Oanda Review 2026: Spreads, Fees, Platforms & Verdict

Comprehensive Oanda review for 2026 covering regulation, spreads, account types, MT4/MT5 platforms, deposit methods, and who this forex broker suits best.

What Is Oanda?

Oanda is a globally recognized forex and CFD broker that’s been operating since 1996. That’s almost three decades in the retail trading space, making it one of the longest-running names in the industry. The company originally started as a currency data and technology firm before expanding into brokerage services.

Headquartered in New York, Oanda serves traders across multiple jurisdictions including the United States, United Kingdom, Canada, Australia, Singapore, and Japan. The broker is especially notable for being one of the few major platforms still accepting U.S.-based forex traders through its CFTC/NFA-regulated entity.

Over the years, Oanda has built a reputation around reliable execution, transparent pricing, and strong regulatory compliance. It consistently ranks among the top brokers for trust and safety in independent reviews. TradingView voted Oanda “Most Popular Broker” three consecutive years (2020-2022), reflecting its solid standing among retail traders worldwide.

Oanda Regulation and Safety

Regulation is where Oanda genuinely stands out. The broker holds licenses from multiple tier-1 financial authorities, which is the gold standard for retail trader protection.

Regulatory Licenses

| Regulator | Jurisdiction | Entity |

|---|---|---|

| CFTC/NFA | United States | OANDA Corporation |

| FCA | United Kingdom | OANDA Europe Limited |

| ASIC | Australia | OANDA Australia Pty Ltd |

| CIRO | Canada | OANDA (Canada) Corporation |

| MAS | Singapore | OANDA Asia Pacific Pte Ltd |

Having tier-1 regulation across five jurisdictions means Oanda adheres to strict capital adequacy requirements, client fund segregation rules, and regular audits. For U.S. traders, CFTC and NFA oversight means your funds are protected under some of the world’s toughest financial regulations.

Independent review aggregators consistently score Oanda at 98 out of 100 on trust metrics. The broker has never been involved in any major regulatory scandal, and it publishes its execution quality statistics voluntarily. That kind of transparency isn’t something you see from every broker.

Is Oanda Safe?

Yes. By virtually every objective measure, Oanda is a safe broker. Multi-jurisdictional tier-1 regulation, nearly 30 years of operating history, segregated client accounts, and voluntary transparency reports all contribute to a strong safety profile. If regulatory credibility is your priority, Oanda delivers.

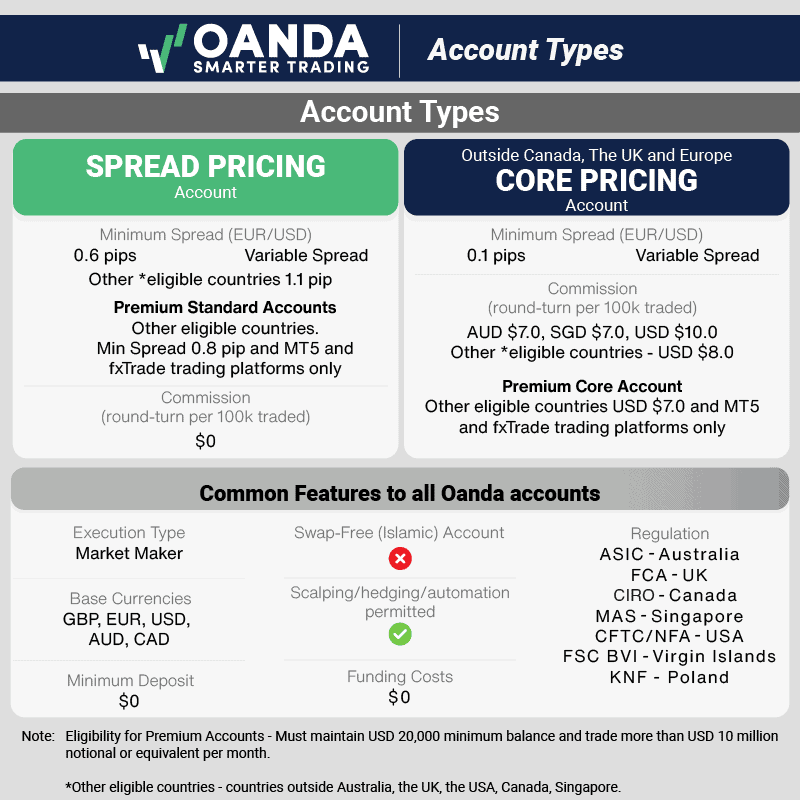

Account Types and Pricing

Oanda’s account structure varies by region, but the core offering revolves around two pricing models: spread-only and core pricing with commission. Understanding the difference is critical for calculating your actual trading costs.

Spread-Only Account (Standard)

The spread-only model is Oanda’s default option. There are no commissions per trade. Instead, all costs are baked into the spread. This is straightforward for beginners who want predictable cost calculations.

- Minimum deposit: $0 (no minimum required)

- EUR/USD average spread: ~1.4-1.7 pips

- Commission: None

- Best for: Casual traders, beginners, small accounts

Core Pricing Account

Core pricing unlocks tighter raw spreads but adds a commission per trade. You’ll need a $10,000 minimum deposit to access this tier. For active traders who calculate cost-per-lot carefully, this is usually the better deal.

- Minimum deposit: $10,000

- EUR/USD average spread: ~0.4-0.6 pips

- Commission: $5 per $100,000 traded (per side)

- Best for: Active traders, scalpers, higher-volume accounts

Elite Trader Program

Oanda’s Elite Trader tier offers additional spread discounts, priority support, and other perks for high-volume clients. Qualification criteria are not publicly listed but are generally based on monthly trading volume or account balance thresholds.

Cost Comparison: On a standard EUR/USD lot (100,000 units), the spread-only account costs roughly $14-17 per round turn. Core pricing costs approximately $4-6 in spread plus $10 in commission, totaling $14-16. The savings become more significant on volatile pairs with wider spreads.

Oanda Spreads Overview

| Currency Pair | Spread-Only (Avg) | Core Pricing (Avg) |

|---|---|---|

| EUR/USD | 1.4 pips | 0.4 pips + commission |

| GBP/USD | 1.8 pips | 0.8 pips + commission |

| USD/JPY | 1.4 pips | 0.4 pips + commission |

| AUD/USD | 1.6 pips | 0.6 pips + commission |

| USD/CAD | 2.0 pips | 0.9 pips + commission |

It’s worth noting that Oanda’s standard spreads are not the tightest in the industry. Traders who prioritize raw spread costs above all else may find more competitive pricing at ECN-focused brokers. However, Oanda’s all-in cost becomes more competitive when you factor in the execution quality and minimal slippage that comes with a well-regulated market maker.

Trading Platforms

Oanda gives traders multiple platform options. The choice depends on your trading style, whether you’re running automated strategies, and which features matter most to you.

OANDA Trade (Proprietary Platform)

Oanda’s in-house platform is available as a web app, desktop application, and mobile app. The web and desktop versions feature charts powered by TradingView, which means you get access to 80+ technical indicators, multiple chart types, and the ability to overlay currency pairs for visual comparison.

The interface is clean and functional without being overwhelming. Order execution is straightforward with market, limit, stop, and trailing stop orders all available. One-click trading is supported for speed-critical situations.

That said, the OANDA Trade platform doesn’t quite match the depth of leading proprietary platforms. If you’re used to heavy customization or advanced order types, you may feel somewhat limited.

MetaTrader 4 (MT4)

MT4 remains Oanda’s most popular platform for automated and algorithmic traders. The broker offers a premium MT4 upgrade that adds 28 advanced technical indicators and tools on top of the standard MT4 package. Expert Advisors (EAs) run natively, and you get access to Oanda’s competitive pricing through the familiar MT4 interface.

For traders running EAs around the clock, MT4 on Oanda pairs well with a dedicated MT4 VPS hosting solution. Low latency to Oanda’s servers reduces slippage on automated entries and exits, especially during high-volatility news events.

MetaTrader 5 (MT5)

Oanda has expanded MT5 availability, offering the platform through its UK, Japan, and BVI (emerging markets) entities. However, MT5 is currently not available for U.S. clients through Oanda. This is a limitation to keep in mind if you’re U.S.-based and specifically want MT5’s additional timeframes and Depth of Market features.

Where MT5 is available, you get 21 charting timeframes (versus MT4’s 9), an improved strategy tester for backtesting, and native support for hedging alongside the netting mode. It’s a meaningful upgrade for traders who need more analytical granularity.

TradingView Integration

Oanda integrates directly with TradingView, allowing traders to execute orders from TradingView’s interface. This is a significant draw for those who rely on TradingView’s advanced charting and community features but want to execute through a regulated broker. The integration supports live trading, not just paper trading, which sets Oanda apart from brokers that only offer a basic TradingView connection.

Platform Comparison

| Feature | OANDA Trade | MT4 | MT5 | TradingView |

|---|---|---|---|---|

| Automated Trading | Limited | Full (EAs) | Full (EAs) | Alerts-based |

| Custom Indicators | 80+ | 28+ premium | Built-in + custom | Community scripts |

| Timeframes | Standard | 9 | 21 | Extensive |

| Mobile App | Yes | Yes | Yes | Yes |

| VPS Compatible | Web-based | Yes | Yes | Web-based |

| U.S. Availability | Yes | Yes | No | Yes |

Instruments and Markets

Oanda’s instrument range depends on your jurisdiction and entity. The global offering is broader than what U.S. traders can access due to regulatory restrictions.

Forex

Oanda offers 68+ currency pairs covering majors, minors, and exotics. This is a solid selection that covers virtually every popular trading pair. Major pairs like EUR/USD, GBP/USD, and USD/JPY are available with competitive liquidity.

Indices

CFDs on major global indices are available including the US30 (Dow Jones), US500 (S&P 500), US Tech 100 (Nasdaq), UK100 (FTSE), DE40 (DAX), JP225 (Nikkei), AU200 (ASX), and HK50 (Hang Seng). Index trading is available outside of the U.S. entity.

Commodities

Gold, silver, platinum, copper, crude oil, natural gas, and agricultural commodities like corn and soybeans are available as CFDs. Metals trading is particularly popular among Oanda users as a hedge or diversification tool alongside forex positions.

Cryptocurrencies

Oanda offers crypto CFDs on major coins including Bitcoin, Ethereum, and Litecoin. The U.S. entity provides access to 9 cryptocurrency pairs. Crypto trading is available outside regular forex hours, making it an option for weekend activity.

Stocks and ETFs

Through select entities (primarily European and APAC), Oanda provides CFD access to U.S., German, UK, Spanish, Belgian, Nordic, and Dutch stocks along with a range of ETFs. This broadens the platform beyond pure forex into multi-asset territory.

U.S. Trader Note: If you’re trading through Oanda’s U.S. entity, your instrument selection is limited to forex and precious metals due to CFTC regulations. Indices, stocks, and most other CFDs are not available. International traders get access to the full 4,000+ instrument catalog.

Deposit and Withdrawal

Oanda keeps its funding process straightforward. There’s no minimum deposit requirement to open an account, which is a genuine advantage for traders who want to start small or test the platform with real money before committing larger amounts.

Deposit Methods

| Method | Processing Time | Limits | Fee |

|---|---|---|---|

| Debit/Credit Card | Instant | $20,000/month | Free |

| ACH Bank Transfer | Up to 6 days | $50,000/transaction | Free |

| Wire Transfer | 1-5 business days | No limit | Bank fees may apply |

Withdrawal Methods

Withdrawals follow the same-method policy. You withdraw back to the method you used for depositing. Debit card withdrawals process in up to 3 business days. Wire transfers take 1-2 days domestically and up to 5 days for international withdrawals.

One limitation: you can only withdraw to your debit card up to the total amount you originally deposited using that card. Any remaining balance must be withdrawn via bank wire. This is standard anti-money-laundering practice but can catch newer traders off guard.

Fees and Charges

- Deposit fees: None from Oanda (third-party bank fees may apply for wires)

- Withdrawal fees: None for most methods

- Inactivity fee: $10/month after 12 months of no trading activity

- Account maintenance: Free

The inactivity fee is worth monitoring. If you plan to park your account without trading, consider closing open positions and withdrawing funds to avoid the monthly charge kicking in after a year.

Execution Quality and Infrastructure

Oanda operates as a market maker, meaning it takes the other side of your trades rather than routing them to an external liquidity pool. This model gets a bad reputation in some circles, but Oanda publishes its execution statistics transparently, and the data shows tight execution with minimal slippage for the majority of trades.

The broker reports that the majority of market orders are filled at the requested price or better during normal market conditions. Negative slippage does occur, particularly during news events, but positive slippage (price improvement) is also passed through to clients.

Latency Considerations

For automated trading strategies, execution speed depends heavily on your network proximity to Oanda’s servers. Running an EA from a home internet connection introduces 50-200ms of latency, which can be the difference between a filled order and a requote during fast-moving markets.

This is where a trading VPS becomes essential. A VPS positioned in a data center near Oanda’s matching engine delivers sub-millisecond round-trip times. If you’re running scalping EAs or news-trading strategies on Oanda, a VPS isn’t a luxury. It’s infrastructure that directly impacts your bottom line.

Mobile Trading

Oanda’s mobile app is available on both iOS and Android. It supports one-click trading, real-time charts, push notifications for price alerts, and access to all the instruments available on your account type.

The app is generally well-reviewed for usability. It won’t replace a full desktop setup for detailed analysis, but for monitoring positions, adjusting stop levels, or executing quick trades on the go, it gets the job done. Touch ID and Face ID login add a layer of security without sacrificing convenience.

The TradingView-powered charts on mobile provide a better visual experience than the standard mobile MT4 interface, making the OANDA Trade app a reasonable choice for traders who primarily trade from their phones.

Research and Education

Oanda provides a solid research toolkit that includes daily market analysis, economic calendars, and its proprietary MarketPulse news feed. The MarketPulse content covers technical and fundamental analysis across forex, commodities, and indices with regular updates throughout the trading day.

Research Tools

- MarketPulse: Oanda’s proprietary news and analysis portal

- Economic Calendar: Real-time event tracking with impact ratings

- Order Book: Shows aggregate client positioning data (unique to Oanda)

- Currency Converter: Historical exchange rate data going back decades

- Sentiment Indicators: Client positioning ratios updated in real time

The Order Book tool deserves special mention. It shows you where Oanda’s client base has placed pending orders and where current open positions sit. This is genuine market data that can inform your trading decisions. Most brokers don’t offer this level of internal transparency.

Educational Resources

Oanda’s educational content covers the basics well but doesn’t go as deep as some competitors. You’ll find beginner guides, webinars, and platform tutorials. For advanced strategy development or in-depth technical analysis education, you’ll likely need to supplement with external resources.

Customer Support

Support is available 24/5 via live chat, email, and phone across all major jurisdictions. Response times are generally quick during market hours. Several reviewers report that Oanda’s support team proactively reaches out to new account holders within 48 hours of account creation, which is a positive touch for onboarding.

The knowledge base and FAQ section are comprehensive and well-organized. Most common questions about account setup, platform configuration, and funding can be resolved through self-service without needing to contact a representative.

One area that draws occasional criticism is the verification and withdrawal process. Some users have reported delays during peak periods, particularly with document verification for new accounts. This is not unique to Oanda but is worth noting if you need rapid account activation.

Oanda Pros and Cons

Pros

- Top-tier regulation across five major jurisdictions (CFTC, FCA, ASIC, CIRO, MAS)

- No minimum deposit required to open an account

- TradingView integration for advanced charting and direct execution

- Accepts U.S. traders with full CFTC/NFA compliance

- Transparent execution with published slippage statistics

- Nearly 30 years of operating history

- Order Book tool provides unique client positioning data

- MT4 support with premium indicator package

Cons

- Standard spreads are above average compared to ECN-focused brokers

- Core pricing requires $10,000 minimum deposit

- MT5 not available for U.S. clients

- Limited instrument selection for U.S. traders (forex and metals only)

- $10/month inactivity fee after 12 months of dormancy

- OANDA Trade platform trails leading proprietary platforms in depth

- Educational content could be more comprehensive for advanced traders

Who Is Oanda Best For?

Oanda isn’t trying to be everything to everyone, and that focus actually works in its favor for specific trader profiles.

U.S.-Based Forex Traders

If you’re trading forex from the United States, your broker options are limited. Oanda is one of the strongest choices available with full CFTC/NFA regulation, competitive execution, and solid platform support. The TradingView integration is especially valuable since many U.S.-focused brokers lack this feature.

Automated Traders and EA Users

MT4 support with Oanda’s premium indicator package makes it a reliable host for Expert Advisors. Follow our EA installation guide to get started, then pair it with a low-latency VPS and you have an infrastructure setup that handles automated strategies reliably around the clock. The published execution statistics let you audit your fill quality against the broker’s reported benchmarks.

Beginners Who Value Safety

No minimum deposit, tier-1 regulation, a clean interface, and straightforward pricing make Oanda approachable for new traders. You can start with a small amount, learn the platform, and scale up when ready. The demo account is also available with no expiration, which is increasingly rare.

Who Should Look Elsewhere

Aggressive scalpers who need the absolute tightest raw spreads may find better options at dedicated ECN brokers. Traders who want multi-asset CFD access from a U.S. account won’t get that here due to regulatory constraints. And if you specifically need MT5 in the U.S., Oanda can’t deliver that yet.

Oanda vs. Other Forex Brokers

When comparing Oanda to other brokers in the same tier, a few distinctions emerge. Oanda’s regulatory footprint is among the broadest in the industry. Few brokers hold tier-1 licenses in five jurisdictions simultaneously. The TradingView integration and Order Book tool are differentiators that most competitors simply don’t offer.

On the flip side, Oanda’s standard account spreads are wider than what you’ll find at ECN-focused brokers. The core pricing option closes this gap significantly but requires that $10,000 deposit. Brokers specializing in raw spreads often offer sub-0.1 pip pricing with lower commission structures.

The proprietary platform is functional but not industry-leading. Brokers like IG and Saxo have invested more heavily in their native platforms, offering deeper analytical tools and more customization. If the proprietary platform experience is important to you, Oanda may feel a step behind in this specific area.

How to Optimize Your Oanda Trading Setup

Getting the most out of Oanda isn’t just about choosing the right account type. Your technical setup matters, especially if you’re running automated strategies or trading during volatile sessions.

Use a Trading VPS for EAs

If you’re running Expert Advisors on MT4 through Oanda, a trading VPS eliminates the latency, disconnections, and power outages that home setups are prone to. A VPS positioned near Oanda’s servers maintains a persistent, low-latency connection that keeps your EAs executing as intended 24/5.

Check our forex VPS plans to ensure your trading setup never misses a beat.

Choose the Right Pricing Tier

If your account balance supports it, the core pricing model is almost always more cost-effective for active trading. Run the math on your average monthly volume. If you’re trading more than 5 standard lots per month, the commission savings on tighter spreads typically outweigh the spread-only model.

Leverage the Order Book

Oanda’s Order Book is an underutilized tool. It shows where retail positions are clustered, which often aligns with areas of stop-loss accumulation. Institutional traders frequently target these clusters, making the Order Book a useful contrarian indicator.

Frequently Asked Questions

Is Oanda a legitimate and regulated broker?

Yes. Oanda is regulated by five tier-1 authorities including the CFTC/NFA (U.S.), FCA (UK), ASIC (Australia), CIRO (Canada), and MAS (Singapore). The broker has operated since 1996 with a clean regulatory record and publishes execution quality data voluntarily.

What is the minimum deposit to open an Oanda account?

Oanda has no minimum deposit requirement for its standard spread-only account. You can fund with any amount. The core pricing account, which offers tighter spreads with commission, requires a $10,000 minimum deposit.

Does Oanda support MetaTrader 4 and MetaTrader 5?

Oanda supports MT4 across all entities and offers a premium MT4 upgrade with 28 additional indicators. MT5 is available through Oanda’s UK, Japan, and BVI entities. However, MT5 is not currently available for U.S. clients.

Can U.S. traders use Oanda?

Yes. Oanda is one of the few major forex brokers that accepts U.S. traders through its CFTC/NFA-regulated entity. U.S. clients can trade forex and precious metals. Other CFDs (indices, stocks, crypto) are not available to U.S. clients due to regulatory restrictions.

How do Oanda’s spreads compare to other brokers?

Oanda’s standard account spreads (averaging ~1.4 pips on EUR/USD) are slightly above the industry average. The core pricing model (averaging ~0.4 pips plus $10 round-turn commission on a standard lot) is more competitive and closer to ECN-level pricing.

Does Oanda charge inactivity fees?

Yes. Oanda charges a $10 monthly inactivity fee if your account has no trading activity for 12 consecutive months. To avoid this, either execute at least one trade per year or withdraw your funds if you plan to stop trading.

Should I use a VPS with Oanda for automated trading?

A VPS is strongly recommended if you run Expert Advisors or any automated strategy on Oanda. A trading VPS provides persistent connectivity, eliminates latency from your home internet, and ensures your EAs keep running during power outages or system restarts. This is especially important for scalping and news-trading strategies where milliseconds matter.

Final Verdict

Oanda is a solid, well-regulated forex broker that excels in trustworthiness, platform diversity, and accessibility. It’s not the cheapest option on every metric, and its proprietary platform doesn’t lead the pack. But the combination of tier-1 regulation across five jurisdictions, TradingView integration, transparent execution reporting, and U.S. market access makes it a strong choice for traders who prioritize reliability and safety.

For automated traders running EAs on MT4, Oanda provides a stable and well-regulated foundation. Pair it with the right infrastructure, including a low-latency trading VPS, and you have a setup that delivers consistent execution without the connectivity headaches of a home setup.

If you value regulation, transparency, and a broker that’s been around long enough to have proven its stability, Oanda deserves a spot on your shortlist.

About the Author

Thomas Vasilyev

Writer & Full Time EA Developer

Tom is our associate writer, and has advanced knowledge with the technical side of things, like VPS management. Additionally Tom is a coder, and develops EAs and algorithms.