Exness Review 2026: Spreads, Fees & Instant Withdrawals Tested

In-depth Exness review covering spreads from 0.0 pips, instant withdrawals, 209 instruments, and offshore regulation reality. Find out if Exness fits your trading style.

Is Exness the Right Broker for You?

Exness has grown into one of the largest retail forex brokers globally, processing over $3.8 trillion in monthly trading volume with nearly 700,000 active traders. Those numbers reflect more than a decade of building infrastructure around three core promises: ultra-low minimum deposits ($10), genuinely instant withdrawals, and one of the largest forex pair selections in the industry.

But there’s a significant trade-off that every potential client needs to understand upfront. Despite Exness holding FCA and CySEC licenses, retail traders don’t actually access those regulated entities. You’ll be onboarded under their Seychelles or South Africa subsidiaries, which means offshore regulation without European investor protection schemes.

The bottom line: Exness excels at what it promises—fast execution, competitive spreads, and withdrawals that actually arrive in minutes. If you prioritize trading conditions over Tier-1 regulation, Exness deserves serious consideration. If regulatory protection is non-negotiable, look elsewhere.

This review covers everything you need to make an informed decision: account types and their true costs, platform options for different trading styles, the regulatory reality behind the marketing, and practical insights on deposits, withdrawals, and execution quality.

Exness at a Glance

| Category | Details |

|---|---|

| Founded | 2008 |

| Headquarters | Limassol, Cyprus |

| Regulation | FCA, CySEC (Tier-1, B2B only), FSA Seychelles, FSCA South Africa (Tier-2/3, retail) |

| Minimum Deposit | $10 (Standard), $200 (Professional) |

| Typical Spreads | 0.0-0.6 pips EUR/USD (account dependent) |

| Commission | $0 (Standard/Pro), $7/lot RT (Raw Spread) |

| Platforms | MT4, MT5, Exness Terminal, Exness Trade App |

| Total Instruments | 209 (96 forex pairs, 10 crypto CFDs, 90+ stocks) |

| Trustpilot Rating | 4.8/5 (25,700+ reviews, 89% five-star) |

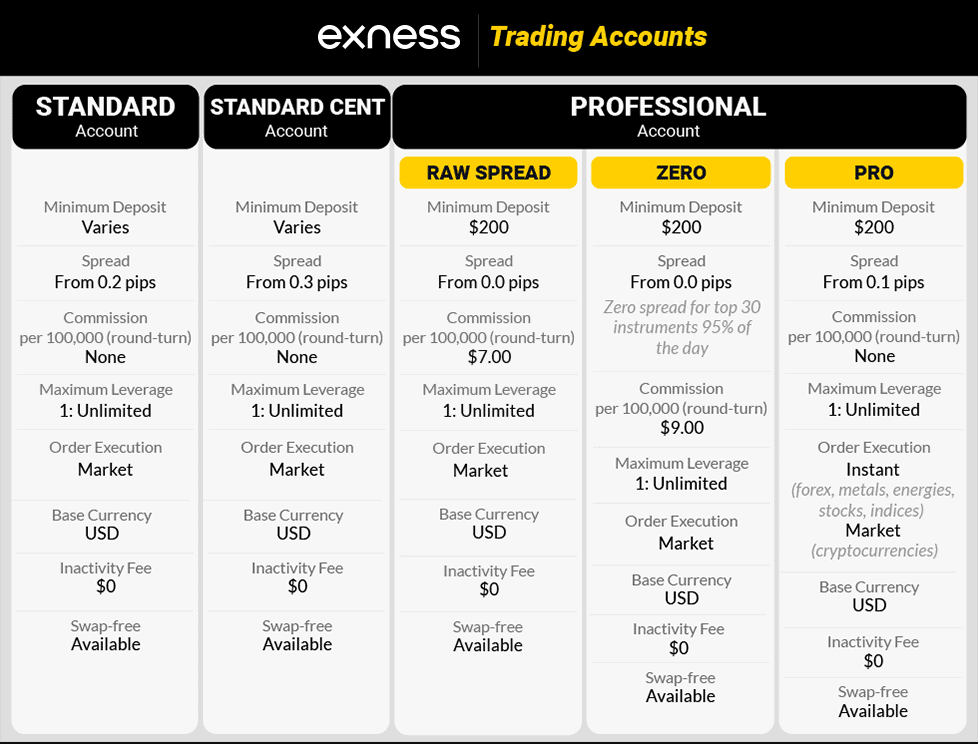

Account Types: Finding Your Fit

Exness structures its accounts into two tiers: Standard accounts for beginners and casual traders, and Professional accounts for active traders who need tighter spreads. Understanding the differences matters because the trading costs vary significantly between them.

Standard Accounts

Standard Account: The flagship option for most traders starting out. With just $10, you can open a live account and access all available instruments. Spreads start from 0.3 pips on EUR/USD with zero commission. Execution is instant, meaning your orders fill at the price you see (or you get a requote). This account works well for swing traders, position traders, and anyone who isn’t hyper-focused on minimizing spread costs.

Standard Cent Account: Functionally identical to the Standard account, but trades execute in cents rather than dollars. A 1-lot trade represents 1,000 units instead of 100,000. This account is designed for traders who want to test strategies with real money but minimal risk, or for running micro-lot Expert Advisors where a blown account costs dollars rather than hundreds.

Professional Accounts

Pro Account: Requires $200 minimum deposit but delivers spreads from 0.1 pips with no commission. Still uses instant execution. For most active traders, this represents the best value—you get tight spreads without paying per-lot fees. The math works out better than Raw Spread for traders doing fewer than 10+ lots daily.

Raw Spread Account: The choice for scalpers and algorithmic traders. Spreads drop to 0.0 pips, but you pay $3.50 per lot per side ($7 round-turn). Market execution means no requotes—your order fills at the next available price. If you’re running high-frequency strategies where every pip matters, Raw Spread is the logical choice. Traders using a forex VPS for automated trading often prefer this account type for its raw pricing model.

Zero Account: Guarantees 0.0 pip spreads on the top 30 instruments for 95% of the trading day. Commission varies by instrument, ranging from $3.50 to $8 per lot. This account targets traders who need predictable spread costs for specific pairs and don’t mind paying variable commission.

Account Comparison Table

| Account | Min. Deposit | EUR/USD Spread | Commission | Execution | Best For |

|---|---|---|---|---|---|

| Standard | $10 | From 0.3 pips | None | Instant | Beginners, swing traders |

| Standard Cent | $10 | From 0.3 pips | None | Instant | Strategy testing, micro trading |

| Pro | $200 | From 0.1 pips | None | Instant | Active traders, day traders |

| Raw Spread | $200 | From 0.0 pips | $7/lot RT | Market | Scalpers, algo traders |

| Zero | $200 | 0.0 pips* | $3.50-$8/lot | Market | Traders needing fixed spreads |

*Zero spreads available on top 30 instruments for 95% of trading hours.

Non-Trading Fees

Exness keeps its fee structure refreshingly straightforward:

- Deposit fees: None from Exness (payment provider fees may apply)

- Withdrawal fees: None—Exness often absorbs third-party transaction costs

- Inactivity fee: None, regardless of how long your account sits dormant

- Currency conversion: Small fee when trading or funding in a different base currency

- Swap-free accounts: Available on most instruments for eligible traders

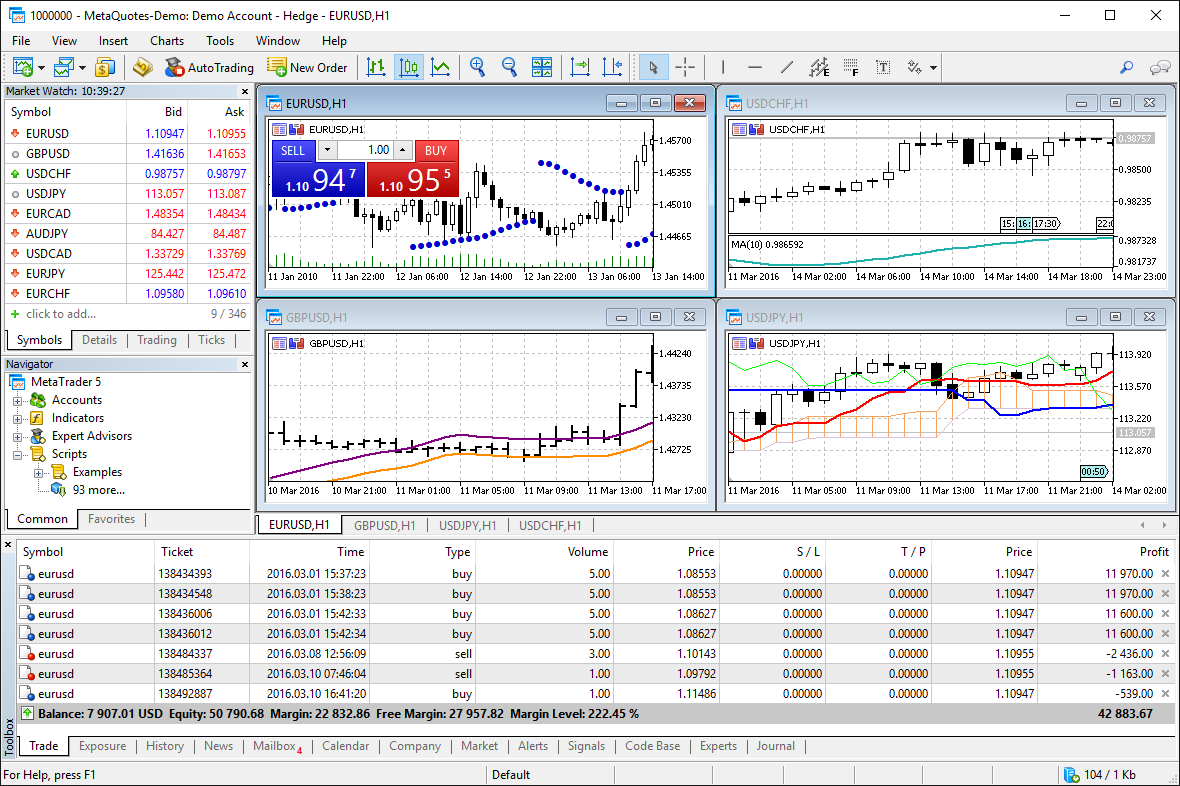

Trading Platforms: MT4, MT5, and Proprietary Options

Exness supports the industry-standard MetaTrader suite alongside its own proprietary platforms. Your trading style and technical requirements will determine which platform fits best.

MetaTrader 4

MT4 remains the workhorse for retail forex traders. Exness offers it across desktop, web, and mobile. You get 9 timeframes, 30 built-in indicators, and full Expert Advisor support. The platform shows its age compared to newer alternatives, but the ecosystem of custom indicators and robots is unmatched. If you’re running legacy EAs or prefer a familiar interface, MT4 delivers what you need.

For traders running EAs 24/7, connecting MT4 to a dedicated Exness VPS ensures your strategies execute even when your home computer is off. The combination of Exness’s fast execution and a low-latency VPS can reduce slippage on automated entries.

MetaTrader 5

MT5 expands on its predecessor with 21 timeframes, 38 indicators, a built-in economic calendar, and depth of market display. The backtesting engine is significantly more powerful for strategy development. Exness provides MT5 across all account types. For new traders without existing MT4 dependencies, MT5 is generally the better starting point.

Exness Terminal

Exness’s proprietary web platform integrates TradingView charts with a streamlined interface. It strips away MetaTrader’s complexity in favor of clean execution and innovative features like drag-to-modify orders. The platform only supports MT5 accounts and lacks automated trading features, but for manual traders who want modern aesthetics without installing software, it’s a solid option.

Exness Trade App

The mobile app handles account management, deposits, withdrawals, and position monitoring. In-app trading works for MT5 accounts; MT4 users get redirected to the standard MetaTrader mobile app. The app’s strength is account administration on the go rather than active trading.

Execution Quality and Slippage

Exness claims to be among the most precise execution providers in the market, particularly for gold, oil, and crypto CFDs. The broker publishes average slippage statistics, showing that the majority of orders fill at or better than the requested price during normal market conditions.

For scalpers and news traders, execution speed matters enormously. Exness reports order execution times averaging under 25 milliseconds on their professional accounts. This speed advantage becomes meaningful when combined with a properly configured VPS—the difference between filling at your target price versus experiencing slippage can add up significantly over hundreds of trades.

Slippage tends to increase during high-volatility events like major economic releases. During NFP or central bank announcements, even the best brokers can’t guarantee fills at exact prices. Exness handles this through market execution on Raw Spread and Zero accounts—you get filled at the next available price rather than receiving requotes.

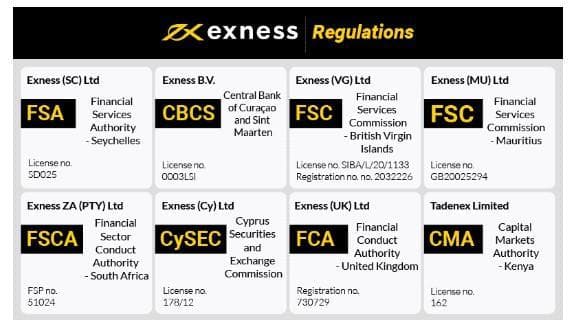

The Regulation Reality: What You’re Actually Signing Up For

Exness’s regulatory structure requires careful attention. The broker holds licenses from multiple authorities, but the entity you trade under depends on where you live—and most retail traders won’t access the top-tier regulators.

Exness Regulatory Entities

| Entity | Regulator | Tier | Retail Access? |

|---|---|---|---|

| Exness (UK) Ltd | FCA (United Kingdom) | Tier-1 | No — B2B/institutional only |

| Exness (Cy) Ltd | CySEC (Cyprus) | Tier-1 | No — B2B/institutional only |

| Exness (SC) Ltd | FSA (Seychelles) | Tier-3 | Yes — primary retail entity |

| Exness ZA (Pty) Ltd | FSCA (South Africa) | Tier-2 | Yes — some regions |

What this means for you: When you sign up as a retail trader, you’ll almost certainly be onboarded under the Seychelles (FSA) entity. The FCA and CySEC licenses look impressive in marketing materials, but they serve institutional clients only. You won’t get access to the Financial Services Compensation Scheme or European investor protections.

Is this a dealbreaker? That depends on your priorities. Exness has operated since 2008 without major regulatory scandals. Their Trustpilot rating of 4.8/5 with over 25,700 reviews suggests clients are generally satisfied. The broker also maintains segregated client accounts and provides negative balance protection. But if Tier-1 regulation is essential to your peace of mind, Exness isn’t the right fit.

What Can You Trade? 209 Instruments Breakdown

Exness offers a solid instrument selection with particular strength in forex. Here’s what’s available across asset classes:

Forex (96 Pairs)

The forex selection is one of Exness’s standout features. You get 7 major pairs, 25+ minor pairs, and 60+ exotic pairs—more than most competitors offer. If you trade beyond EUR/USD and GBP/USD, this variety matters. Exotic pairs like USD/ZAR, EUR/TRY, and USD/THB are available with reasonable spreads.

Cryptocurrencies (10 CFDs)

Crypto CFDs include majors like BTC, ETH, and LTC alongside other popular tokens. The selection is narrower than dedicated crypto exchanges, but adequate for forex traders who want occasional crypto exposure. A notable advantage: crypto trades are available with swap-free options, making Exness competitive for crypto-curious forex traders who don’t want a separate exchange account.

Leverage on crypto CFDs is more conservative than forex—typically capped at 1:200 for BTC and ETH, lower for altcoins. This aligns with the higher volatility of crypto markets. Trading hours are 24/7, matching the underlying crypto market schedule rather than forex session hours.

Stocks (90+ CFDs)

Stock CFDs cover major US companies including Apple, Tesla, Amazon, Nvidia, and Meta. The selection focuses on large-cap tech and consumer names rather than comprehensive market coverage. If stock CFDs are your primary interest, some competitors offer broader selections.

Stock CFD trading hours follow the underlying exchange schedule—US stocks trade during NYSE/NASDAQ hours. Leverage on stock CFDs is typically capped at 1:20, reflecting the higher volatility compared to major forex pairs. Dividends are credited or debited to your account based on your position direction.

Indices and Commodities

Major global indices are available: US500, NAS100, US30, GER40, UK100, and JP225 among others. Commodity coverage includes gold, silver, platinum, palladium, crude oil (WTI and Brent), and natural gas. The metals spreads are particularly competitive—XAUUSD averages around 11.2 pips during normal market conditions.

Notable gaps: No ETFs, no agricultural commodities, and no bonds. If you need these asset classes, you’ll need an additional broker relationship.

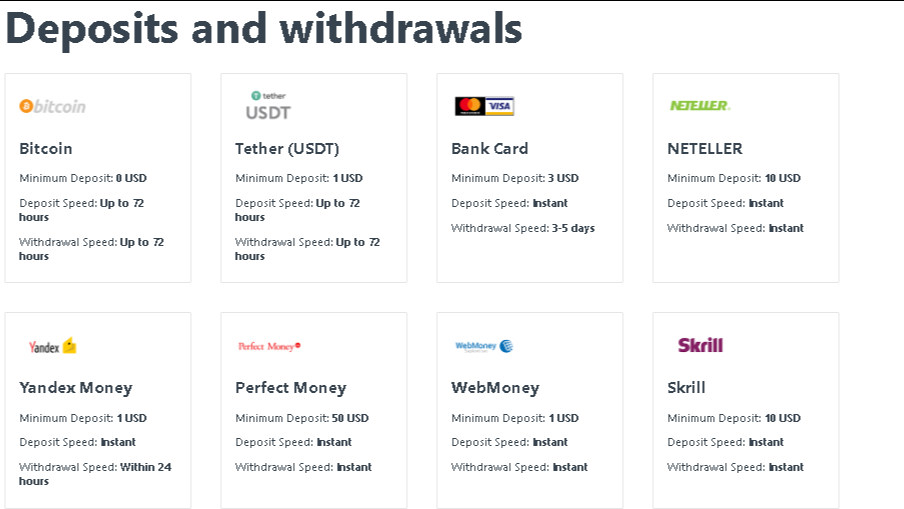

Deposits and Withdrawals: The Speed Test

Withdrawal speed is genuinely one of Exness’s competitive advantages. This isn’t marketing fluff—the infrastructure is built for fast processing.

Deposit Methods

- Credit/Debit Cards: Visa, Mastercard — instant processing

- E-Wallets: Skrill, Neteller, Perfect Money, WebMoney — instant

- Cryptocurrencies: Bitcoin, USDT — network confirmation dependent

- Bank Transfers: 1-3 business days

- Local Methods: Varies by region (UPI in India, M-Pesa in Africa, etc.)

No deposit fees from Exness. Some payment providers charge their own fees, but Exness doesn’t add markup.

Withdrawal Processing

Exness processes over 98% of withdrawals automatically without manual review. E-wallet and crypto withdrawals typically complete within minutes—many traders report receiving funds in under 3 minutes. This isn’t typical in the industry where “instant” often means 24 hours.

Bank card withdrawals take 3-5 business days due to banking system processing, not Exness delays. Wire transfers follow similar timelines. Withdrawals process 24/7, including weekends and holidays.

Potential Withdrawal Complications

Some traders report withdrawal complications in certain scenarios:

- Insufficient trading volume: Depositing and immediately withdrawing without trading may trigger anti-money-laundering reviews

- Additional KYC requests: Some users report being asked for extra verification documents mid-withdrawal

- Third-party deposit issues: Funds deposited from another person’s account may be flagged

These appear to be compliance measures rather than bad-faith delays, but the communication could be clearer. Trade normally and withdraw your own funds, and you shouldn’t encounter problems.

Leverage and Margin: The Unlimited Option

Exness offers one of the most flexible leverage structures in the industry, including its controversial “unlimited” leverage option. Understanding the tiers is crucial for risk management.

Leverage Structure

| Account Equity | Maximum Leverage |

|---|---|

| Under $1,000 | Unlimited (up to 1:2000000) |

| $1,000 – $4,999 | 1:2000 |

| $5,000 – $29,999 | 1:1000 |

| $30,000+ | 1:500 |

Unlimited Leverage Requirements

To access unlimited leverage, you must meet specific conditions:

- Account equity under $1,000

- At least 10 closed positions (excluding pending orders)

- Minimum 5 lots traded total across closed positions

This feature suits experienced traders testing strategies with small capital, but it’s a double-edged sword. The potential for rapid account destruction is real. Exness provides negative balance protection, so you can’t lose more than your deposit, but you can lose your deposit very quickly with unlimited leverage.

Leverage During News Events

Exness automatically reduces leverage during high-impact news events and low-liquidity periods. Around major economic releases like NFP or FOMC announcements, leverage may drop to 1:200 regardless of your account settings. This protects both the broker and traders from gap risk during extreme volatility. The automatic adjustments revert to normal leverage approximately 15 minutes after the news release.

Weekend gaps present similar considerations. Positions held over the weekend may face temporarily reduced leverage as markets approach Friday close. Understanding these automatic adjustments prevents unexpected margin calls when volatility spikes.

VPS Hosting and Automated Trading

For traders running Expert Advisors or automated strategies, execution infrastructure matters as much as spreads. Exness addresses this with a free VPS offering and seamless platform integration.

Free VPS from Exness

Exness provides free VPS hosting to qualifying clients. The requirements are reasonable:

- Minimum $500 account balance, OR

- Monthly trading volume of 10+ lots

The free VPS runs on Windows Server with MT4/MT5 pre-installed. Server locations include New York, London, and Amsterdam. For basic EA operation, it’s adequate. However, the shared resources mean performance can degrade during high-activity periods.

Dedicated VPS Alternative

Serious algorithmic traders often prefer dedicated VPS solutions for guaranteed resources and lower latency. A dedicated MT5 VPS with 1ms latency to major brokers can improve fill rates and reduce slippage on time-sensitive strategies. The cost difference between free and paid VPS typically pays for itself in execution quality improvements.

Swap-Free Trading

Exness offers swap-free accounts for traders who cannot receive or pay interest due to religious beliefs or personal preference. The swap-free feature is available on most instruments, including forex majors, minors, and popular commodities. Unlike some brokers who add administrative fees to compensate for lost swap revenue, Exness keeps most swap-free instruments genuinely fee-free for positions held overnight.

To activate swap-free trading, you’ll need to request it through your account settings. Eligibility may depend on your region and account type. Some instruments remain subject to standard swap rates even with swap-free enabled, so check the specific terms for your preferred pairs.

Customer Support and Education

Exness provides 24/7 multilingual support across multiple channels. Response times are generally fast, especially via live chat.

Support Channels

- Live Chat: Available 24/7 with typical response under 2 minutes

- Email: Response within 24 hours

- Phone: Available in 14 languages

- Help Center: Comprehensive FAQ and documentation

Educational Resources

The Exness Insights blog covers market analysis and trading concepts. The educational content has improved over the years but still lags behind some competitors. If deep educational resources are a priority, supplement with external learning platforms.

Social Trading

Exness offers a social trading feature that allows less experienced traders to copy strategies from successful traders. Strategy providers share their trading performance, and followers can allocate capital to automatically replicate their trades. The platform shows historical performance, risk metrics, and follower counts for each strategy.

Commission structures vary by strategy provider—some take a percentage of profits, others charge fixed fees. Social trading can work well for passive investors, but remember that past performance doesn’t guarantee future results. The most-copied strategies aren’t necessarily the most profitable long-term.

Where Exness Falls Short

No broker is perfect. Here’s where Exness underperforms compared to top-tier alternatives:

- Offshore regulation for retail: Despite FCA/CySEC licenses, retail traders access Tier-3 entities only

- Limited product range: 209 instruments is adequate but narrow compared to brokers offering 1,000+

- No US or EU retail access: American and European traders cannot open accounts

- Research content: Market analysis and research tools are basic compared to premium brokers

- Crypto selection: Only 10 crypto CFDs versus 30+ at crypto-focused competitors

Who Should Trade with Exness?

After analyzing the complete offering, here’s who benefits most from Exness:

Exness Is a Strong Choice For:

- Active forex traders: The 96-pair selection and tight spreads on professional accounts reward high-volume trading

- Scalpers and algo traders: Raw Spread accounts with 0.0 pip spreads and market execution suit high-frequency strategies

- Traders who value withdrawal speed: If getting your money quickly matters, Exness delivers

- Budget-conscious beginners: $10 minimum deposit removes capital barriers to entry

- Emerging market traders: Strong presence in Asia, Africa, and Latin America with localized payment options

Look Elsewhere If You Need:

- Tier-1 regulation: EU/UK traders seeking FSCS protection should consider FCA-regulated retail alternatives

- Broad asset coverage: Stock traders wanting comprehensive equity access need a more diversified broker

- US market access: Exness doesn’t accept US residents

- Premium research: Traders relying on broker-provided analysis should look at research-focused platforms

The Final Verdict on Exness

Exness has built its reputation on execution quality and operational efficiency. The instant withdrawals work as advertised. The spreads on professional accounts compete with any broker in the market. The platform selection covers most trading styles. And the 17-year track record without major regulatory issues provides reasonable confidence in the operation.

The regulation situation requires honest assessment. You’re trading under Seychelles oversight, not FCA or CySEC. If that’s acceptable given the trading conditions, Exness delivers excellent value. If it’s not, there are Tier-1 regulated alternatives—though typically with higher spreads or more restrictive conditions.

For forex-focused traders in regions where Exness operates, and who prioritize trading conditions over regulatory jurisdiction, Exness earns a solid recommendation. Open a Standard account with minimal capital, test the execution and withdrawal speeds yourself, and scale up if it meets your needs.

Frequently Asked Questions

What is the minimum deposit for Exness?

Standard and Standard Cent accounts require just $10 to open. Professional accounts (Pro, Raw Spread, Zero) require a $200 minimum deposit. There are no deposit fees from Exness regardless of account type.

Is Exness regulated by the FCA?

Exness holds an FCA license through Exness (UK) Ltd, but this entity serves institutional clients only. Retail traders are onboarded under the Seychelles (FSA) or South Africa (FSCA) entities, which provide less regulatory protection than UK authorization.

How fast are Exness withdrawals really?

E-wallet withdrawals (Skrill, Neteller, etc.) typically complete within minutes—often under 3 minutes. Over 98% of withdrawals process automatically without manual review. Bank card and wire transfer withdrawals take 3-5 business days due to banking system processing times.

Does Exness support Expert Advisors?

Yes. Exness fully supports automated trading through MT4 and MT5 Expert Advisors. There are no restrictions on EA strategies or trading styles. The broker also offers free VPS hosting for accounts with $500+ balance or 10+ monthly traded lots.

What are the spreads on Exness Raw Spread accounts?

Raw Spread accounts offer spreads starting from 0.0 pips on major pairs like EUR/USD. You pay a $3.50 commission per lot per side ($7 round-turn). The combination of raw spreads plus commission typically results in lower total costs for high-volume traders.

Can US residents use Exness?

No. Exness does not accept clients from the United States. American traders need to use CFTC-regulated brokers such as OANDA, IG, or Forex.com for retail forex trading.

Is Exness safe to trade with?

Exness has operated since 2008 without major regulatory actions or fraud allegations. The broker maintains segregated client accounts, provides negative balance protection, and holds PCI DSS certification for payment security. However, retail clients trade under offshore regulation, which offers less investor protection than Tier-1 jurisdictions.

What platforms does Exness offer?

Exness supports MetaTrader 4, MetaTrader 5, the proprietary Exness Terminal (web-based with TradingView charts), and the Exness Trade mobile app. All platforms are available across desktop, web, and mobile devices.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.