Perceptrader AI EA Review 2026: Is This AI-Powered Grid Robot Worth $2,800?

Comprehensive Perceptrader AI EA review covering its neural network technology, 48-month track record, grid trading strategy, and whether the premium price is justified.

What Makes Perceptrader AI Different from Other Trading Robots?

Perceptrader AI represents an ambitious attempt to solve one of grid trading’s biggest problems: knowing when not to trade. Traditional grid systems open positions mechanically based on price levels, often getting caught in devastating drawdowns during strong trending markets. Perceptrader AI adds an artificial intelligence layer designed to filter out unfavorable conditions before the grid even begins.

Developed by Valeriia Mishchenko—the same developer behind the popular Waka Waka EA—Perceptrader AI combines deep learning algorithms with the proven grid methodology that made its predecessor successful. The result is a system claiming 48 consecutive profitable months with controlled drawdowns, backed by verified Myfxbook accounts.

But at $2,800, this is one of the most expensive retail EAs on the market. This review examines whether the AI technology delivers meaningful improvements over standard grid systems, analyzes the verified performance data, and determines who should consider this premium-priced trading robot.

Perceptrader AI at a Glance

| Specification | Details |

|---|---|

| Developer | Valeriia Mishchenko |

| Price | $2,800 (MQL5 Market) |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Currency Pairs | NZDUSD, USDCAD, AUDCAD, AUDNZD, NZDCAD, GBPCHF |

| Timeframe | M5 (5-minute) |

| Strategy | AI-filtered grid trading |

| Minimum Deposit | $1,000 (1:100 leverage) / $6,000 (1:30 leverage) |

| Activations | 10 accounts |

| Track Record | 48+ consecutive profitable months |

| Refund Policy | 30-day money-back guarantee |

How Perceptrader AI’s Neural Network Works

The core innovation of Perceptrader AI is its artificial neural network (ANN) that analyzes market conditions before allowing the grid system to activate. Understanding this architecture helps evaluate whether the “AI” label is marketing hype or genuine technological advancement.

The Deep Learning Layer

Perceptrader AI uses a perceptron-based neural network trained on historical market data to identify favorable trading conditions. The system analyzes multiple factors simultaneously:

- Trend detection: Neural network assessment of current market direction and strength

- Momentum analysis: Evaluation of price acceleration and potential reversals

- Volatility filtering: Identification of market conditions suitable for grid trading

- News event detection: Automatic avoidance of high-impact economic releases

- Stock market correlation: Monitoring of equity market crashes that affect forex

ChatGPT and Bard Integration

One of Perceptrader AI’s more unusual features is its integration with large language models including ChatGPT and Google’s Bard. The EA can query these AI systems for additional market analysis and forecasting. However, this feature should be approached with appropriate skepticism—LLMs aren’t designed for financial prediction, and their contribution to actual trading decisions remains unclear.

The Grid Trading Foundation

Beneath the AI layer, Perceptrader AI operates on the same fundamental grid strategy as Waka Waka. When conditions are deemed favorable, the system opens an initial position and places additional orders at predetermined intervals if price moves against the position. The AI’s role is determining when to activate this grid—not fundamentally changing how it operates once running.

This means Perceptrader AI retains both the strengths and weaknesses of grid trading. During ranging markets, it can accumulate steady profits as price oscillates through grid levels. During strong trends, open positions can accumulate significant floating losses before (hopefully) recovering.

Verified Performance Analysis

The developer maintains a Myfxbook account that publishes several live signals for the Perceptrader EA with different settings. This provides a level of transparency not see with many other EA vendors.

Below are the available Myfxbook records for the various Perceptrader settings:

- PAI Unique Mode No Limits

- PAI Unique Mode 5 Pairs with AI Filter

- PAI Standard Mode 5 Pairs with AI Filter

- PAI Standard Mode No Limits

- PAI Standard Mode 5 Pairs

Key Performance Metrics

- Track record: 48+ consecutive profitable months

- Total gains: 314% on primary verified account

- Maximum drawdown: 17-18% on standard risk settings

- Monthly average: 4-5% returns

- Win rate: Approximately 65%

- Profit factor: Above 2.0 in backtests

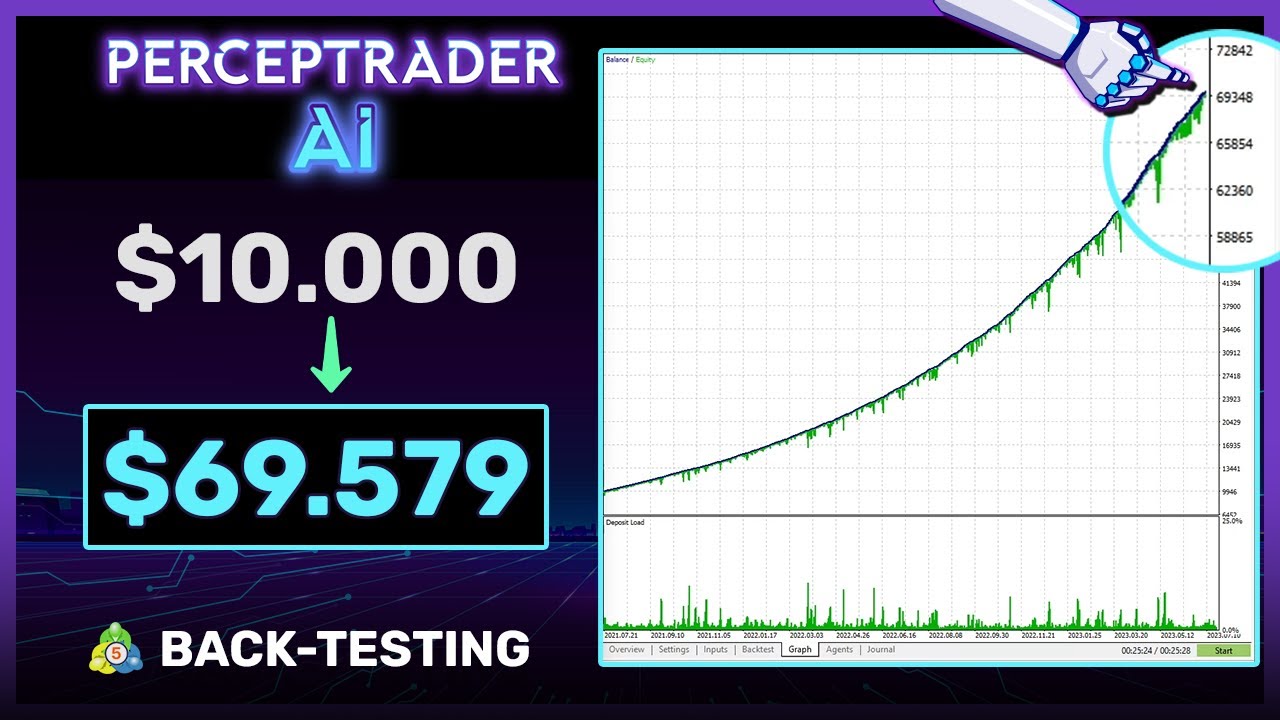

Backtesting Data

The developer provides 13+ years of backtesting using 99% modeling quality tick data with variable spreads and slippage simulation. The backtests show consistent profitability across different market conditions, though it’s worth noting that AI-based systems are inherently difficult to backtest accurately—the neural network was trained on historical data, potentially creating overfitting concerns.

Live vs. Backtest Comparison

Encouragingly, the live trading results broadly align with backtested expectations. The 48-month live track record demonstrates the strategy works in real market conditions, not just historical simulations. This consistency between backtest and live performance is a positive indicator, though past results never guarantee future performance.

Drawdown Behavior

On standard risk settings, maximum drawdown has remained under 20%—significantly better than many grid systems that routinely hit 40-50% drawdowns. The AI filtering appears to provide meaningful protection against the worst-case scenarios that plague traditional grid EAs. However, users running higher risk settings have reported drawdowns exceeding 50%, demonstrating that the underlying grid risk still exists.

Supported Currency Pairs and Setup

Perceptrader AI trades six currency pairs, all chosen for their mean-reverting characteristics that suit grid trading strategies.

Recommended Pairs

- AUDCAD: Primary recommended pair for single-chart setup

- NZDUSD: Strong mean-reversion tendency

- USDCAD: Commodity currency with range-bound behavior

- AUDNZD: Highly correlated pair with tight ranges

- NZDCAD: Lower volatility cross pair

- GBPCHF: European session focus

Single Chart Operation

Like other Mishchenko EAs, Perceptrader AI supports single-chart operation—attach the EA to one AUDCAD M5 chart and it manages all six pairs automatically. This simplifies setup and reduces VPS resource usage compared to running separate charts for each pair.

Account Requirements

The minimum requirements depend on available leverage:

- 1:100 leverage: $1,000 minimum deposit

- 1:30 leverage: $6,000 minimum deposit

- Recommended: $3,000-10,000 for comfortable risk management

These requirements are higher than many competing EAs, reflecting the grid system’s need for sufficient margin to weather drawdown periods without margin calls.

The “Unique Trades” Feature Explained

One genuinely innovative feature is Perceptrader AI’s “unique trades” system. Each installation generates slightly different entry points and grid parameters, meaning no two traders receive identical trades.

Why This Matters

Popular EAs face a collective action problem: when thousands of traders run identical systems, they all enter and exit at the same prices. This concentrated order flow can move markets against the collective position, degrading performance for everyone. By randomizing entries within acceptable parameters, Perceptrader AI reduces this correlation risk.

Practical Implications

The unique trades feature means your results won’t exactly match the developer’s verified accounts or other users’ performance. This is a trade-off: you lose the ability to precisely replicate published results, but gain protection against collective overcrowding in the strategy.

Running Perceptrader AI on a VPS

Grid systems require uninterrupted operation—missing grid levels due to disconnection can transform recoverable drawdowns into account-ending events. A reliable forex VPS is effectively mandatory for running Perceptrader AI.

VPS Requirements

- RAM: 2GB minimum, 4GB recommended

- Uptime: 99.9%+ guaranteed

- Latency: Under 10ms to broker servers

- Operating system: Windows Server with MT4/MT5

Prop Firm Compatibility

Perceptrader AI includes specific features designed for prop firm trading, though grid systems and funded accounts are generally an uncomfortable match.

Prop Firm Features

- Max daily drawdown settings: FTMO-style daily loss limits

- Equity-based stop: Automatic shutdown at specified drawdown levels

- Hedging controls: Compliance with firm-specific hedging rules

- Conservative presets: Lower-risk settings for challenge phases

Reality Check

While these features exist, grid trading fundamentally conflicts with typical prop firm drawdown limits (5-10%). Even with AI filtering, grid systems can experience extended drawdown periods that would fail most funded account evaluations. Use Perceptrader AI for prop firm challenges only with extremely conservative settings and realistic expectations about pass rates.

Known Issues and Concerns

User reports and forum discussions reveal several issues potential buyers should consider:

VPS Configuration Issues

Some users report problems with GMT offset detection and news filter loading when switching from local computers to VPS environments. These issues appear solvable with proper configuration but require technical troubleshooting.

Marketing vs. Reality

The “AI” and “neural network” terminology, while technically accurate, represents a relatively simple perceptron model rather than cutting-edge deep learning. The ChatGPT/Bard integration is more experimental feature than proven trading advantage. Approach the marketing language with appropriate skepticism—this is an improved grid system, not artificial general intelligence for trading.

Grid System Risks Remain

Despite AI filtering, Perceptrader AI remains fundamentally a grid trading system. During extended trending markets, the strategy can accumulate significant floating losses. The AI reduces but doesn’t eliminate this core risk. Users must be psychologically and financially prepared for drawdown periods lasting weeks or months.

Pricing and Value Assessment

At $2,800 on the MQL5 Market, Perceptrader AI sits at the premium end of retail EA pricing.

What’s Included

- Lifetime license for 10 MT4/MT5 accounts

- Free updates to all future versions

- 6 months free Valery VPS hosting

- Telegram community access

- Strategy guides and profit calculators

- Developer support

Risk Mitigation

- 14-day free trial: Test before purchasing

- 30-day money-back guarantee: Full refund if unsatisfied

- Demo version: Available for strategy testing

Cost-Benefit Analysis

For a $10,000 account generating 4% monthly returns, Perceptrader AI would pay for itself in approximately 7 months. For smaller accounts, the payback period extends significantly—and assumes consistent profitability that isn’t guaranteed. The free trial and refund policy reduce purchase risk, but buyers should have sufficient capital to make the investment proportionally reasonable.

Who Should Consider Perceptrader AI?

Good Fit If You:

- Have adequate capital: $3,000+ to run with comfortable margin

- Understand grid risks: Accept potential for extended drawdown periods

- Want passive automation: Prefer set-and-monitor over active trading

- Value verified results: Prioritize EAs with transparent track records

- Can run 24/7: Have VPS infrastructure for continuous operation

Poor Fit If You:

- Have limited capital: Under $1,000 available for EA trading

- Need low drawdowns: Can’t tolerate 15-20%+ floating losses

- Trade prop firm challenges: Grid systems conflict with strict drawdown rules

- Expect guaranteed returns: No EA can promise consistent profits

- Want budget options: Many capable EAs cost 80-90% less

Perceptrader AI vs. Waka Waka

Since both EAs share the same developer and grid foundation, comparison is inevitable:

| Feature | Perceptrader AI | Waka Waka |

|---|---|---|

| Price | $2,800 | $2,520 |

| AI Filtering | Yes (neural network) | No |

| Currency Pairs | 6 pairs | 3 pairs (AUD/NZD crosses) |

| Track Record | 48+ months | 70+ months |

| Unique Trades | Yes | No |

| LLM Integration | ChatGPT/Bard | No |

Perceptrader AI offers more sophisticated filtering and broader pair coverage, while Waka Waka provides a longer track record at slightly lower cost. Neither is objectively superior—the choice depends on whether you value the AI enhancements or prefer the simpler, longer-proven system.

Final Verdict

Perceptrader AI delivers on its core promise: adding intelligent filtering to grid trading that reduces (but doesn’t eliminate) drawdown risk. The 48-month verified track record demonstrates real-world effectiveness, and the unique trades feature addresses a genuine problem with popular EA strategies.

However, the $2,800 price tag is difficult to justify for traders with limited capital. The AI technology, while functional, isn’t as revolutionary as marketing suggests—this is an evolutionary improvement on grid trading, not a paradigm shift. And the fundamental risks of grid systems remain present regardless of the filtering layer.

Recommended for: Experienced traders with $5,000+ capital who understand grid trading risks and want a premium, well-supported EA with verified performance.

Not recommended for: Beginners, undercapitalized traders, or anyone expecting the “AI” label to eliminate grid trading’s inherent risks.

Use the 14-day free trial to test with your broker and risk tolerance before committing. The technology works, the track record is legitimate, but the premium pricing only makes sense if you have the capital to deploy it properly.

Frequently Asked Questions

Is Perceptrader AI a martingale system?

Perceptrader AI uses grid trading, which shares characteristics with martingale but isn’t identical. The system opens additional positions during drawdowns at fixed intervals rather than doubling position sizes. However, total exposure does increase during adverse moves, creating similar risk dynamics. The AI layer attempts to avoid entering grids during unfavorable conditions.

What is the minimum deposit for Perceptrader AI?

The minimum is $1,000 with 1:100 leverage or $6,000 with 1:30 leverage. However, the developer recommends higher balances ($3,000-10,000) for comfortable risk management. Running with minimum capital increases the risk of margin calls during extended drawdown periods.

Does Perceptrader AI work with US brokers?

The EA is NFA and FIFO compliant, making it compatible with US-regulated brokers. However, US brokers typically offer lower leverage (1:50 maximum), which increases the minimum capital requirements. Verify specific compatibility with your broker before purchasing.

How does the ChatGPT integration work?

Perceptrader AI can query ChatGPT and Google Bard for supplementary market analysis. The feature is optional and experimental—the EA functions fully without it. The practical trading benefit of LLM integration remains unproven, and users should treat this as an interesting addition rather than a core feature.

Can I use Perceptrader AI on multiple accounts?

Yes. The license includes 10 activations, allowing use across multiple live and demo accounts. You can run the EA on different brokers simultaneously, though the unique trades feature means results will vary between installations.

What happens if the AI makes wrong predictions?

The AI filtering reduces but doesn’t prevent losses. When the neural network misjudges market conditions and activates a grid during a trending market, drawdowns will occur. The system includes stop-loss and maximum drawdown settings to limit damage, but no AI system achieves perfect prediction accuracy.

Is Perceptrader AI suitable for beginners?

Not ideally. The high capital requirements, complex risk dynamics of grid trading, and premium pricing make this EA better suited for experienced traders. Beginners should consider lower-cost EAs with simpler strategies while learning how automated trading works.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.