value

- You expect smooth backtest curves to continue indefinitely

- You are using capital you cannot afford to lose

- You want transparent, non-manipulated performance data

- 70% drawdowns would devastate you financially or emotionally

- You need reliable income rather than gambling on recovery

Alternatives to Consider

If you want automated GBPUSD trading without hidden grid tactics, consider these alternatives with more transparent risk profiles:

- GPS Forex Robot: Transparent strategy with 11+ year track record, uses actual stop losses rather than averaging

- Forex Fury: Session-based trading without martingale mechanics, 7+ years of verified results

- Night Hunter Pro: Scalping with real risk management, though currently stale on updates

These alternatives will not show 90% win rates or impossibly smooth equity curves—because legitimate EAs do not hide risk behind averaging tactics and artificial deposits.

Frequently Asked Questions

Is Quantum Emperor a martingale?

Despite explicit marketing claims, the mathematical mechanics are grid/martingale: multiple averaging positions, using winners to close losers, 90% win rate with 6x larger losses. Independent analysts classify it as “disguised martingale” based on trade data analysis.

What happened in June 2024?

Quantum Emperor experienced 70%+ drawdown across many accounts. Some users reported 85% drawdowns. This occurs when grid systems fail to recover—an inevitable outcome with any averaging strategy given sufficient time.

Why is it the best-seller if it is risky?

High win rates create appealing equity curves that attract buyers. Most traders do not understand that 90% wins combined with 6x larger losses creates a mathematical time bomb. Survivorship bias in reviews compounds the perception problem.

Are the Myfxbook results manipulated?

The $12,168 in deposits to a $1,000 account raises legitimate questions. Deposits during drawdowns can artificially maintain margin and prevent stop-outs, making long-term statistics appear better than organic performance.

Should I buy Quantum Emperor?

Only if you fully understand grid/martingale risks, use money you can lose entirely, and accept that 70%+ drawdowns will happen again. Most traders seeking reliable automated income should avoid this EA.

Final Verdict

Quantum Emperor is the best-selling EA on MQL5 for a reason: the marketing is excellent, the win rate looks incredible, and the equity curve between disasters appears smooth and profitable. But beneath the polished presentation lies a grid/averaging system that has already produced 70%+ drawdowns and will mathematically do so again.

The developer claims it is “not martingale,” but the math does not lie: 90% win rate, losses 6x larger than wins, trades held for weeks waiting for recovery, catastrophic drawdowns when recovery fails. This is textbook grid behavior regardless of marketing language.

The $12,168 in deposits to the signal account—12x the starting balance—suggests even the developer knows the risk profile. Why else add that much capital to a system marketed as consistently profitable?

Our recommendation: avoid Quantum Emperor unless you are a sophisticated trader who understands exactly what you are buying. The 567 positive reviews do not change fundamental mathematics. Best-seller status does not equal best performance. Marketing spin cannot transform grid mechanics into legitimate risk management.

If you proceed anyway, use minimum lot sizes, withdraw profits regularly, and run it on a reliable VPS to ensure 24/5 operation. But understand you are playing Russian roulette with better odds—you will win most chambers, but eventually one will be loaded.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.