Maven Trading Review 2026: Is This Budget Prop Firm Worth It?

Our in-depth Maven Trading review covers challenges, rules, payouts, and real trader feedback. Find out if this budget-friendly prop firm is right for you.

Our Rating: 3.8/5

Bottom Line: Maven Trading is one of the most affordable prop firms on the market, with challenges starting at just $13. The lack of time limits and fast payouts make it attractive for beginners. However, wide spreads, strict consistency rules, and a $10,000 payout cap per cycle limit its appeal for serious traders looking to scale.

Best For: Budget-conscious beginners, traders who prefer no time pressure

Not Ideal For: Scalpers, high-frequency traders, those seeking tight spreads

Maven Trading has quickly become one of the most talked-about prop firms since its 2022 launch. With challenge fees starting at $13 and no time limits on evaluations, it’s positioned itself as the budget-friendly option for traders looking to get funded without breaking the bank.

But cheap doesn’t always mean good value. While Maven boasts a 4.6-star rating on Trustpilot with over 5,000 reviews, traders consistently complain about wide spreads, slippage issues, and rules that seem to change without warning.

In this review, we’ll break down everything you need to know about Maven Trading—their challenge types, payout rules, trading conditions, and what real traders are saying—so you can decide if it’s the right prop firm for your trading style.

What Is Maven Trading?

Maven Trading is a proprietary trading firm founded in 2022 and headquartered in Vancouver, British Columbia, Canada. Unlike traditional prop firms that trade with their own capital, Maven operates a “funded trader” program where traders complete simulated evaluations to prove their skills before gaining access to funded accounts.

Key Company Stats:

- Founded: 2022

- Headquarters: Vancouver, Canada

- Traders Funded: 5,000+

- Capital Provided: $60M+

- Trustpilot Rating: 4.6/5 (5,000+ reviews)

- Discord Community: 91,000+ members

Important Note: Maven Trading is not affiliated with Maven Securities, a UK-based proprietary trading firm founded in 2011 that trades with its own internal capital. Despite the similar names, they’re completely separate companies with different business models.

Maven Trading operates exclusively with simulated accounts. Even after passing a challenge and becoming “funded,” you’re trading on a demo account—Maven pays you based on the simulated profits you generate. This is standard practice for most modern prop firms, but it’s worth understanding before you sign up.

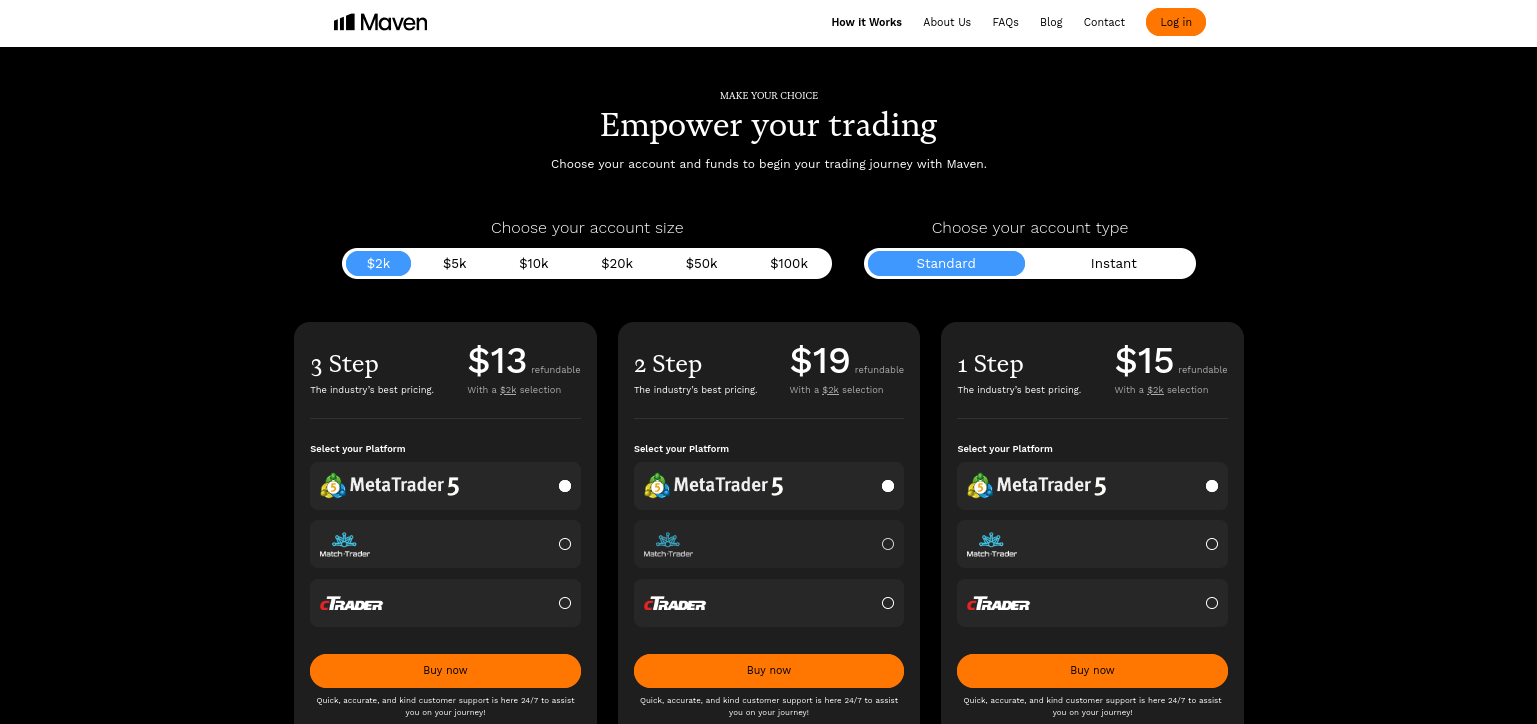

Maven Trading Challenge Types

Maven offers four distinct paths to funding, each designed for different trader profiles and risk tolerances. All challenges share one major advantage: no time limits. You can take as long as you need to reach your profit targets.

Video: Understanding Prop Firm Challenges

New to prop firm challenges? This video explains how funded trader evaluations work and what to expect: https://www.youtube.com/embed/Lhf_2gJJS1Q

1-Step Challenge

The 1-Step Challenge is Maven’s streamlined option for experienced traders who want to prove themselves quickly.

- Entry Fee: From $15 (refundable)

- Profit Target: 8%

- Daily Drawdown: 3%

- Max Drawdown: 5% trailing

- Account Sizes: $2,000 – $100,000

The trailing drawdown is the key consideration here. Unlike static drawdown, a trailing stop follows your highest equity point. If you profit 4% and then give back 5%, you’re out—even if you’re still above your starting balance.

2-Step Challenge

The 2-Step Challenge offers more breathing room with its static drawdown and two-phase structure.

- Phase 1 Profit Target: 8%

- Phase 2 Profit Target: 5%

- Daily Drawdown: 4%

- Max Drawdown: 8% static

- Minimum Trading Days: 3 profitable days (0.5% each) per phase

The static drawdown is a significant advantage. If you start with $10,000, your drawdown limit is $800 from your starting balance—it doesn’t trail upward as you profit. The 4% daily drawdown also gives you more room to maneuver compared to the 1-Step’s tighter 3%.

3-Step Challenge

Launched in January 2025, the 3-Step Challenge is Maven’s most beginner-friendly option with the lowest barrier to entry.

- Entry Fee: From $13 (refundable)

- Profit Target: 3% per phase (all three phases)

- Daily Drawdown: 2%

- Max Drawdown: 3% static

- Account Sizes: $2,000 – $100,000

The 3-Step is designed for traders who want a gradual path to funding without aggressive profit targets. The tradeoff is the tight 3% static drawdown—one bad day can end your challenge.

Instant Funding

For traders who want to skip evaluations entirely, Maven offers Instant Funding accounts.

- Entry Fee: From $19

- Profit Target: None (immediate access)

- Max Risk Per Trade: 1%

- Consistency Rule: 20%

- Minimum Profit for Payout: 3%

There’s a catch: Maven Instant and Mini accounts only allow one payout. After your first withdrawal, the account closes. This makes it better suited for traders who want to test the platform’s execution quality rather than build a long-term funded relationship.

Maven Trading Rules & Restrictions

Understanding Maven’s rules is critical before starting a challenge. Many traders fail not because of poor trading decisions, but because they didn’t fully grasp the restrictions.

Drawdown Rules

| Challenge | Daily Drawdown | Max Drawdown | Type |

|---|---|---|---|

| 1-Step | 3% | 5% | Trailing |

| 2-Step | 4% | 8% | Static |

| 3-Step | 2% | 3% | Static |

News Trading Restrictions

Maven prohibits opening or closing trades within 2 minutes before or after high-impact news events. Any profits made during restricted news windows will be voided. This affects traders who rely on news-driven volatility strategies.

Scalping Restrictions

If more than 50% of your trades are held for less than 60 seconds, Maven may flag your account for “excessive scalping.” This doesn’t mean an automatic fail, but it can trigger a review of your trading activity.

Martingale (Now Allowed)

As of November 2025, Maven removed its Martingale restriction. Traders can now hold up to 5 open positions in drawdown on the same pair simultaneously. This is a significant change that gives traders more flexibility for scaling into positions.

IP Consistency Requirements

Maven tracks IP addresses across all phases of your challenge and funded account. If your IP changes unexpectedly (traveling, switching networks, using a VPN), your account may be flagged for review. Legitimate IP changes require documentation, and resolution can take several days—problematic if you’re mid-payout.

Account Activity

Accounts become inactive after 30 calendar days without an executed trade. Inactive accounts are closed, meaning you’ll lose your challenge progress or funded status.

Payout Policy & Profit Split

Maven’s payout structure has several nuances that can catch traders off guard.

Profit Split

All funded accounts receive an 80% profit split. Maven keeps 20% of your simulated trading profits.

Payout Timeline

- First Payout: Available 14 days after your funded account becomes active

- Faster Option: 7-day payout cycle available

- Processing Time: Within 1 business day (some traders report receiving funds in as little as 20 minutes)

Minimum Profit Requirement

You must achieve at least 3% profit to be eligible for a payout.

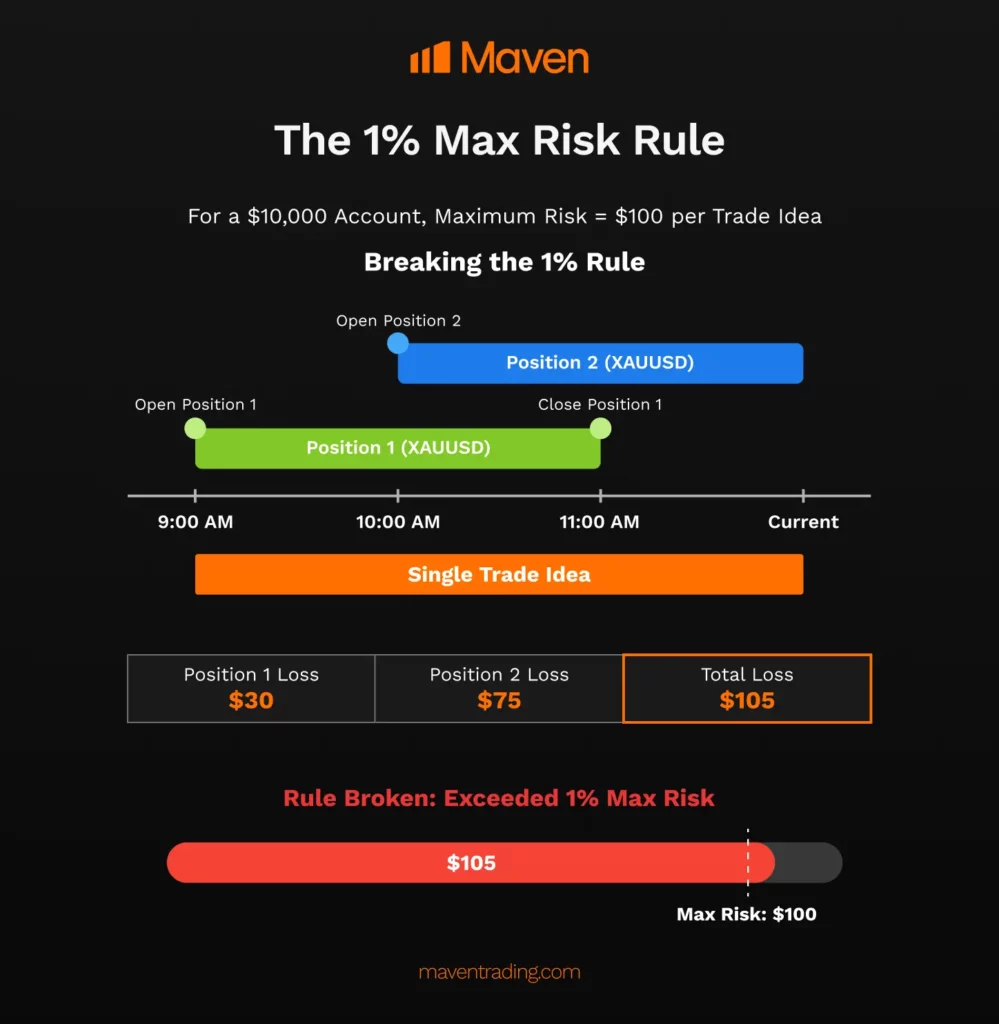

Consistency Rules

20% Rule: Your largest winning trade cannot exceed 20% of your total profit. Calculate this as: largest winning trade ÷ total profit. If this exceeds 20%, you won’t qualify for payout.

50% Rule (for profits over $5,000): If your total profit exceeds $5,000, your best trading day or single trade cannot exceed 50% of your profit in that payout cycle. Profits exceeding this threshold are reduced to the 50% mark.

Risk Interview

After exceeding $5,000 in cumulative payouts, Maven requires a risk interview with one of their analysts. You have two weeks to schedule and attend. Missing the interview without rescheduling means your payout won’t be processed.

Withdrawal Limits

Maven’s “Overflow” feature caps withdrawals at $10,000 per two withdrawal cycles. This scales proportionally with account size, but it can limit earnings for successful traders on larger accounts.

Scaling Program

Maven allows traders to scale their accounts up to $1,000,000 in capital.

Requirements:

- Achieve 10% net profit over 4 consecutive months (average 2.5% per month)

- Process at least 1 payout per month during this period

- Upon qualification, receive a 25% account increase

The scaling program is achievable but requires consistent performance. You can’t simply have one great month and coast—Maven wants to see sustained profitability.

Trading Platforms & Instruments

Maven Trading supports three platforms:

- cTrader — Popular for its intuitive interface and advanced charting

- Match-Trader — Maven’s primary platform with proprietary integrations

- MetaTrader 5 (MT5) — Re-introduced in May 2025 after trader demand

Available Instruments (75+):

- 40 Forex pairs

- Cryptocurrencies

- Metals (gold, silver)

- Energies (oil, natural gas)

- Global indices (US, Australia, China, EU, Japan, UK)

- Agricultural commodities

Leverage:

- Forex: Up to 1:75

- Commodities/Indices: Up to 1:20

- Cryptocurrencies: Up to 1:2

Maven Trading Pros & Cons

Pros

- Ultra-low entry fees — Starting at $13, Maven is one of the most affordable prop firms available

- No time limits — Trade at your own pace without deadline pressure

- Fast payouts — Some traders report receiving funds within 20 minutes to 6 hours

- Buyback feature — Return to a funded account at reduced cost if you fail

- Multiple challenge options — 1-Step, 2-Step, 3-Step, and Instant cater to different skill levels

- 24/7 Discord support — Active community with 91,000+ members

- Martingale now allowed — November 2025 update removed this restriction

- Refundable fees — Challenge fees returned after first successful payout

Cons

- Wide spreads — The most common complaint. Traders report 4-6 pip spreads even on “raw” accounts, significantly wider than retail brokers

- Slippage issues — Multiple reports of orders filling at worse prices than expected

- Simulated accounts only — Even funded accounts don’t trade real capital

- Rule changes — Maven has a reputation for changing rules unexpectedly, causing uncertainty

- IP tracking — Strict monitoring can flag legitimate travelers or VPS users

- $10K payout cap per cycle — Limits earnings potential for successful traders

- Risk interview requirement — Mandatory after $5,000 in payouts

- Tight consistency rules — 20% rule can disqualify traders with one big winning trade

- Technical latency — Some traders report SL/TP levels not being respected

What Traders Are Saying

Video View of Mavin Trading

Trustpilot Analysis

Maven Trading has accumulated over 5,000 reviews on Trustpilot with an overall rating of 4.6 out of 5 stars.

Maven Trading Trustpilot Rating: 4.6/5 (5,000+ reviews)

- 5-star reviews: 85%

- 1-star reviews: 6%

Common Positive Feedback:

- “Fastest payout I’ve ever received—got $30,000 in 6 hours”

- “Most affordable prop firm I’ve tried, and the no time limit is a game changer”

- “Discord support is incredibly responsive, even on weekends”

Common Complaints:

- “The ‘raw’ spreads are actually 4-6 pips… definitely not low”

- “They closed my trades during news without warning”

- “Account flagged for ‘gamifying trading’ after passing the challenge”

- “No communication after repeated emails about my funded account activation”

- “Too much latency when opening/closing trades, SL/TP not always respected”

Traders Union Score

Traders Union gives Maven Trading a 4.05 out of 10 with a “higher than average risk” warning. They recommend traders “consider a more reliable partner with better conditions.”

This contrasts sharply with Trustpilot’s 4.6/5, highlighting the importance of looking at multiple review sources.

Is Maven Trading Legit?

Yes, Maven Trading is a legitimate prop firm—not a scam. They have:

- A verifiable three-year operating history (founded 2022)

- Thousands of documented payouts

- An active, transparent community on Discord

- Partnerships with regulated brokers (Purple Trading, Match-Prime)

However, “legit” doesn’t mean “perfect.” Several yellow flags are worth noting:

- Lack of transparency — Maven doesn’t clearly disclose its liquidity providers or how spreads are determined

- Frequent rule changes — Traders report policies changing without advance notice

- Simulated trading — You’re never trading real capital, which some argue creates conflicts of interest

- Mixed review sources — The gap between Trustpilot (4.6/5) and Traders Union (4.05/10) raises questions

Maven isn’t going to steal your money or disappear overnight. But the trading conditions—particularly spreads and rule enforcement—may not match what you’d expect from a legitimate operation.

Who Should Use Maven Trading?

Best For:

- Budget-conscious beginners — $13-15 entry fees let you test prop trading without significant risk

- Swing traders — No time limits and static drawdown options favor longer-term strategies

- Traders who hate pressure — The no-deadline structure removes time-based stress

- Those testing the prop firm model — Low cost makes it easy to experiment

Not Ideal For:

- Scalpers — Wide spreads and the 60-second rule make scalping impractical

- News traders — 2-minute restrictions around high-impact events limit this strategy

- High-frequency traders — Technical latency and slippage reports are concerning

- Experienced traders seeking scale — $10K payout cap and consistency rules limit earnings

- Travelers — IP consistency requirements can cause issues

VPS Considerations for Maven Traders

Maven’s IP consistency rules create a unique consideration for traders who use Virtual Private Servers (VPS) or trade while traveling.

If your IP address changes between your challenge phases or funded account activity, Maven may flag your account for review. While legitimate changes can be resolved with documentation, the process can take days—potentially interrupting payouts or trading activity.

Many Maven traders use a dedicated trading VPS to maintain a consistent IP address and avoid these issues. A VPS also provides:

- Consistent IP — Same address whether you’re at home, traveling, or switching networks

- Lower latency — Faster order execution, which matters given Maven’s reported latency issues

- 24/7 uptime — Your platform stays running even if your local internet drops

- Reduced slippage — Faster connections mean better fill prices

If you’re serious about trading with Maven (or any prop firm), a low-latency trading VPS can help avoid IP-related account issues while improving overall execution quality.

Frequently Asked Questions

Is Maven Trading legit?

Yes, Maven Trading is a legitimate prop firm founded in 2022. They have a 4.6/5 rating on Trustpilot with over 5,000 reviews and have funded more than 5,000 traders with $60M+ in capital. However, like most prop firms, they operate with simulated accounts, not real market capital.

What is Maven Trading’s profit split?

Maven Trading offers an 80% profit split on all funded accounts. Traders keep 80% of profits from their simulated trading, with payouts processed within 1 business day after the initial 14-day waiting period.

How much does Maven Trading cost?

Maven Trading is one of the most affordable prop firms available. The 3-Step Challenge starts at just $13 for a $2,000 account, while the 1-Step Challenge starts at $15. Account sizes range from $2,000 to $100,000, with fees scaling accordingly.

What platforms does Maven Trading support?

Maven Trading supports three trading platforms: cTrader, Match-Trader, and MetaTrader 5 (MT5), which was re-introduced in May 2025. Traders can access over 75 instruments including forex, indices, commodities, crypto, and metals.

Does Maven Trading have a time limit on challenges?

No, Maven Trading does not impose time limits on any of their challenges. Traders can take as long as needed to reach profit targets, reducing pressure and allowing for more strategic trading approaches.

What is Maven Trading’s consistency rule?

Maven Trading enforces a 20% consistency rule, meaning your largest winning trade cannot exceed 20% of your total profit. For profits over $5,000, there’s an additional 50% rule where your best trading day cannot exceed 50% of total profits in that payout cycle.

Can I use a VPS with Maven Trading?

Yes, but with caution. Maven Trading has strict IP consistency requirements across all phases. Using a VPS is allowed, but sudden IP changes may trigger account flags. Many traders use a dedicated trading VPS with a consistent IP address to avoid issues.

Final Verdict

Our Rating: 3.8/5

Maven Trading delivers on its core promise: affordable access to prop trading with no time pressure. For beginners testing the waters or swing traders who need flexibility, the $13-15 entry fees and unlimited challenge duration are genuinely valuable.

But the low cost comes with real tradeoffs. Wide spreads eat into profits. Consistency rules can disqualify traders who have one great trade. The $10,000 payout cap limits scaling potential. And the reputation for changing rules creates ongoing uncertainty.

If you’re a beginner who wants to learn prop trading without risking much capital, Maven is worth considering. If you’re an experienced trader looking for tight spreads, fast execution, and room to scale—you may find the trading conditions frustrating despite the low entry cost.

The bottom line: Maven Trading is a legitimate, budget-friendly option with significant limitations. Go in with realistic expectations, understand the rules thoroughly before you start, and don’t expect retail-broker-quality execution on a $13 challenge.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.