Grid Trading Forex: Complete Strategy Guide for 2026

Learn how grid trading works in forex, including strategy types, risk management, drawdown scenarios, and infrastructure requirements for running grid EAs 24/7.

What Is Grid Trading in Forex?

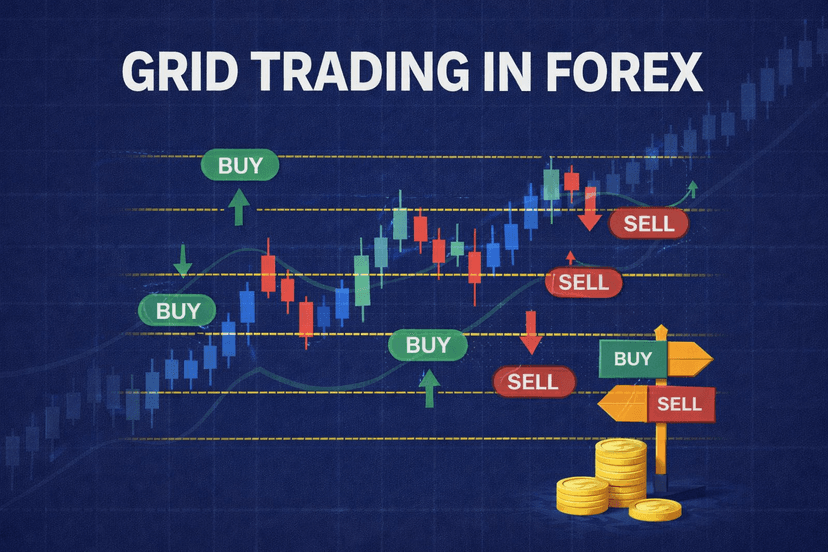

Grid trading is a mechanical trading strategy that places multiple buy and sell orders at predetermined price intervals above and below a set price level. These orders form a grid pattern on your chart, automatically capturing profits as price oscillates within a range.

The concept is straightforward. You define a starting price, set the distance between orders (grid spacing), and let the system open and close positions as the market moves. When price rises, buy orders below close in profit. When price falls, sell orders above close in profit.

Grid trading appeals to forex traders because currency pairs often move sideways for extended periods. Rather than predicting direction, you profit from volatility itself. The strategy works whether price goes up, down, or nowhere at all. This makes it a popular choice for algorithmic trading strategies that run continuously on automated systems.

But here’s what most grid trading guides won’t tell you: the strategy carries significant drawdown risk. A strong trend against your grid can accumulate losses rapidly. Understanding both the mechanics and the dangers is essential before deploying any grid system.

How Grid Trading Works: A Practical Example

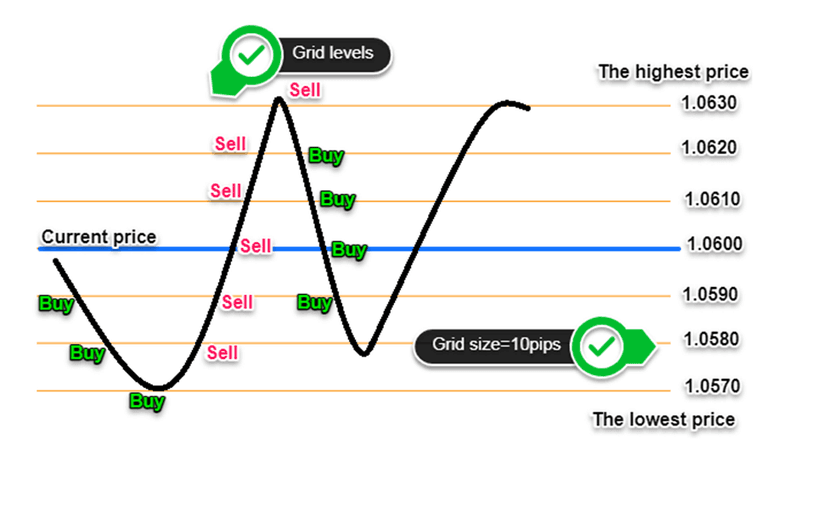

Let’s walk through a basic grid setup on EUR/USD trading at 1.0850.

You decide to place buy orders below current price and sell orders above. Your grid uses a 20-pip spacing with a 20-pip take profit on each order. Here’s what your grid might look like:

- Sell order at 1.0870 (TP at 1.0850)

- Sell order at 1.0890 (TP at 1.0870)

- Sell order at 1.0910 (TP at 1.0890)

- Buy order at 1.0830 (TP at 1.0850)

- Buy order at 1.0810 (TP at 1.0830)

- Buy order at 1.0790 (TP at 1.0810)

Price drops to 1.0810, triggering two buy orders. It then rebounds to 1.0850, closing both in profit. That’s 40 pips captured without predicting direction.

But imagine price drops to 1.0750 without retracing. You now hold four buy positions underwater. If it keeps falling, losses compound. This is the core tension in grid trading: profits come from oscillation, but trends create drawdown.

Key Grid Parameters

Every grid strategy requires these core settings:

- Grid spacing: The pip distance between orders (typically 10-50 pips)

- Take profit: Usually equals grid spacing for symmetry

- Lot size: Position size per grid level

- Grid levels: Total number of orders above and below starting price

- Grid range: Maximum price distance the grid covers

Tighter grids (10-15 pips) generate more trades but require more capital to survive trends. Wider grids (30-50 pips) trade less frequently but handle trends better.

Types of Grid Trading Strategies

Not all grids are identical. The strategy you choose depends on your market outlook, risk tolerance, and capital available.

Pure Grid (No Trend Bias)

The classic approach places both buy and sell orders symmetrically around a central price. You profit from any price movement as long as it oscillates. This works best in ranging markets with clear support and resistance levels.

The downside? Strong trends in either direction hurt equally. You’ll accumulate losing positions on one side while the other side generates small wins.

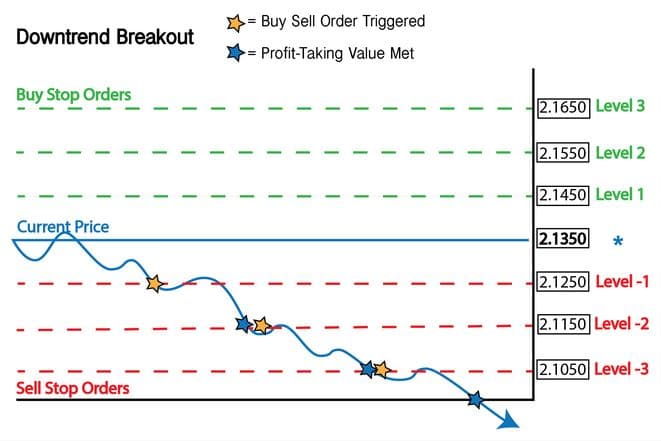

Trend-Following Grid

This variation only places orders in the direction of the prevailing trend. In an uptrend, you place only buy orders below current price. Each dip triggers a buy, and each rally books profit.

Trend grids reduce the risk of fighting momentum. However, identifying trend direction introduces subjectivity. Get the trend wrong, and you’re buying into a sustained decline.

Counter-Trend Grid

Counter-trend grids place orders against the prevailing direction, betting on mean reversion. After a strong rally, you place sell orders expecting price to pull back. This makes it a popular choice for algorithmic trading strategies that run continuously on automated systems.

This approach can be highly profitable in overextended markets but carries extreme risk if the trend continues. Counter-trend grids require strict capital management and often incorporate a maximum drawdown stop.

Dynamic Grid

Dynamic grids adjust parameters based on market conditions. Some systems widen spacing during high volatility and tighten during quiet periods. Others shift the grid’s center point as price moves.

These adaptive approaches require more sophisticated Expert Advisors and can be harder to backtest reliably. But they often outperform static grids over the long term. You can explore various implementations in our guide to the best forex grid EAs and robots.

Grid Trading vs. Martingale: Understanding the Difference

Traders often confuse grid trading with martingale strategies. While both involve multiple positions, they’re fundamentally different approaches.

Martingale doubles position size after each loss, attempting to recover everything with a single winning trade. It’s a high-risk strategy where one extended losing streak can wipe out an account.

Grid trading uses consistent lot sizes across all grid levels. You’re not trying to recover losses with increasingly larger bets. Instead, you’re systematically capturing profits from oscillation while managing a predictable maximum exposure.

| Aspect | Grid Trading | Martingale |

|---|---|---|

| Position sizing | Consistent lot size | Doubles after each loss |

| Risk profile | Gradual drawdown | Exponential risk growth |

| Capital requirement | Calculable in advance | Theoretically infinite |

| Recovery method | Multiple small wins | Single large win |

| Account blow-up risk | Lower but still present | Very high |

Some hybrid systems combine grid structure with martingale lot increases. These “grid martingale” strategies amplify both profit potential and risk. Approach them with extreme caution.

Grid Trading Pros and Cons

Before committing capital, understand what grid trading actually delivers and what risks you’re accepting.

Advantages

- No direction prediction needed: Profits come from volatility, not forecasting

- Mechanical execution: Rules-based approach removes emotional trading decisions

- Works in ranging markets: Thrives in conditions where directional traders struggle

- Consistent small wins: Regular profit-taking can produce steady returns

- Easily automated: Perfect candidate for Expert Advisors running 24/7

Disadvantages

- Significant drawdown risk: Strong trends create accumulating losses

- Capital intensive: Requires substantial margin to survive adverse moves

- Swap costs: Holding multiple positions overnight incurs financing charges

- Psychological pressure: Watching floating losses grow tests discipline

- Not suitable for all markets: Trending pairs can devastate grid systems

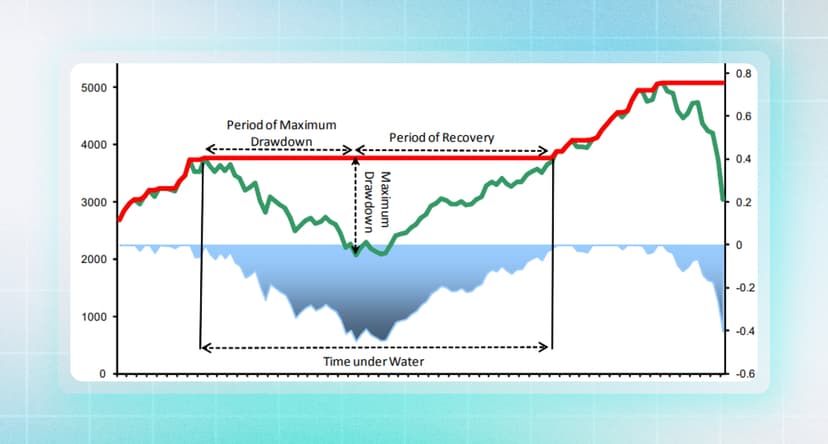

Grid Trading Drawdown: Real Numbers

Most grid trading content glosses over drawdown risk with vague warnings. Here’s what actually happens when trends move against you.

Drawdown Scenario: 10-Level Grid

Consider a grid with 10 buy levels, 20-pip spacing, and 0.1 lots per level. You’re trading a standard account where 1 pip equals $1 per 0.1 lots.

If price moves down through all 10 levels without retracing:

- Level 1: -20 pips ($20)

- Level 2: -40 pips ($40)

- Level 3: -60 pips ($60)

- Level 4: -80 pips ($80)

- Level 5: -100 pips ($100)

- Level 6: -120 pips ($120)

- Level 7: -140 pips ($140)

- Level 8: -160 pips ($160)

- Level 9: -180 pips ($180)

- Level 10: -200 pips ($200)

Total floating loss: $1,100

That’s after just a 200-pip move. Major news events can move EUR/USD 200+ pips in hours. A sustained trend can move 500+ pips over days.

Capital Requirements by Configuration

Your grid configuration directly determines minimum capital needed:

| Grid Levels | Spacing | Lot Size | Max Drawdown | Recommended Capital |

|---|---|---|---|---|

| 5 levels | 20 pips | 0.01 | $55 | $500+ |

| 10 levels | 20 pips | 0.01 | $110 | $1,000+ |

| 10 levels | 20 pips | 0.1 | $1,100 | $10,000+ |

| 20 levels | 30 pips | 0.1 | $6,300 | $25,000+ |

The rule of thumb: your account should survive maximum drawdown with at least 50% equity remaining. This gives you room for the market to eventually retrace.

When to Use Grid Trading (And When to Avoid It)

Grid trading isn’t universally applicable. Success depends heavily on matching the strategy to appropriate market conditions.

Ideal Conditions for Grid Trading

- Ranging markets: Clear support and resistance with price oscillating between

- Low-trend pairs: Currencies with historically sideways behavior

- Stable volatility: Consistent daily ranges without extreme spikes

- Major pairs: EUR/USD, GBP/USD, USD/CHF often range for extended periods

- Asian session: Lower volatility and tighter ranges than London/New York

When to Avoid Grid Trading

- Strong trending conditions: When a pair breaks out of long-term ranges

- High-impact news: NFP, central bank decisions, elections

- Exotic pairs: USD/TRY, EUR/ZAR have extreme trending tendencies

- Correlated grids: Running EUR/USD and GBP/USD grids doubles USD risk

- Undercapitalized accounts: If you can’t survive maximum drawdown, don’t trade

Pre-Deployment Checklist

Before activating any grid EA, answer these questions honestly:

- Have you backtested across 5+ years including major market events?

- Can your account survive maximum drawdown plus 50% buffer?

- Have you calculated worst-case swap costs for holding positions long-term?

- Do you have a plan for what happens if drawdown exceeds expectations?

- Are you running on infrastructure that guarantees 24/7 operation?

Risk Management for Grid Trading

Grid trading without proper risk management is gambling. Here’s how to protect your capital.

Position Sizing

Calculate lot size based on worst-case scenario, not expected behavior. If your grid has 15 levels with 25-pip spacing, you need to survive a 375-pip adverse move. Size positions so that event leaves you with adequate margin.

Maximum Drawdown Stop

Define a point where you close all positions and accept the loss. Watching floating losses grow indefinitely is psychologically destructive and financially ruinous. A 25-30% account drawdown stop is common.

Pair Selection

Some currency pairs are structurally unsuited for grid trading. Pairs with interest rate differentials trend strongly as carry trade flows dominate. Stick to pairs with similar interest rates or historically range-bound behavior.

Time-Based Rules

Consider pausing grids during high-impact news events. Many grid EAs include a news filter that suspends new orders around scheduled announcements. The temporary pause prevents getting caught in spike moves.

Correlation Management

If you run multiple grids, ensure they’re not correlated. EUR/USD and EUR/GBP grids both carry EUR exposure. A strong EUR move hurts both simultaneously. Diversify across uncorrelated pairs or limit yourself to one grid at a time.

Best Currency Pairs for Grid Trading

Not all forex pairs behave the same. Some are structurally better suited for grid strategies.

High-Probability Grid Pairs

- EUR/CHF: Historically range-bound due to Swiss National Bank interventions

- AUD/NZD: Two highly correlated economies, creating tight ranges

- EUR/GBP: Both European economies, limited trending behavior

- USD/CAD: Often ranges for extended periods, particularly when oil is stable

Pairs to Avoid

- USD/JPY: Strong trending due to interest rate differentials

- GBP/JPY: Extreme volatility and extended trends

- Emerging market pairs: Political risk creates sustained directional moves

- Any pair during central bank policy divergence: Creates multi-month trends

Infrastructure Requirements for Grid Trading

Grid strategies require your trading platform to run continuously. Every moment offline is a missed opportunity or unmanaged risk.

Why Grid EAs Need 24/7 Operation

Unlike discretionary trading, grid systems must respond to market moves instantly. If price drops through three grid levels while you’re asleep, those orders need to execute. If your computer is off, you miss entries and your risk calculations become invalid.

Running grid EAs on your home computer introduces multiple failure points:

- Power outages stop the EA entirely

- Internet disruptions prevent order execution

- Windows updates restart your machine mid-trade

- Computer crashes leave positions unmanaged

- Sleep mode suspends the trading platform

VPS Solutions for Grid Trading

A forex VPS eliminates these risks. Your Expert Advisor runs on a server in a professional data center with redundant power, network connectivity, and cooling. The platform stays online even when your personal computer is off.

Beyond reliability, execution speed matters for grid strategies. Home internet connections typically have 50-100ms latency to broker servers. A VPS located near your broker’s infrastructure can achieve sub-millisecond latency.

This speed difference affects grid trading in several ways:

- Orders fill at your requested price more consistently

- Take profits execute before price reverses

- Multiple rapid orders process without delays

- Requotes and slippage decrease significantly

For serious grid traders running capital they can’t afford to lose, professional infrastructure isn’t optional. It’s a baseline requirement.

Grid Trading Psychology

The mental challenge of grid trading differs from other strategies. Understanding these psychological pressures helps you manage them.

Watching Floating Losses Grow

Grid trading means accepting unrealized losses as part of normal operation. When price trends against you, floating losses accumulate across multiple positions. This is expected behavior, not a sign the strategy failed.

Many traders panic and close positions at maximum drawdown, right before the retracement that would have recovered losses. The discipline to hold through drawdown while the strategy works as designed is difficult.

Managing Expectations

Grid profits often come in small, consistent increments. You might make $50 per day for weeks, then face a $500 drawdown that takes days to recover. The equity curve looks jagged, not smooth.

If you expect linear growth, you’ll be disappointed. Grid trading produces episodic returns punctuated by drawdown periods. Accepting this pattern is essential for long-term success.

Automation as Discipline

Many traders run grid EAs specifically because automation removes emotional interference. The EA executes the plan without hesitation, fear, or greed. It doesn’t second-guess entries or close profitable positions early.

If you find yourself manually interfering with your grid EA’s operation, you’re undermining the systematic advantage. Either trust the system or don’t run it.

Is Grid Trading Profitable?

The honest answer: it can be, under the right conditions with proper risk management. But it’s not a guaranteed profit machine.

Grid trading profits in ranging markets and suffers during trends. Long-term profitability depends on:

- Choosing appropriate currency pairs

- Sizing positions conservatively

- Having sufficient capital to survive drawdowns

- Running 24/7 on reliable infrastructure

- Not interfering with the system during drawdowns

Backtesting shows many grid configurations produce positive returns over multi-year periods. However, those same backtests include drawdown periods of 30-50%. If you can’t emotionally or financially survive those drawdowns, the long-term returns are irrelevant.

Grid trading isn’t inherently profitable or unprofitable. It’s a tool that works in certain conditions and fails in others. Your job is recognizing which situation you’re in.

Getting Started with Grid Trading

If you’ve read this far and still want to explore grid trading, here’s a sensible approach:

- Demo first: Run your grid EA on a demo account for at least 3 months across different market conditions

- Start small: Begin with minimum lot sizes on a live account

- Choose one pair: Master grid trading on a single currency pair before expanding

- Set hard limits: Define maximum drawdown before you start, and honor it

- Use proper infrastructure: Deploy on a VPS from day one to ensure 24/7 operation

- Review monthly: Assess performance against expectations and adjust parameters if needed

Grid trading rewards patience, capital, and systematic execution. It punishes impatience, undercapitalization, and emotional interference. Know which category you fall into before committing real money.

Run Your Grid Strategy on Professional Infrastructure

Grid trading strategies require reliable infrastructure to operate effectively. Your EA needs to run continuously, execute orders without delay, and maintain connection to your broker around the clock.

A forex VPS provides the stability and speed that grid trading demands. With servers located in major financial hubs and sub-millisecond latency to popular brokers, you eliminate the infrastructure risks that can undermine even well-designed grid strategies.

If you’re serious about running grid EAs, professional hosting isn’t an upgrade. It’s a prerequisite for managing risk properly. Explore MT5 VPS options optimized for automated trading.

Frequently Asked Questions

What is the best grid spacing for forex trading?

Optimal grid spacing depends on your currency pair’s typical daily range. For EUR/USD, 20-30 pips works well. Wider spacing (40-50 pips) reduces trade frequency but survives trends better. Tighter spacing (10-15 pips) generates more profits in ranges but requires more capital for trend protection. Backtest different spacings on your specific pair.

How much capital do I need for grid trading?

Calculate based on your grid configuration’s maximum drawdown. A 10-level grid with 20-pip spacing and 0.01 lots needs approximately $1,000 to survive worst-case scenarios with adequate buffer. Larger lot sizes or more grid levels require proportionally more capital. Never trade a grid you can’t fully fund.

Can grid trading work without a stop loss?

Traditional grid trading doesn’t use per-position stop losses because the strategy expects temporary drawdowns. However, you should always have an account-level maximum drawdown limit. When floating losses exceed a predetermined percentage (typically 25-30%), close all positions. This prevents total account loss during extreme trends.

Is grid trading better than martingale?

Grid trading is generally safer than martingale because position sizes remain constant. Martingale’s doubling after losses creates exponential risk that can quickly exceed account equity. Grid drawdown is linear and calculable in advance. However, both strategies carry significant risk during sustained trends.

What’s the best time to run a grid EA?

Grid strategies often perform best during lower-volatility sessions like the Asian trading hours when major pairs tend to range. Avoid running grids during high-impact news releases, central bank announcements, or major economic data. Many grid EAs include news filters that pause operation during scheduled events.

Why do grid trading strategies fail?

Most grid failures result from undercapitalization, poor pair selection, or running during trending conditions. Traders often use lot sizes too large for their account, select volatile pairs prone to trending, or start grids right before major market-moving events. Success requires conservative sizing, appropriate pair selection, and market condition awareness.

Do professional traders use grid trading?

Some professional traders and funds incorporate grid elements into their strategies, typically with sophisticated risk management layers. However, pure grid trading is more common among retail traders using automated EAs. Professional implementations usually include trend filters, dynamic spacing adjustments, and strict drawdown limits that basic grid EAs lack.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.