Forex Tax Guide: How Traders File Taxes in the US, UK & EU

Learn how forex trading profits are taxed in the US (Section 988 vs 1256), UK (HMRC rules, spread betting), and EU. Covers record-keeping and common mistakes.

Why Forex Taxes Catch Traders Off Guard

You spent months refining your strategy, backtesting EAs, and optimizing your VPS setup. Then tax season hits and you realize you have no idea how to report your forex gains.

You’re not alone. Forex taxation is one of the most confusing areas in trading because rules vary wildly depending on where you live, what instruments you trade, and how your broker classifies your account. A spot forex trade in the US is taxed completely differently than a spread bet in the UK or a CFD position in Germany.

This guide breaks down exactly how forex trading profits are taxed in the three largest trading regions: the United States, the United Kingdom, and the European Union. We’ll cover the specific tax codes, filing requirements, deductible expenses (yes, your trading VPS counts), and the mistakes that trigger audits.

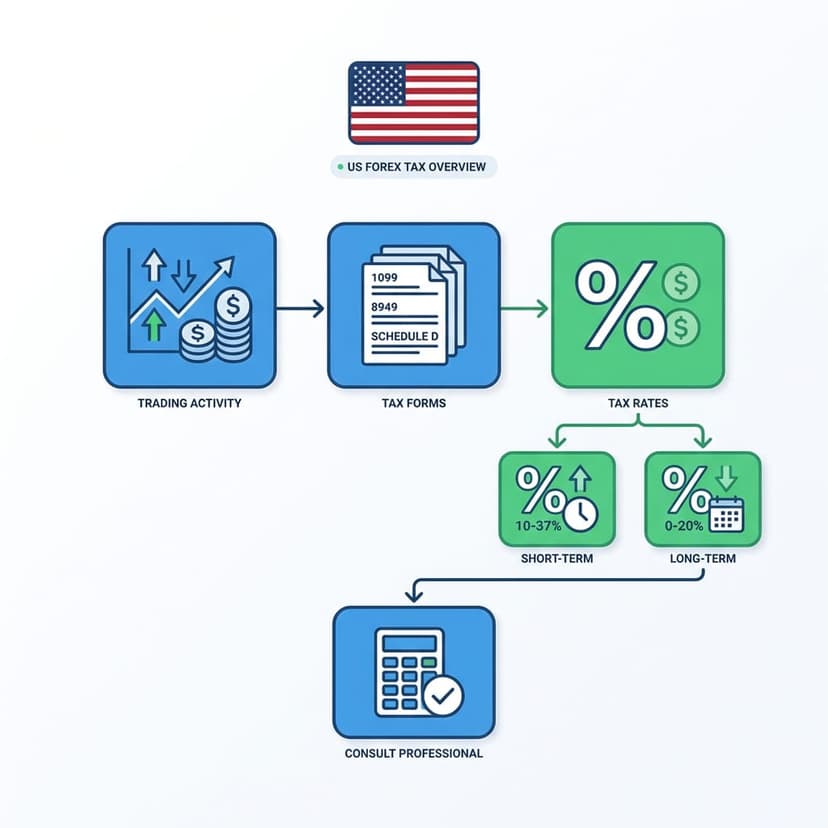

Forex Taxes in the United States

US forex taxation revolves around two Internal Revenue Code sections: Section 988 and Section 1256. Which one applies to you depends on what you trade and whether you make a proactive election.

Section 988: The Default for Spot Forex

If you trade spot forex (the standard pairs you see on MT4/MT5), you fall under Section 988 by default. This treats all gains and losses as ordinary income, taxed at your marginal rate between 10% and 37%.

The key characteristics of Section 988:

- Tax rate: Ordinary income rates (10%–37% for 2026)

- Loss treatment: Losses are fully deductible against other income (wages, business income) with no cap

- Reporting: Net gain or loss reported on Schedule 1 as “Other Income”

- No holding period distinction: It doesn’t matter if you held for 30 seconds or 30 days

Section 988 is actually advantageous if you had a losing year. Unlike capital losses (capped at $3,000 per year), Section 988 losses can offset your entire ordinary income. If you lost $20,000 trading forex and earned $80,000 at your job, you’d only pay tax on $60,000.

Section 1256: The 60/40 Election

Traders who want potentially lower tax rates can elect Section 1256 treatment. This applies automatically to regulated futures contracts and certain forex options, but spot forex traders can opt in by making a formal election.

Under Section 1256, your gains receive 60/40 treatment:

- 60% taxed as long-term capital gains (max 20%)

- 40% taxed as short-term capital gains (ordinary rates up to 37%)

- Blended maximum rate: Approximately 26.8% vs. 37% under Section 988

The catch? You must make this election before January 1 of the tax year or before you place your first trade. You can’t wait to see if you’re profitable and then choose retroactively. The election is made internally (no IRS form required), but you need to document it in your records.

Quick comparison: On $50,000 in forex profits, a trader in the 37% bracket would owe roughly $18,500 under Section 988 vs. $13,400 under Section 1256. That’s a $5,100 difference. But if you had losses instead, Section 988’s unlimited deduction against ordinary income is more valuable.

Which Section Should You Choose?

There’s no universal answer. Here’s a practical framework:

- Consistently profitable? Section 1256 likely saves you money with the 60/40 split

- New trader or inconsistent results? Stay with Section 988 for the unlimited loss deduction

- Trading futures or options? Section 1256 applies automatically

- Using a prop firm? Check your payout structure first; some are treated as contractor income (1099-NEC), not trading gains

US Filing Checklist

Here’s what you need to file correctly:

- Download your annual trading statement from your broker (Form 1099-B or equivalent)

- Calculate net gain or loss across all forex accounts

- For Section 988: Report on Schedule 1, Line 8z as “Other Income”

- For Section 1256: Report on Form 6781 and carry totals to Schedule D

- Keep your Section 1256 election documentation if applicable

- File by April 15 (or October 15 with extension)

Forex Taxes in the United Kingdom

The UK has one of the most trader-friendly tax environments in the world, but only if you’re using the right instrument.

Spread Betting: Tax-Free Trading

Spread betting profits are exempt from both Capital Gains Tax (CGT) and stamp duty in the UK. HMRC classifies spread betting as gambling, which means your gains aren’t taxable for most retail traders.

This is a significant advantage. A trader making GBP 30,000 per year from spread betting pays zero tax on those profits, while the same gains from CFD trading would be subject to CGT at 10% or 20% (depending on your income band).

Key points about spread betting tax exemption:

- No CGT: Profits are completely tax-free for most retail traders

- No stamp duty: You never take ownership of the underlying asset

- No reporting requirement: You don’t need to include spread betting on your Self Assessment

- Losses are not deductible: The flip side is you can’t offset spread betting losses against other taxable income

When Spread Betting Becomes Taxable

There is an exception. If HMRC determines that your spread betting activity constitutes a trade or business (not just a sideline), your profits could be subject to income tax. HMRC looks at several factors:

- Is spread betting your primary income source?

- Do you trade systematically with business-like organization?

- How much time do you spend on trading activity?

- Is the volume and frequency consistent with a professional operation?

There’s no specific threshold (like a number of trades), and HMRC assesses each case individually. Most retail traders running EAs on a trading VPS as a side activity won’t trigger this.

CFD Trading in the UK

If you trade forex through CFDs (Contracts for Difference) rather than spread bets, your profits are subject to Capital Gains Tax:

- CGT annual exempt amount: GBP 3,000 for 2026/27 tax year

- Basic rate taxpayers: 10% on gains above the exempt amount

- Higher/additional rate: 20% on gains above the exempt amount

- Losses are deductible: Can offset against other capital gains

CFD losses can be carried forward indefinitely to offset future gains, which is an advantage over spread betting where losses simply disappear.

UK Filing Checklist

- Determine if you traded via spread betting (tax-free) or CFDs (taxable)

- For CFDs: Calculate total gains and losses for the tax year (April 6 to April 5)

- Apply the CGT annual exempt amount (GBP 3,000)

- Report via Self Assessment (SA108 Capital Gains supplementary pages)

- File online by January 31 following the end of the tax year

- Keep records for at least 5 years after the filing deadline

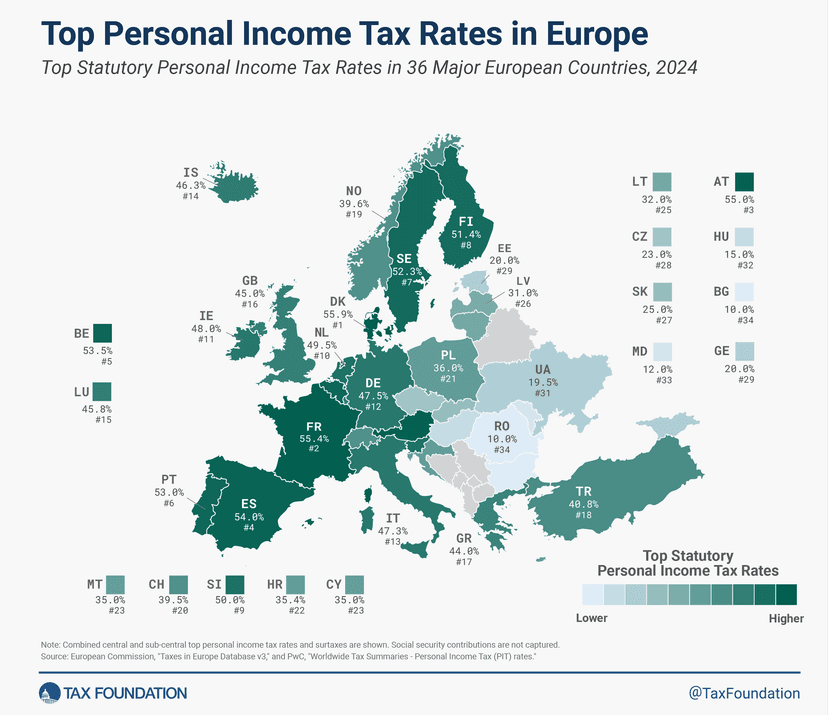

Forex Taxes in the European Union

There is no unified EU forex tax. Each member state sets its own rules. Here’s a breakdown of the major trading nations.

Country-by-Country Tax Rates

| Country | Tax Type | Rate | Key Notes |

|---|---|---|---|

| Germany | Flat capital gains tax | 26.375% | 25% + 5.5% solidarity surcharge. EUR 1,000 annual allowance |

| France | Flat tax (PFU) | 30% | 12.8% income tax + 17.2% social charges. Can opt for progressive scale |

| Netherlands | Wealth tax (Box 3) | ~1.2–1.6% | Taxed on assumed return, not actual gains. Benefits active traders |

| Italy | Substitute tax | 26% | Flat rate on capital gains. Losses carry forward for 4 years |

| Spain | Progressive CGT | 19–28% | 19% on first EUR 6,000, scaling up. Losses offset gains same year |

| Ireland | Capital Gains Tax | 33% | EUR 1,270 annual exemption. Must file by October 31 or mid-December |

| Belgium | Generally tax-free | 0% (usually) | Casual trading exempt. Professional/speculative trading may be taxed at 33% |

| Switzerland | Generally tax-free | 0% (usually) | Private trading gains exempt. Professional trader status triggers income tax |

Germany: Abgeltungsteuer (Flat Tax)

Germany applies a flat 25% capital gains tax (Abgeltungsteuer) plus a 5.5% solidarity surcharge on that amount, bringing the effective rate to 26.375%. Church tax members pay an additional 8–9%.

Key details for German traders:

- Sparerpauschbetrag: EUR 1,000 annual tax-free allowance (EUR 2,000 for married couples filing jointly)

- Guenstigerpruefung: If your marginal income tax rate is below 25%, you can apply for taxation at your personal rate instead

- Loss offsetting: Trading losses can only offset trading gains, not salary or business income

- Broker withholding: German brokers automatically withhold tax. Foreign brokers require you to self-report

France: Prelevement Forfaitaire Unique (PFU)

France levies a flat 30% tax on investment income, split between 12.8% income tax and 17.2% social contributions. This is the default for most retail traders.

However, you can opt for the progressive income tax scale (bareme progressif) if your marginal rate is below 12.8%. This choice applies to all your investment income for the year, so calculate carefully before electing.

Professional traders whose primary income comes from trading face a different regime entirely, with progressive rates up to 45% plus social charges.

Netherlands: The Box 3 System

The Netherlands doesn’t tax actual trading gains. Instead, it taxes an assumed return on your total assets under the Box 3 system. For 2026, the deemed return rates vary by asset class, and the tax rate on the deemed return is approximately 36%.

This is favorable for profitable traders (you pay the same tax regardless of how much you earn) but unfavorable for those with large account balances and small returns.

Deductible Expenses for Forex Traders

Regardless of your country, most tax authorities allow you to deduct legitimate trading expenses. These reduce your taxable income and can make a real difference to your bill.

Commonly Deductible Expenses

- VPS hosting: Your trading VPS subscription is a direct trading expense. If you’re running EAs 24/7 on a dedicated server, that cost is deductible

- Data feeds and market subscriptions: Bloomberg Terminal, TradingView Pro, real-time data feeds

- Trading software: EA licenses, indicators, custom development costs

- Education: Trading courses, books, conference fees (check your jurisdiction; some countries limit this)

- Internet and computer equipment: Proportional to trading use (e.g., if you use your internet 30% for trading, you can deduct 30%)

- Broker fees and commissions: These are typically factored into your cost basis automatically, but verify with your broker statement

- Accounting and tax software: The cost of preparing your trading tax return is itself deductible

Keeping Deduction Records

For any deduction to hold up, you need documentation. Keep invoices, receipts, and bank statements showing payment for every expense you claim. A folder with 12 months of VPS invoices is far more convincing to a tax inspector than “I had a server somewhere.”

Record-Keeping Best Practices

Good records are your best defense in an audit and your biggest time-saver at filing time. Here’s what to track.

Essential Records to Maintain

- Trade-by-trade log: Date, pair, direction, lot size, entry price, exit price, profit/loss. Your broker provides this, but download and store it independently

- Monthly and annual statements: Download from your broker at least quarterly. Brokers can shut down or change platforms, and you don’t want to scramble for records

- Expense receipts: VPS invoices, software licenses, data subscriptions, any trading-related purchase

- Tax election documentation: If you elected Section 1256 in the US, keep your written record with a timestamp

- Deposit and withdrawal history: Every fund movement in and out of your trading accounts

- Multi-account reconciliation: If you run EAs across multiple brokers, maintain a consolidated spreadsheet

Pro tip: Export your MT4/MT5 account history at the end of every month. Platforms can lose historical data during updates or migrations. A monthly export takes 30 seconds and could save you hours of reconstruction later. If you’re running algorithmic trading strategies, keep logs for every EA alongside your trade records.

How Long to Keep Records

| Country | Minimum Retention Period |

|---|---|

| United States | 3 years (6 years if underreporting suspected) |

| United Kingdom | 5 years after the January 31 filing deadline |

| Germany | 10 years for business-related records |

| France | 3 years from the year of assessment |

| General EU rule | 5–10 years depending on member state |

Common Tax Mistakes Forex Traders Make

Tax authorities have seen every mistake in the book. Avoid these to stay out of trouble.

1. Not Reporting at All

Some traders assume that because their broker doesn’t send a tax form (common with offshore brokers), they don’t need to report. Wrong. In every major jurisdiction, you are responsible for reporting your trading income regardless of whether you receive a formal tax document.

2. Mixing Personal and Trading Funds

Using the same bank account for groceries and margin deposits makes tracking nearly impossible. Open a dedicated bank account for trading fund flows. It simplifies record-keeping and looks far cleaner in an audit.

3. Ignoring Currency Conversion

If you trade in USD but file taxes in GBP or EUR, every deposit, withdrawal, and realized gain needs conversion at the prevailing exchange rate. Many traders forget this and end up with numbers that don’t reconcile. Use your central bank’s published rates for consistency.

4. Choosing the Wrong Tax Treatment (US)

Staying on Section 988 when you’re consistently profitable can cost thousands. Conversely, electing Section 1256 when you have heavy losses limits your deductions to $3,000 per year in capital losses. Review your expected performance before each tax year and elect accordingly.

5. Forgetting Multi-Broker Consolidation

If you run multiple EAs across different brokers, you still need to report the combined total. Authorities don’t care that you made $5,000 on one account and lost $3,000 on another. They care about the net result, and they expect you to calculate it correctly.

6. Missing Deadlines

Late filing triggers automatic penalties in most countries. In the US, it’s 5% of unpaid tax per month (up to 25%). In the UK, HMRC charges GBP 100 immediately for a late Self Assessment, rising to GBP 1,600+ after 12 months. Set calendar reminders well before the deadline.

When to Hire a Tax Professional

Self-filing works fine if you trade a single account in your home country with straightforward gains and losses. But consider professional help if:

- You trade across multiple jurisdictions or with offshore brokers

- You earned significant profits and need to optimize your tax position

- You’re considering trader tax status (US) or professional trader classification (EU)

- You use complex instruments (options on futures, currency swaps)

- You need to set up a trading entity (LLC, Ltd, GmbH)

A tax accountant who specializes in trading typically costs $500–$2,000 per year. Compared to the penalties for incorrect filing or the tax savings from proper structuring, it’s often worth the investment.

Frequently Asked Questions

Do I pay taxes on forex demo account profits?

No. Demo accounts use virtual money, so there are no real gains or losses to report. Taxes only apply to live trading accounts where real capital is at risk. You don’t need to track or report demo trading activity.

Can I deduct my forex VPS costs on my tax return?

Yes, in most jurisdictions. A trading VPS is a direct business expense related to generating trading income. Keep your monthly invoices and include them in your deductible expenses. In the US, this falls under Schedule C if you have trader tax status, or as an investment expense otherwise.

What happens if I trade forex and don’t report it?

Tax authorities can access broker records, bank transaction data, and cross-border information through agreements like FATCA (US) and CRS (global). Non-reporting can result in penalties, back taxes with interest, and in severe cases, criminal charges. It’s not worth the risk.

Is forex trading tax-free anywhere?

Some countries don’t tax personal trading gains. Belgium and Switzerland generally exempt casual forex traders. Malaysia, the UAE, and several Caribbean nations have no capital gains tax. UK spread betting is also tax-free for most retail traders. However, “tax-free” status often depends on not being classified as a professional trader.

How do I handle forex taxes with a prop firm?

Prop firm payouts are typically treated as contractor income, not trading gains. In the US, you’d receive a 1099-NEC and report it as self-employment income on Schedule C, subject to self-employment tax (15.3%). The tax treatment differs from personal trading accounts, so track prop firm income separately.

Do I need to report forex losses?

Yes, and you should. Reporting losses allows you to offset gains (current or future) and can reduce your overall tax bill. In the US under Section 988, losses offset ordinary income without any cap. In the UK, CFD losses carry forward indefinitely against future capital gains. Failing to report losses means you miss out on these deductions.

Does my broker’s location affect how I’m taxed?

Your tax residency determines how you’re taxed, not where your broker is based. A UK resident using an Australian broker still pays UK taxes on their gains. However, brokers in certain jurisdictions may not report to your home country’s tax authority, which makes self-reporting even more critical.

Stay Compliant and Keep More of Your Profits

Forex taxation isn’t simple, but it follows consistent logic once you understand the framework in your country. US traders should evaluate Section 988 vs. Section 1256 annually. UK traders should strongly consider spread betting for its tax advantages. EU traders need to check their specific country’s rules since rates and structures vary significantly.

The real savings come from two habits: maintaining clean records throughout the year and deducting every legitimate expense. Your trading infrastructure costs, from VPS hosting to data feeds, reduce your taxable income. A few hours of record-keeping each quarter prevents the scramble (and mistakes) that happen when you try to reconstruct a year’s worth of trades in April.

Check our forex VPS plans to ensure your automated strategies run 24/7 while you focus on what matters, including keeping the taxman happy.

About the Author

Thomas Vasilyev

Writer & Full Time EA Developer

Tom is our associate writer, and has advanced knowledge with the technical side of things, like VPS management. Additionally Tom is a coder, and develops EAs and algorithms.