QuantConnect Review 2026: Features, Pricing, Pros & Cons

QuantConnect review covering LEAN engine, pricing tiers, supported brokers, backtesting, and live trading. Find out if this algo platform fits your strategy.

What Is QuantConnect?

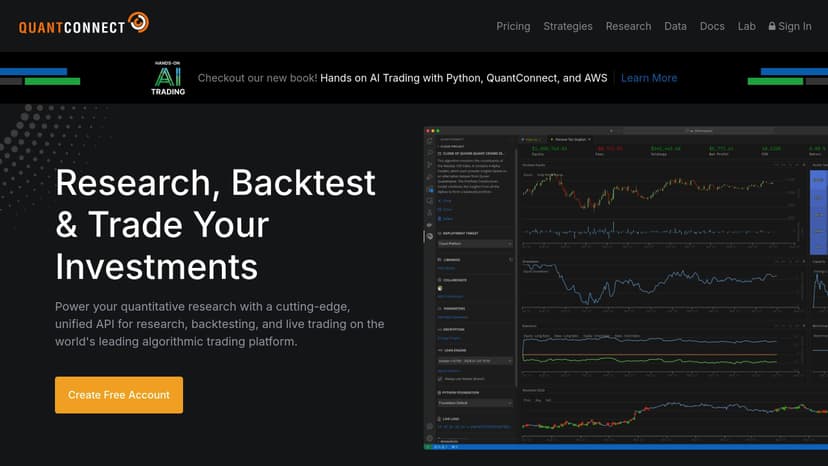

QuantConnect is an open-source algorithmic trading platform built for quants, developers, and institutional traders who want a single environment for research, backtesting, and live deployment. Founded in 2012, the platform now serves over 300,000 users worldwide and processes more than $45 billion in notional volume every month.

At its core sits the LEAN engine — an open-source trading framework available on GitHub with over 16,000 stars and contributions from 180+ engineers. LEAN handles everything from historical data ingestion to live order routing, and it supports Python 3.11 and C# for strategy development.

QuantConnect positions itself as a full-stack solution. You research ideas using cloud-hosted Jupyter notebooks, backtest them against terabytes of point-in-time data, optimize parameters across thousands of iterations, then deploy live to co-located servers — all without leaving the platform.

Key Features at a Glance

Before diving into each feature, here is a quick summary of what QuantConnect offers in 2026.

| Feature | Details |

|---|---|

| Asset Classes | Equities, Options, Futures, Forex, Crypto, CFDs, Indexes |

| Supported Languages | Python 3.11, C# |

| Brokers | 20+ (Interactive Brokers, Alpaca, Coinbase, Binance, Tradier, more) |

| Historical Data | 400TB+ from 40+ vendors |

| Backtesting Speed | 10-year equity backtest in ~33 seconds |

| Live Deployment | Co-located servers with managed infrastructure |

| Open Source | LEAN engine (GitHub, free to use commercially) |

| AI Assistant | Mia — natural-language strategy design and code editing |

LEAN Engine: The Foundation

The LEAN Algorithmic Trading Engine is what sets QuantConnect apart from most competitors. It is fully open source, which means you can inspect every line of code, run it locally, or extend it for proprietary use.

How LEAN Works

LEAN uses an event-driven architecture. Your algorithm subscribes to data feeds — tick, second, minute, hour, or daily resolution — and reacts to each new data point. The engine handles order management, portfolio tracking, margin calculations, and fill modeling behind the scenes.

For backtesting, LEAN simulates realistic conditions including T+3 settlement, brokerage fees, slippage, and spread adjustments. This matters because many platforms skip these details, producing backtests that look great on paper but fall apart in live markets. Running your strategy on a trading VPS alongside LEAN helps ensure consistent uptime and low-latency execution once you go live.

Local vs. Cloud

You can run LEAN entirely on your own machine using the CLI (pip install lean) or use QuantConnect’s cloud infrastructure. The cloud option gives you access to their full data library and scalable compute. The local option is ideal when you have proprietary datasets or want complete control over execution.

A hybrid approach works too. Code locally in VS Code, sync to the cloud for backtesting, and deploy live from either environment. This flexibility is genuinely useful for teams that need to keep sensitive logic on-premise while still tapping into QuantConnect’s data.

Supported Asset Classes and Data

QuantConnect covers seven asset classes, which is broader than most algorithmic trading platforms.

What You Can Trade

- US Equities: Tick-to-daily data going back to 1998. Includes ETFs.

- Options: Equity and index options with minute resolution from 2010 onward. The dynamic margin modeling engine is particularly strong here.

- Futures: 70+ liquid contracts at tick-to-daily resolution.

- Forex: Interbank spreads with realistic margin modeling. Supports major and minor pairs.

- Crypto: Thousands of pairs from six exchanges including Binance, Coinbase, and Kraken.

- CFDs: International derivative instruments.

- Indexes: Cash indexes like SPX, NDX, and VIX.

Alternative Data

Beyond price data, QuantConnect integrates 40+ alternative data vendors. These include sentiment feeds, earnings estimates, insider trading data, and more. Each dataset links automatically to underlying securities and tracks corporate actions to prevent survivorship and selection bias.

Data add-ons come at extra cost. Extract Alpha tools run $75-$450/month. Quiver Quantitative feeds are $5-$15/month. Benzinga news data costs $120/month. These prices add up, so budget accordingly if you plan to use alternative data in your strategies.

Backtesting and Research

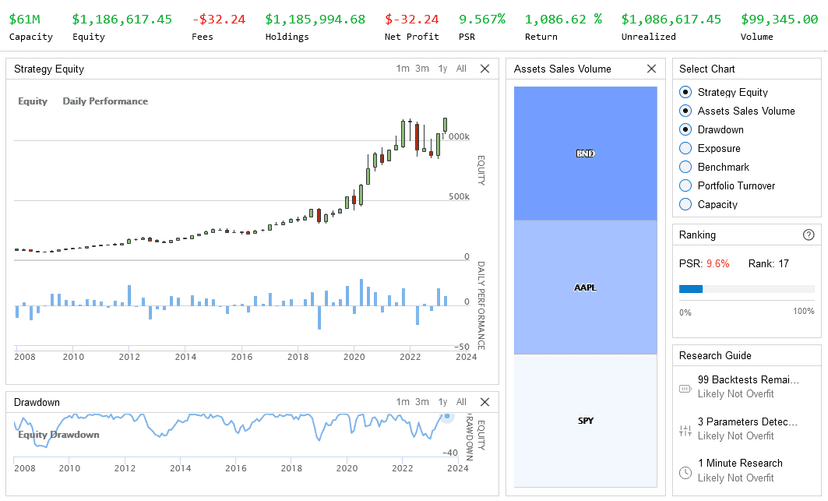

Backtesting is where QuantConnect shines brightest. The platform processes over 500,000 backtests monthly, and the infrastructure is built to handle heavy workloads.

Speed and Scale

A 10-year equity backtest completes in roughly 33 seconds on cloud hardware. For parameter optimization, you can run thousands of full backtests simultaneously using distributed compute nodes. What might take weeks on a local machine finishes in minutes.

Results are visualized through heatmaps that show parameter sensitivity. This helps you understand whether your strategy is robust or just curve-fitted to a narrow set of conditions.

Research Notebooks

Cloud-hosted Jupyter notebooks come with machine learning libraries pre-installed. You can train models, analyze data, and prototype strategies in the same environment where you’ll eventually deploy. Point-in-time data delivery prevents look-ahead bias, which is a common and dangerous pitfall in quantitative research.

Point-in-time data means you only see data that was actually available at each historical moment. This prevents accidental look-ahead bias, where your backtest uses future information to make “past” decisions.

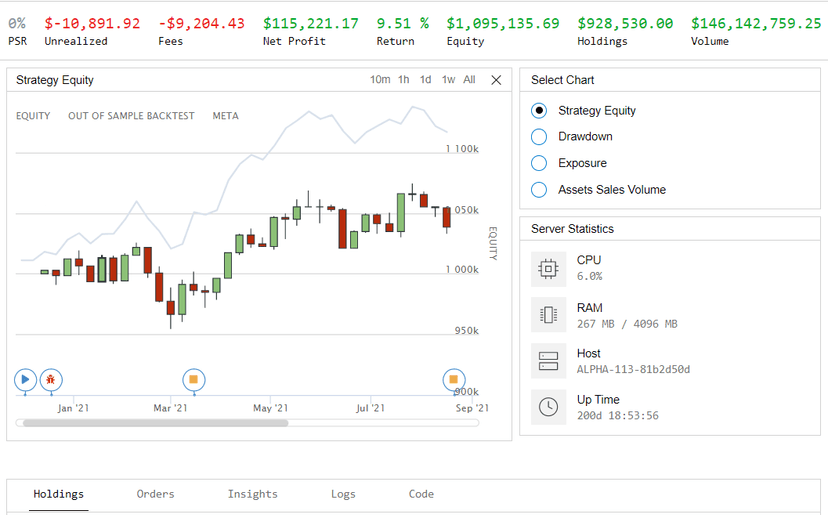

Live Trading Infrastructure

Moving from backtest to live is straightforward on QuantConnect. The platform claims “minimal-to-no code changes” between a backtest and a live algorithm, and that claim largely holds up.

Co-Located Deployment

QuantConnect runs co-located servers with redundant 10GB fiber internet connections. Live trading nodes range from L-MICRO (512MB RAM) to L24-128-GPU (24 CPU, 128GB RAM). For US equities, you can expect 5-40 milliseconds of platform-side latency.

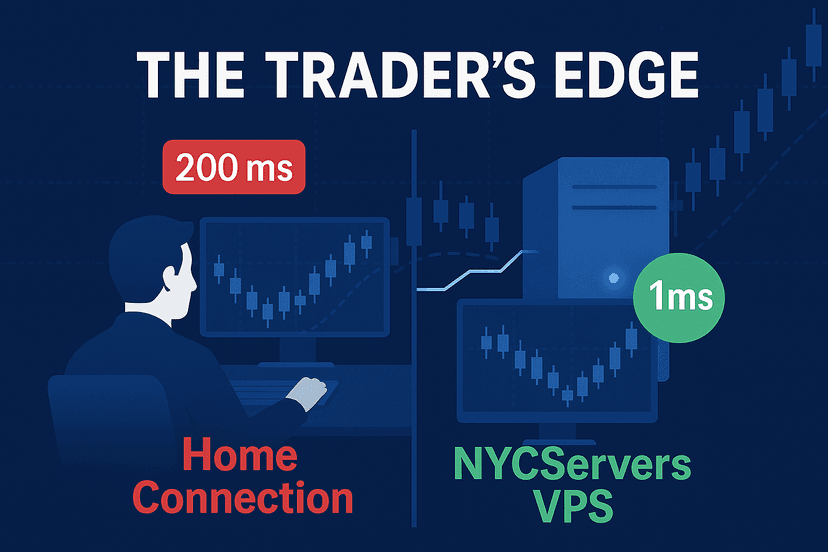

However, the bigger latency factor is your broker. Round-trip order times from brokers typically range from 100ms to 5 seconds, which dwarfs the platform latency. This is where your overall infrastructure setup becomes critical — and where a dedicated VPS close to your broker’s servers can make a real difference.

Supported Brokers

QuantConnect integrates with over 20 brokers for live trading. The major ones include Interactive Brokers, Alpaca, Coinbase, Binance, Tradier, Charles Schwab, TradeStation, Kraken, Bitfinex, Zerodha, and Trading Technologies. For institutional clients, FIX 5.0 SP2 protocol support is available.

Each broker has a dedicated brokerage model in LEAN that simulates their specific fee structures, order types, and API behaviors. This means your backtest closely mirrors what happens in production.

Self-Hosted Option

If you want more control over latency and uptime, you can run LEAN on your own VPS. This is popular among forex traders who need sub-millisecond connections to specific brokers. You install the LEAN CLI, connect to your broker’s API, and manage deployment yourself.

Running LEAN on a trading VPS gives you control over server location, hardware resources, and network routing. For strategies where execution speed matters — scalping, arbitrage, or high-frequency approaches — this is the preferred setup.

QuantConnect Pricing Breakdown

QuantConnect offers a free tier plus four paid plans. Pricing changed in recent years, so here is the current structure as of 2026.

| Plan | Monthly Price | Annual Price | Key Inclusions |

|---|---|---|---|

| Free | $0 | $0 | All asset classes, unlimited backtesting, community support |

| Researcher | $60 | $600 | 1 research node, 1 backtest node, 1 live node (L-MICRO), Bronze support |

| Team | $120 | $1,200 | 2-10 members, upgraded nodes, project collaboration, 128KB file limit |

| Trading Firm | $336 | $3,360 | 2-1,000 users, multiple nodes, Silver support, permissions management |

| Institution | $1,080 | $10,800 | 5-100 seats, on-premise option, AES-256 encryption, Gold support, FIX protocol |

Additional Compute Costs

Each plan includes baseline compute nodes, but you can add more at extra cost. Backtesting nodes run $14-$96/month depending on CPU and RAM. Live trading nodes range from $24/month (L-MICRO) to $1,000/month for GPU-equipped nodes. Research nodes with GPU support cost $400/month.

The free tier is genuinely useful for learning and prototyping. You get unlimited backtesting on all asset classes. But once you need live trading or faster compute, you are looking at a minimum of $60/month plus whatever additional nodes your strategy requires.

Is It Worth the Cost?

Compared to building your own infrastructure from scratch — buying data feeds, setting up servers, writing execution frameworks — QuantConnect is significantly cheaper. Their own “Build vs. Buy” calculator estimates the alternative at $15,000+/month for equivalent capability.

For individual traders running one or two strategies, the Researcher plan at $60/month is reasonable. If you’re exploring what kind of algorithmic trading strategies to deploy, QuantConnect’s free tier lets you prototype before committing. Teams and firms will find the higher tiers competitive against comparable institutional platforms. The main cost concern is data add-ons, which can push monthly expenses well beyond the base plan price.

Pros and Cons

What QuantConnect Does Well

- Open-source transparency: LEAN’s code is public. You can audit, extend, or self-host it.

- Data breadth: 400TB+ of historical data across seven asset classes with 40+ alternative data vendors.

- Backtesting realism: Fee, slippage, settlement, and spread modeling produce results closer to real trading.

- Broker coverage: 20+ broker integrations with dedicated models for each.

- Research-to-production pipeline: Minimal code changes between backtest and live deployment.

- Community: 464,000+ members, 1,200+ shared strategies, and an active forum.

- Flexible deployment: Cloud, on-premise, or hybrid approaches all work.

Where It Falls Short

- Steep learning curve: You need Python or C# skills. There is no drag-and-drop strategy builder.

- No EU exchange support: QuantConnect currently lacks integrations with European exchanges, which limits traders focused on European markets.

- Data costs escalate: Alternative data add-ons are priced separately and can add hundreds per month.

- Live node limitations: The included L-MICRO node has only 512MB RAM, which may not be enough for data-heavy strategies.

- Platform-specific syntax: Even experienced Python developers face a learning curve with QuantConnect’s API conventions.

QuantConnect vs. Alternatives

How does QuantConnect stack up against other algorithmic trading platforms available in 2026?

QuantConnect vs. Backtrader

Backtrader is a free, local-only Python framework. It gives you more granular control over simulation details and custom order types. However, it has no built-in data library, no cloud infrastructure, and no managed live deployment. If you want a fully local setup with maximum flexibility and don’t mind sourcing your own data, Backtrader works. For everything else, QuantConnect offers a more complete package.

QuantConnect vs. Zipline

Zipline was once the default Python backtesting library, but active development has stalled. It remains useful for learning and academic research, but it lacks live trading support and broker integrations. QuantConnect’s LEAN engine is a more modern and actively maintained alternative.

QuantConnect vs. Building from Scratch

Rolling your own algo platform means buying data, writing execution logic, managing infrastructure, and maintaining everything yourself. QuantConnect’s “Build vs. Buy” analysis puts the cost of a comparable custom setup at $15,000+/month. For most traders and small funds, the platform approach saves both time and money.

Who Should Use QuantConnect?

QuantConnect is not for everyone. It works best for specific types of traders and firms.

Good Fit

- Quant developers who are comfortable writing Python or C# and want institutional-grade infrastructure without building it themselves.

- Small to mid-size funds that need multi-asset backtesting, parameter optimization, and managed live deployment.

- Data scientists who want to apply machine learning to trading with access to alternative datasets.

- Algorithmic forex traders who want to backtest against realistic interbank spreads, then deploy on a VPS for low-latency execution.

Not a Good Fit

- Beginners who have never coded. The platform requires programming skills from day one.

- Manual traders looking for charting or signal services. QuantConnect is for automation.

- EU-focused equity traders who need European exchange data and execution.

Deploying QuantConnect Strategies on a VPS

While QuantConnect’s cloud handles most deployment needs, many traders prefer running LEAN on their own VPS for tighter control over latency and uptime. This is especially relevant for forex and futures strategies where milliseconds matter.

With a self-hosted setup, you install LEAN via pip, connect it to your broker’s API, and run your algorithms on dedicated hardware. The advantage is choosing a server location that minimizes the distance to your broker’s matching engine. For example, an NY4 datacenter VPS puts you within 1ms of brokers operating out of Equinix NY4.

A trading VPS also means you are not sharing resources with other users. Your strategy gets dedicated CPU, RAM, and network bandwidth — no noisy neighbors affecting execution during volatile sessions.

Frequently Asked Questions

Is QuantConnect free to use?

Yes, QuantConnect offers a free tier that includes unlimited backtesting across all asset classes, community support, and access to crypto data. However, live trading, faster compute nodes, and premium data feeds require a paid plan starting at $60/month.

What programming languages does QuantConnect support?

QuantConnect supports Python 3.11 and C# for writing trading algorithms. Python is the more popular choice among users due to its extensive library ecosystem for data analysis and machine learning.

Can I run QuantConnect on my own server?

Yes. The LEAN engine is open source and can be installed locally or on a VPS using pip install lean. This lets you self-host your algorithms with full control over hardware, location, and network configuration.

How many brokers does QuantConnect support?

QuantConnect supports live trading with over 20 brokers including Interactive Brokers, Alpaca, Coinbase, Binance, Tradier, Charles Schwab, TradeStation, Kraken, and more. Institutional clients also get FIX protocol support for connecting to additional liquidity providers.

Is QuantConnect good for forex trading?

QuantConnect supports forex with interbank spread data and realistic margin modeling. For backtesting forex strategies, it is a strong option. For live forex trading, many users deploy LEAN on a dedicated VPS close to their broker’s servers to minimize execution latency.

What is the LEAN engine?

LEAN is the open-source algorithmic trading engine that powers QuantConnect. Available on GitHub with 16,000+ stars, it handles data ingestion, backtesting, optimization, and live order routing. You can use it through QuantConnect’s cloud or run it independently on your own infrastructure.

How does QuantConnect compare to MetaTrader for algo trading?

MetaTrader uses MQL4/MQL5 and is focused primarily on forex and CFD trading. QuantConnect supports seven asset classes, uses Python/C#, and offers more advanced backtesting with point-in-time data. MetaTrader is simpler to start with, while QuantConnect provides more depth for quantitative strategies.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.