BlackBull Markets Review 2026: Spreads, Fees & Verdict

Honest BlackBull Markets review covering ECN spreads from 0.0 pips, FMA regulation, MT4/MT5/cTrader platforms, and 26,000+ instruments. Read before you trade.

BlackBull Markets at a Glance

BlackBull Markets is a New Zealand-based ECN broker that’s carved out a solid reputation since launching in 2014. Headquartered in Auckland and regulated by the Financial Markets Authority (FMA), the broker positions itself as a bridge between retail traders and institutional-grade execution.

What sets BlackBull apart from the crowd? Three things: raw ECN spreads starting at 0.0 pips, Equinix server infrastructure in NY4 and LD5, and a platform lineup that includes MT4, MT5, cTrader, and TradingView. That’s a combination you won’t find at most brokers in this price range.

With over 26,000 tradeable instruments, three account tiers, and copy trading integrations through ZuluTrade and Myfxbook, BlackBull caters to everyone from beginner forex traders to algorithmic scalpers running multiple EAs on a VPS. But no broker is perfect. Let’s dig into the details.

Regulation and Safety

Trust matters when you’re handing over capital to a broker. BlackBull Markets operates under two regulatory licenses, and they’re worth understanding before you fund an account.

FMA Regulation (New Zealand)

BlackBull’s primary regulator is the Financial Markets Authority of New Zealand. The FMA is a Tier 1 regulator, meaning it enforces strict compliance standards including segregated client funds, regular audits, and dispute resolution mechanisms. BlackBull received its Derivatives Issuer license from the FMA in 2020.

For traders based in New Zealand, this means your funds sit in segregated bank accounts, separate from BlackBull’s operating capital. If the broker goes under, your money is ring-fenced.

FSA Regulation (Seychelles)

International clients outside New Zealand trade through BlackBull’s Seychelles entity, regulated by the Financial Services Authority (FSA). This is a Tier 4 regulator, which offers significantly lighter protections. No investor compensation scheme. No guaranteed negative balance protection for all account types.

This is the trade-off. You get access to higher leverage (up to 1:500) through the Seychelles entity, but with less regulatory oversight. If you value regulatory protection above leverage flexibility, this is something to weigh carefully.

Fund Safety

BlackBull states that all client funds are held in segregated accounts with major banking partners. The broker also offers negative balance protection, so your account can’t go below zero during extreme volatility events. These are standard practices, but they’re important ones.

Account Types and Minimum Deposits

BlackBull Markets offers three ECN-powered account tiers. Each uses STP/NDD execution with no dealing desk intervention. Here’s how they compare:

| Feature | ECN Standard | ECN Prime | ECN Institutional |

|---|---|---|---|

| Minimum Deposit | $0 | $0 | $20,000 |

| Spreads From | 0.8 pips | 0.0 pips | 0.0 pips |

| Commission | $0 | $6 per lot RT | $4 per lot RT |

| Execution | ECN/STP | ECN/STP | ECN/STP |

| Max Leverage | 1:500 | 1:500 | 1:500 |

ECN Standard Account

The Standard account is commission-free with spreads starting from 0.8 pips. No minimum deposit requirement makes this the lowest barrier to entry. It’s designed for newer traders or those who prefer simpler cost structures without per-trade commissions.

The trade-off is wider spreads. On EUR/USD, you’ll typically see 0.8-1.2 pips during active sessions. For swing traders and position holders, this is fine. For scalpers, it’ll eat into your edge.

ECN Prime Account

The Prime account is where things get interesting. Spreads drop to 0.0 pips with a $6 round-turn commission per standard lot. Following a spread reduction in 2025, the EUR/USD now averages around 0.16 pips, and gold averages 0.12 pips. That puts BlackBull’s Prime account in competitive territory against most ECN brokers.

The minimum deposit was recently reduced to $0, removing a previous barrier. For active traders running EAs or scalping strategies on a trading VPS, the Prime account offers the best balance of cost and execution quality.

ECN Institutional Account

The Institutional account requires $20,000 minimum and drops the commission to $4 per round-turn lot. Spreads start at 0.0 pips with negotiable terms for high-volume traders. This tier is designed for fund managers, proprietary trading firms, and serious retail traders moving significant volume.

Islamic (Swap-Free) Account

BlackBull also offers swap-free accounts compliant with Islamic finance principles. These are available across all three account tiers, with positions held overnight not incurring swap charges. There may be administrative fees on certain instruments for extended holds.

Trading Platforms

Platform selection is one of BlackBull’s strongest cards. The broker supports four major platforms, giving traders genuine flexibility rather than forcing everyone into a single ecosystem.

MetaTrader 4 (MT4)

MT4 remains the most popular retail forex platform globally, and BlackBull’s implementation is solid. You get the full feature set: 30+ technical indicators, 9 timeframes, one-click trading, and full Expert Advisor support. The platform connects to BlackBull’s ECN liquidity through optimized server infrastructure.

For EA traders, MT4 on BlackBull is a strong choice. The broker’s Equinix NY4 and LD5 server locations mean your orders route through the same data centers used by institutional players. If you’re running your EA on an MT4 VPS in the same facility, execution latency drops to sub-millisecond levels.

MetaTrader 5 (MT5)

MT5 expands on MT4 with 21 timeframes, 38 built-in indicators, an integrated economic calendar, and the MQL5 programming language for more sophisticated EAs. It also supports hedging and netting account modes, giving you more flexibility in position management.

BlackBull’s MT5 offering includes access to the full instrument range, including stocks and commodities that aren’t available on MT4. If you trade across multiple asset classes, MT5 is the better choice.

cTrader

cTrader is the platform of choice for traders who prioritize transparency and advanced order execution. BlackBull’s cTrader integration provides Level II pricing (depth of market), detachable charts, and cTrader Automate for algorithmic trading in C#.

The platform’s execution reporting is excellent. You can see exact fill prices, slippage data, and execution times for every order. This level of transparency helps you verify that your broker is actually delivering ECN execution.

TradingView

BlackBull’s TradingView integration lets you trade directly from TradingView’s charting platform. You get access to 100+ indicators, 50+ drawing tools, and 12 chart types, all connected to your live BlackBull account. This is a genuine advantage for traders who rely on TradingView for technical analysis but previously had to place orders separately.

Mobile Trading

All four platforms offer mobile versions for iOS and Android. The MT4 and MT5 mobile apps are standard MetaQuotes builds, while cTrader’s mobile app is widely regarded as one of the best in the industry. TradingView’s mobile experience is equally strong, with full charting capability on the go.

Spreads, Fees, and Trading Costs

Let’s break down what you’ll actually pay to trade with BlackBull Markets. Cost structure varies significantly between account types, so understanding the real numbers matters.

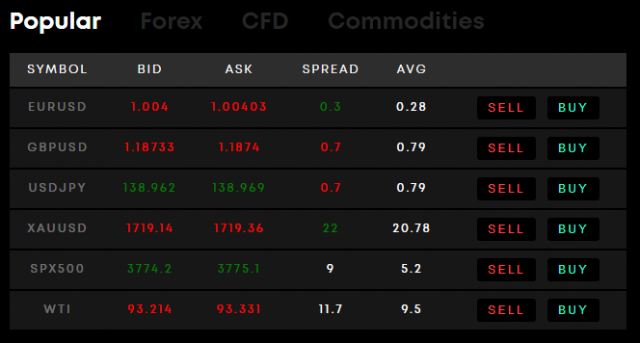

Forex Spreads

On the Prime account, typical EUR/USD spreads sit around 0.16 pips during London and New York sessions. GBP/USD averages roughly 0.3 pips, and USD/JPY comes in around 0.2 pips. Add the $6 round-turn commission ($3 per side), and your all-in cost on EUR/USD is approximately $7.60 per standard lot.

On the Standard account, the same EUR/USD trade costs around $8-12 per lot through the wider spread, with no commission on top. For most traders, the Prime account works out cheaper once you factor in the tighter spreads.

Non-Trading Fees

BlackBull charges no deposit fees regardless of method. Withdrawals carry a flat $5 fee, which is on the higher side compared to brokers offering free withdrawals. There’s no inactivity fee, which is a plus for traders who take breaks between active trading periods.

Cost Tip: The Prime account’s all-in cost of ~$7.60 per standard lot on EUR/USD puts BlackBull in the competitive range for ECN brokers. However, the $5 withdrawal fee adds up if you withdraw frequently. Consider consolidating withdrawals to minimize this cost.

Swap Rates

Swap rates are standard for the industry. BlackBull calculates overnight financing using interbank rates plus a markup. Swap-free accounts are available for traders who need to avoid overnight charges, though administrative fees may apply on some instruments.

Instruments and Markets

BlackBull’s instrument selection is massive. With 26,000+ tradeable symbols, the broker offers one of the widest market ranges available. Here’s what’s on the menu:

Forex

Over 64 currency pairs spanning majors, minors, and exotics. The major pairs get the tightest spreads on ECN accounts, while exotic pairs carry wider spreads and higher swap costs. Standard forex offering, but well-covered.

Stocks and Equities

This is where BlackBull really stands out. The broker offers 26,000+ share CFDs covering US, European, and Asian markets. You can trade Apple, Tesla, NVIDIA, and thousands of other global stocks as CFDs. This is a significantly larger selection than most forex-focused brokers offer.

Indices

Major global indices including US30 (Dow Jones), S&P 500, NAS100 (Nasdaq), FTSE 100, DAX 40, and more. Spreads are competitive on the major indices, though less-traded indices carry wider costs.

Commodities

Gold, silver, platinum, crude oil, natural gas, and agricultural commodities are all available. Gold spreads on the Prime account average around 0.12 pips, which is competitive. Oil spreads are also tight during peak sessions.

Cryptocurrencies

BlackBull offers 22 cryptocurrency pairs including BTC/USD, ETH/USD, and other major tokens. Leverage goes up to 1:100 on crypto, which is higher than many regulated brokers offer. Crypto trading is available 24/7, including weekends.

Execution Quality and Infrastructure

Execution quality separates good brokers from great ones. BlackBull Markets has invested heavily in infrastructure, and it shows.

Equinix Server Locations

BlackBull operates servers in Equinix NY4 (New York) and Equinix LD5 (London). These are the same data centers used by major banks, hedge funds, and institutional market makers. For traders using a VPS located in the same facility, this means order routing measured in microseconds rather than milliseconds.

If you’re running automated strategies or scalping, server co-location matters. A trading VPS positioned in NY4 or LD5, connected to BlackBull’s servers in the same building, eliminates network latency as a variable in your execution quality. To understand why this matters, read our guide on what a forex VPS is and how it optimizes your trading.

Execution Speed

BlackBull reports average order execution speeds under 75 milliseconds. The broker aggregates liquidity from 66+ providers, creating deep order books for major instruments. During normal market conditions, slippage is minimal on ECN accounts.

That said, execution during high-impact news events follows standard patterns. Spreads widen, liquidity thins, and slippage increases. No ECN broker can avoid this entirely. What matters is how quickly conditions normalize, and BlackBull’s multi-provider liquidity pool helps here.

VPS Hosting for BlackBull Traders

Running EAs, copy trading bots, or automated strategies on BlackBull requires a stable, always-on connection. Your home internet going down at 3 AM means missed trades and broken logic chains. A dedicated trading VPS solves this by keeping your platform running 24/7 with sub-millisecond latency to BlackBull’s execution servers.

NYCServers offers VPS hosting in Equinix NY4 and LD4, providing direct proximity to BlackBull’s infrastructure. Your MT4 or MT5 instances stay connected without interruption, and your EAs execute with the lowest possible latency.

Deposit and Withdrawal Methods

Getting money in and out of your account smoothly is non-negotiable. Here’s how BlackBull handles funding and withdrawals.

Deposit Methods

BlackBull accepts deposits through:

- Bank wire transfer (1-5 business days)

- Credit/debit cards (instant to 1 day)

- Skrill

- Neteller

- UnionPay

- FasaPay

- Cryptocurrency deposits

No deposit fees are charged on any method. Minimum deposit amounts vary by method, starting from $1 for bank transfers and some e-wallets, while card and crypto deposits start from $25-50.

Withdrawals

Withdrawals carry a flat $5 fee regardless of method. BlackBull aims to process withdrawal requests within 24 hours, though bank wire transfers take 3-5 business days to arrive. E-wallets are typically faster, processing within 1-3 business days.

Due to AML regulations, withdrawals must return to the same funding source up to the deposited amount. Profits exceeding your deposit can be directed to a different account under your name.

Copy Trading and Social Features

BlackBull Markets integrates with multiple copy trading platforms, making it a solid option for traders who want to follow experienced signal providers.

BlackBull CopyTrader

BlackBull’s proprietary copy trading platform, powered by Hokocloud, lets you mirror trades from lead traders across MT4 and MT5. It includes risk management tools like lot size scaling, maximum drawdown limits, and selective trade copying. No minimum deposit is required, and there are no platform fees.

ZuluTrade

ZuluTrade’s peer-to-peer social trading network connects BlackBull clients with signal providers from over 192 countries. The platform’s ZuluRank algorithm evaluates provider performance, helping you filter through thousands of strategies based on risk-adjusted returns, drawdown history, and trade frequency.

Myfxbook AutoTrade

Myfxbook integration is available for MT4 accounts. You can connect your BlackBull account to Myfxbook’s AutoTrade system, copying verified strategies with transparent performance tracking. All trade histories are independently verified by Myfxbook, removing the guesswork from strategy selection.

Education and Research

Education is not BlackBull’s strongest area. The broker provides a basic library of articles, video tutorials, and market analysis, but the depth doesn’t match what you’ll find at larger brokers with dedicated education departments.

What BlackBull does offer includes:

- Trading guides covering forex basics, technical analysis, and platform tutorials

- Daily market analysis and commentary

- Economic calendar integration

- Webinars (periodic, not daily)

If you’re a complete beginner, you’ll likely need to supplement BlackBull’s resources with external education. For experienced traders, the research tools and market analysis provide enough context for informed decision-making.

Customer Support

BlackBull offers customer support through live chat, email, and phone. Support is available 24/5 during market hours. Response times on live chat are generally quick during New Zealand and UK business hours, though off-peak responses can be slower.

The support team handles account-related queries competently. Technical platform issues are usually resolved promptly, and account setup is straightforward. One limitation: support isn’t available 24/7, which can be frustrating for weekend account management or urgent issues outside market hours.

BlackBull Markets Pros and Cons

Pros

- Raw ECN spreads from 0.0 pips on Prime and Institutional accounts

- 26,000+ tradeable instruments including stocks, crypto, and commodities

- Four platform options (MT4, MT5, cTrader, TradingView)

- Equinix NY4 and LD5 infrastructure for institutional-grade execution

- No minimum deposit on Standard and Prime accounts

- Multiple copy trading integrations (ZuluTrade, Myfxbook, CopyTrader)

- FMA regulation (Tier 1 for New Zealand clients)

- Negative balance protection across all accounts

Cons

- $5 withdrawal fee on all methods

- Seychelles entity has lighter regulation for international clients

- Education content is thin compared to larger brokers

- No 24/7 customer support

- $20,000 minimum for Institutional account

- No proprietary mobile app (relies on third-party platform apps)

Who Is BlackBull Markets Best For?

BlackBull Markets fits certain trader profiles better than others. Here’s where the broker delivers the most value:

Algorithmic and EA Traders

With ECN execution, Equinix server infrastructure, and support for MT4, MT5, and cTrader Automate, BlackBull is a natural fit for algorithmic traders. The Prime account’s tight spreads combined with a VPS in NY4 or LD5 creates optimal conditions for automated strategies that depend on fast, reliable execution.

Multi-Asset Traders

If you trade across forex, stocks, commodities, and crypto, the 26,000+ instrument range means you won’t need accounts at multiple brokers. The platform diversity adds to this flexibility, letting you use TradingView for charting while executing on MT5.

Copy Trading Enthusiasts

The triple integration with ZuluTrade, Myfxbook, and BlackBull CopyTrader gives you more strategy providers to choose from than most single-platform setups. Whether you want passive income from copying or you’re testing strategies before committing your own analysis, the options are there.

Not Ideal For

Complete beginners who need extensive hand-holding and education. Traders who require 24/7 customer support. Anyone who prioritizes Tier 1 regulation and trades through the international (Seychelles) entity.

Frequently Asked Questions

Is BlackBull Markets a safe and regulated broker?

BlackBull Markets is regulated by the Financial Markets Authority (FMA) of New Zealand, which is a Tier 1 regulator. International clients trade through the Seychelles (FSA) entity, which has lighter oversight. Client funds are held in segregated accounts, and negative balance protection is offered across all account types.

What is the minimum deposit for BlackBull Markets?

The ECN Standard and ECN Prime accounts have no minimum deposit requirement. The ECN Institutional account requires a $20,000 minimum deposit. Actual minimum amounts may vary depending on your chosen deposit method.

What platforms does BlackBull Markets support?

BlackBull Markets supports MetaTrader 4, MetaTrader 5, cTrader, and TradingView. All platforms are available on desktop and mobile (iOS and Android). This four-platform lineup is more comprehensive than what most brokers offer.

How much does it cost to trade with BlackBull Markets?

On the Prime account, EUR/USD spreads average 0.16 pips with a $6 round-turn commission per lot, giving an all-in cost of approximately $7.60 per standard lot. The Standard account offers commission-free trading with spreads from 0.8 pips. There are no deposit fees, but withdrawals carry a $5 fee.

Does BlackBull Markets support copy trading?

Yes. BlackBull integrates with ZuluTrade, Myfxbook AutoTrade, and its proprietary BlackBull CopyTrader platform. These tools allow you to mirror trades from experienced signal providers with customizable risk management settings.

Can I run Expert Advisors (EAs) on BlackBull Markets?

Absolutely. BlackBull supports full EA functionality on MT4 and MT5, plus algorithmic trading through cTrader Automate using C#. The broker’s Equinix server infrastructure is optimized for automated trading, and a trading VPS can further reduce execution latency for time-sensitive strategies.

Does BlackBull Markets offer a demo account?

Yes. BlackBull provides free demo accounts on MT4, MT5, and cTrader. Demo accounts come loaded with virtual funds so you can test strategies and familiarize yourself with the platforms before risking real capital.

Final Verdict

BlackBull Markets delivers where it matters most for active traders: tight ECN spreads, robust infrastructure, and genuine platform choice. The Prime account’s pricing is competitive, the Equinix server placement is institutional-grade, and the four-platform lineup gives you flexibility you won’t find at most brokers.

The broker isn’t perfect. The $5 withdrawal fee stings, education is thin, and international clients trade under lighter Seychelles regulation. But for traders who prioritize execution quality, instrument variety, and platform flexibility, BlackBull Markets is a broker worth serious consideration in 2026.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.