Mad Turtle EA Review: AI-Powered Gold Trading Without the Risk?

Mad Turtle EA takes a different approach to gold trading. Instead of the grid and martingale strategies that dominate the […]

Mad Turtle EA takes a different approach to gold trading. Instead of the grid and martingale strategies that dominate the XAUUSD EA market, it uses machine learning with ONNX neural networks and only opens one position at a time.

The short verdict: Mad Turtle EA is a legitimate AI-powered trading robot from an experienced developer with a solid track record. The no-grid, single-position approach makes it significantly safer than most gold EAs, but it comes with tradeoffs—slower profit growth and a swing trading style that requires patience. At $1,300, it’s a premium investment for traders who prioritize capital preservation over aggressive returns.

Developer Gennady Sergienko has been on MQL5 for over 8 years and has created other successful EAs including Nesco EA MT5 and Trader Station MT4. Mad Turtle currently holds a 4.63/5 rating from 74 reviews with 123 monthly purchases.

This review covers the AI/ML technology, verified performance, pricing, and why this EA needs a VPS to run properly.

What is Mad Turtle EA?

Mad Turtle EA is an Expert Advisor for MetaTrader 5 that trades XAUUSD (gold) exclusively using machine learning. Unlike most gold trading robots that rely on grid systems or martingale position sizing, Mad Turtle uses ONNX neural networks to predict market direction and only opens one trade at a time.

The EA operates as a swing trader, holding positions from several hours to multiple days. This longer timeframe approach aims for larger pip gains per trade rather than accumulating many small scalps throughout the day.

What makes Mad Turtle technically interesting is its AI transparency. The neural network displays real-time buy and sell probabilities directly on your chart, so you can see exactly what the model is “thinking” at any moment. This is unusual—most AI trading systems operate as black boxes.

The developer, Gennady Sergienko, is based in Indonesia and has been creating trading software on MQL5 since 2017. His other products include Nesco EA MT5 (another well-rated EA) and Trader Station MT4. This track record matters because EA development requires ongoing maintenance as markets change.

Mad Turtle works with any broker, any GMT offset, and both 2-digit and 3-digit gold pricing. The minimum recommended deposit is $500, though larger accounts allow for better position sizing flexibility.

Key Features

Mad Turtle EA’s feature set centers on its machine learning core and conservative trading approach:

ONNX Neural Network

The EA uses ONNX (Open Neural Network Exchange) format for its machine learning model, which runs natively inside MT5 without requiring external connections or API calls. The model was trained using custom reward and penalty functions designed to optimize for trading performance rather than just prediction accuracy.

Cascade Meta-Model Filtering

Trade signals pass through multiple layers of filtering before execution. The primary neural network generates predictions, which then get filtered through additional meta-models that evaluate signal quality. This cascade approach aims to reduce false signals and improve entry timing.

Overfitting Prevention

A common problem with AI trading systems is overfitting—the model performs well on historical data but fails on new data. Mad Turtle reserves 30-50% of training data for validation specifically to combat this issue. The developer emphasizes this technical detail in the product documentation.

Real-Time Probability Display

Unlike black-box AI systems, Mad Turtle shows its reasoning. The chart displays current buy and sell probabilities from the neural network, updating in real-time as market conditions change. This transparency lets traders understand what the model sees, even if they don’t control its decisions.

Single Position Only

The EA maintains only one open position at any time. No grid of positions, no adding to losers, no martingale lot increases. When a trade closes, the EA waits for the next valid signal before entering again. This approach limits both potential gains and potential losses per trading cycle.

Day and Time Filters

Mad Turtle includes filters to avoid trading during historically risky periods. You can configure it to skip high-impact news events, weekend gaps, or specific hours when gold volatility patterns change.

Feature Summary

| Feature | Description |

|---|---|

| Trading Pair | XAUUSD (Gold) only |

| Platform | MetaTrader 5 |

| Strategy | AI/ML swing trading with ONNX |

| Minimum Deposit | $500 |

| Position Type | Single position only |

| Grid/Martingale | None |

| Trade Duration | Hours to days |

| Broker Compatibility | Any broker, any GMT |

Performance & Results

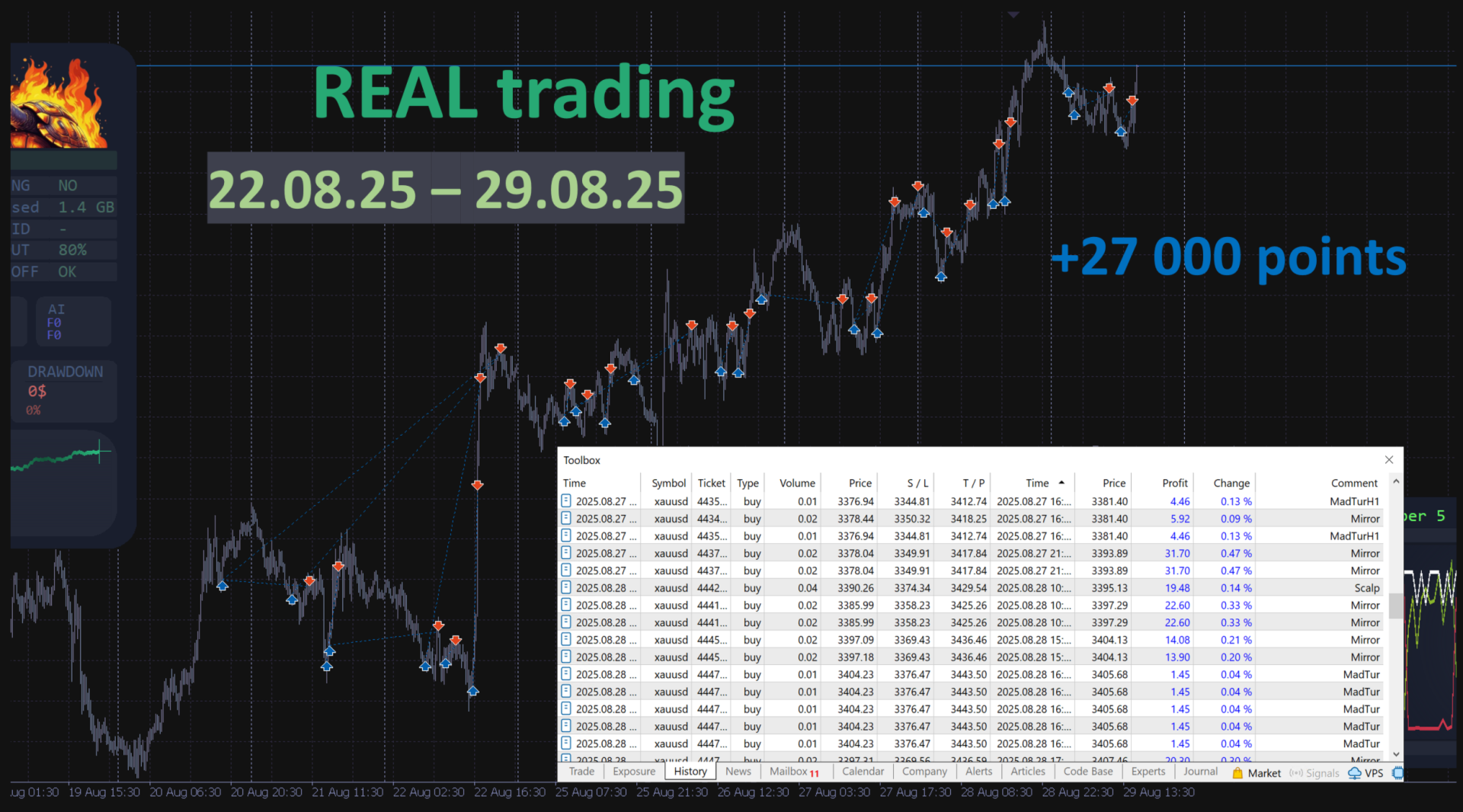

Mad Turtle EA provides signal accounts through MQL5’s signals service. The developer’s approach to measuring performance is worth noting—he emphasizes “clean profit in points, not lots.” This means focusing on pip gains rather than dollar amounts that can be inflated by martingale lot sizing.

One verified account running on ICM Capital shows approximately 127,000 pips gained over 103 trades, averaging around 1,200 pips per trade. This aligns with the swing trading approach—fewer trades, larger gains per position.

A separate verified account showed a 46% gain with a 68% win rate and 9.5% maximum drawdown over a 7-week period. The relatively low drawdown is consistent with the single-position strategy—without stacked grid positions, drawdowns stay controlled during adverse moves.

Important context: these results come from the developer’s signals. Your results will vary based on broker, spread, execution speed, and market conditions during your trading period. The EA’s swing trading approach also means performance can look different over short timeframes—you might have weeks with few trades and minimal activity followed by periods of higher engagement.

The 4.63/5 rating from 74 reviews reflects generally positive user sentiment, though it’s lower than some competitors. Reading through reviews, satisfied users praise the conservative approach and AI transparency, while critical reviews often mention slow profit growth or fewer trades than expected. This aligns with the EA’s design philosophy—it’s built for patience, not quick returns.

Pricing & What’s Included

Mad Turtle EA uses progressive pricing that increases as sales accumulate:

| Detail | Information |

|---|---|

| Current Price | $1,300 |

| Price Model | +$50 per 10 purchases |

| Demo Access | Free, unlimited |

| Activations | 10 activations included |

| Support | Telegram channel + private chat |

| Updates | Free lifetime updates |

The $1,300 price point puts Mad Turtle in premium EA territory. The progressive pricing model means the price has increased over time as more copies sold—earlier buyers paid less, and future buyers will pay more.

You can test the EA on demo accounts for free before purchasing, which is essential given the investment. The 10 activations allow installation across multiple terminals or accounts, and the developer provides support through a Telegram community channel plus private messaging.

The current version (6.5) represents ongoing development—the EA has been updated multiple times since its initial release, indicating active maintenance.

Pros

No Grid or Martingale

The single-position approach eliminates the catastrophic risk inherent in grid and martingale systems. You can’t blow your account from a series of stacked positions that all go wrong simultaneously. For traders who’ve experienced grid EA wipeouts, this is significant.

AI Transparency

Seeing buy/sell probabilities on your chart isn’t just interesting—it helps you understand what the EA is doing. If you want to learn from the AI’s market analysis or verify it’s working correctly, the real-time display provides that visibility.

Experienced Developer

Gennady Sergienko’s 8+ years on MQL5 with multiple successful products suggests staying power. Many EAs get abandoned after initial sales; an active developer means bugs get fixed, and the system adapts to changing markets.

Controlled Risk Per Trade

Single-position trading with defined stops means you know your maximum risk on any trade. No hidden exposure from accumulating positions, no surprise drawdowns from a grid that “just needs more room.”

Broker Flexibility

Works with any broker, any GMT offset, any gold pricing format. This matters for traders locked into specific brokers or those who want to test across multiple platforms.

Machine Learning Adaptation

The ONNX neural network can theoretically adapt to changing market conditions better than fixed rule-based systems. Whether this advantage materializes depends on the model’s architecture and training, but the technology is more sophisticated than simple indicator-based EAs.

Cons

Premium Price Point

$1,300 is significant money for a trading robot, especially one that trades conservatively. The ROI timeline extends longer than cheaper EAs, and the capital requirement effectively becomes $1,800+ when adding the $500 minimum deposit.

MT5 Only

If your broker only offers MT4, or you prefer MT4’s interface, Mad Turtle isn’t an option. The ONNX requirement locks it to MT5 with no workaround available.

Single Pair Limitation

XAUUSD only means no portfolio diversification within the EA. You’re fully exposed to gold market conditions. If gold enters an extended choppy period, the EA may struggle while other pairs trend nicely.

Slower Profit Growth

Swing trading with single positions won’t compound as fast as aggressive grid systems during favorable conditions. Traders who want to see daily profits accumulating may find the pace frustrating.

Lower Rating Than Competitors

At 4.63/5, Mad Turtle rates below some premium competitors in the MQL5 marketplace. While ratings aren’t everything, the gap suggests some users expected different results.

Patience Required

Holding trades for hours or days means watching positions fluctuate. If you tend to interfere with trades or get anxious during drawdowns, the swing trading style may not suit your psychology.

Why You Need a VPS to Run Mad Turtle EA

Swing trading amplifies the VPS requirement compared to scalping EAs. Here’s why:

Extended Position Duration — Mad Turtle holds trades from several hours to multiple days. During that entire period, the EA needs to monitor the position and execute exits when the AI model signals. A home computer that restarts for updates, loses power, or drops internet leaves open positions unmanaged.

Exit Signal Timing — The neural network continuously evaluates market conditions and can signal exits at any time. If your EA goes offline at the wrong moment, you might miss an exit signal that would have locked in profits or limited a loss.

Overnight Exposure — Swing trades routinely carry through overnight sessions when you’re sleeping. Running from a home computer means either leaving it on 24/7 (with associated reliability risks) or accepting gaps in coverage.

AI Model Requirements — The ONNX neural network needs continuous price data to generate accurate probability readings. Interruptions in data feed can affect the model’s analysis quality.

Weekend Gap Protection — If the EA decides to exit before a weekend based on its risk analysis, it needs to be running. Missing that window could expose you to Monday gap risk.

A forex VPS eliminates these concerns. Your EA runs in a data center with redundant power, enterprise internet, and 24/7 uptime—completely independent of your home setup.

NYCServers provides MT5 VPS hosting optimized for Expert Advisors like Mad Turtle. With 1ms latency to major brokers and 100% uptime during trading hours, you get the reliability that swing trading demands. The servers come with MT5 pre-installed and configured, so setup takes minutes rather than hours.

For a $1,300 EA trading real capital, the cost of VPS hosting is minimal insurance against connectivity-related losses.

Mad Turtle EA vs Quantum Queen EA

Both Mad Turtle and Quantum Queen trade XAUUSD at the $1,300 price point, but they take opposite approaches:

| Feature | Mad Turtle EA | Quantum Queen EA |

|---|---|---|

| Strategy | AI/ML Swing Trading | Grid System |

| Positions | Single only | Multiple (grid) |

| Risk Level | Lower | Higher |

| Profit Potential | Slower, steadier | Faster during favorable conditions |

| Rating | 4.63/5 (74 reviews) | 4.98/5 (197 reviews) |

| Trade Frequency | Lower (swing) | Higher (grid accumulation) |

| Drawdown Risk | Controlled | Can escalate with grid |

The choice depends on your risk tolerance. Quantum Queen’s grid approach can generate faster returns but carries higher blowout risk if gold makes extended moves against positions. Mad Turtle’s single-position approach won’t compound as quickly but also won’t stack losses during adverse conditions.

Quantum Queen’s higher rating (4.98 vs 4.63) reflects more users achieving expected results, though this may partly reflect the faster visible returns that grid systems produce during favorable periods.

Who Should Use Mad Turtle EA?

Best for:

- Patient traders who prioritize capital preservation over rapid growth

- Traders who’ve been burned by grid or martingale systems and want a safer approach

- Those interested in AI/ML trading with transparency into how decisions are made

- Swing trading enthusiasts comfortable with holding positions overnight

- Traders with $1,800+ available (EA cost plus minimum deposit)

- MT5 users looking for a gold specialist

Not ideal for:

- Traders seeking quick, visible daily profits

- Aggressive traders who want maximum growth potential

- Those who prefer high trade frequency and constant activity

- MT4 users (no MT4 version available)

- Traders who want pair diversification within a single EA

- Small account traders who can’t meet the $500 minimum comfortably

Verdict

Mad Turtle EA is a legitimate, well-designed trading robot that takes an unconventional approach to gold trading. By avoiding grid and martingale strategies in favor of AI-driven single-position swing trading, it prioritizes account safety over aggressive growth.

The ONNX neural network implementation is technically sophisticated, and the real-time probability display provides unusual transparency into the AI’s decision-making. Developer Gennady Sergienko’s track record and ongoing updates suggest the product will continue to be maintained.

The tradeoffs are real: slower profit growth, less trading activity, MT5-only limitation, and a premium price point. The 4.63/5 rating, while positive, indicates some users don’t get the experience they expected—likely those seeking faster returns.

For risk-conscious gold traders who can afford the $1,300 investment and have the patience for swing trading, Mad Turtle offers a safer alternative to the grid-based EAs that dominate the XAUUSD market. Just make sure you’re running it on a reliable VPS and setting realistic expectations for the pace of returns.

FAQ

Is Mad Turtle EA legit?

Yes. Mad Turtle EA is developed by Gennady Sergienko, an experienced MQL5 developer with 8+ years on the platform and multiple successful products. The EA has a 4.63/5 rating from 74 reviews and uses transparent AI that displays its reasoning directly on your chart. Like any trading robot, results depend on market conditions and proper setup.

Does Mad Turtle EA use martingale or grid?

No. Mad Turtle EA specifically avoids grid and martingale strategies. It only opens one position at a time, making it a lower-risk approach compared to EAs that stack multiple positions. This is one of its main selling points for risk-conscious traders.

What’s the minimum deposit for Mad Turtle EA?

The developer recommends a minimum deposit of $500 to run Mad Turtle EA properly. This allows adequate margin for swing trades that may be held for hours or days while maintaining appropriate lot sizing.

How often does Mad Turtle EA trade?

Mad Turtle EA is a swing trading robot, so it trades less frequently than scalping EAs. Trades are held from several hours to multiple days. If you’re looking for high-frequency trading with many daily trades, this EA isn’t designed for that approach.

Do I need a VPS to run Mad Turtle EA?

Yes, a VPS is strongly recommended. Since Mad Turtle holds swing trades for hours or days, it needs continuous operation to monitor positions and execute exits when the AI model signals. Internet outages or computer restarts while holding open positions can result in missed exits and larger losses.

Can I run Mad Turtle EA on MT4?

No. Mad Turtle EA is MT5 only. The EA uses ONNX neural networks that require MetaTrader 5’s native ONNX support. There is no MT4 version available, and one is unlikely given the technical requirements of the AI/ML implementation.

About the Author

Thomas Vasilyev

Writer & Full Time EA Developer

Tom is our associate writer, and has advanced knowledge with the technical side of things, like VPS management. Additionally Tom is a coder, and develops EAs and algorithms.