Best Time to Trade Forex: Session Overlaps & Peak Hours

Learn the best time to trade forex in 2026. We break down all four trading sessions, overlap windows, and peak volatility hours for every major pair.

Why Timing Matters in Forex Trading

The forex market runs 24 hours a day, five days a week. But not all hours are created equal. Trade during the wrong window and you’re staring at flat price action, wide spreads, and choppy moves that stop you out for no reason.

Trade during the right window and you get tight spreads, clean trends, and the volume needed to fill your orders at the price you actually want.

The difference comes down to trading sessions. Four major financial centres drive the global forex market: Sydney, Tokyo, London, and New York. Each session has its own personality, its own active currency pairs, and its own volatility profile. When two sessions overlap, that’s where the real action happens.

This guide breaks down exactly when each session runs, which overlaps produce the most opportunity, and how to match your trading strategy to the right hours.

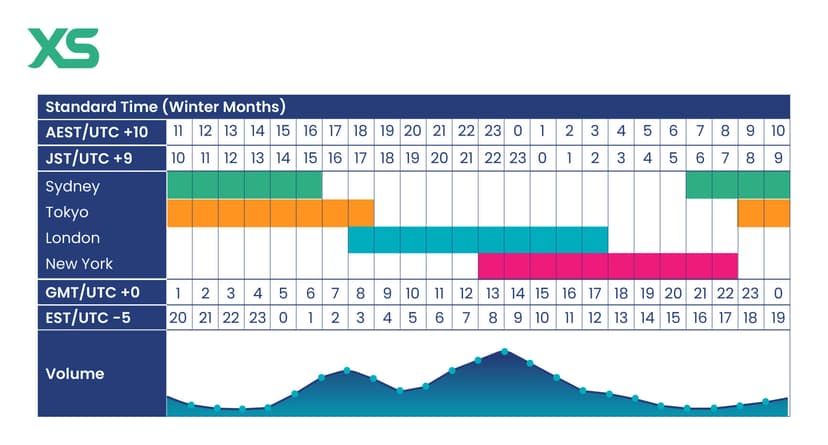

The Four Major Forex Trading Sessions

The forex market follows the sun around the globe. As one financial centre closes, another opens. Here’s the breakdown of all four sessions in UTC (GMT) and Eastern Time (ET).

Sydney Session

The Sydney session kicks off the trading week. It opens on Sunday evening in the US and marks the transition from the weekend. Liquidity is relatively thin, and spreads tend to be wider than other sessions.

| Detail | Value |

|---|---|

| Hours (UTC) | 10:00 PM – 7:00 AM |

| Hours (ET) | 5:00 PM – 2:00 AM |

| Key Pairs | AUD/USD, NZD/USD, AUD/NZD |

| Volatility | Low |

The Sydney session matters most for traders focused on the Australian and New Zealand dollars. Price action is generally slow, making it suitable for range-bound strategies rather than breakout plays.

Tokyo Session

The Tokyo session, also called the Asian session, picks up where Sydney starts to wind down. Japan is the third-largest forex trading centre in the world, and the yen pairs see their peak activity here.

| Detail | Value |

|---|---|

| Hours (UTC) | 12:00 AM – 9:00 AM |

| Hours (ET) | 7:00 PM – 4:00 AM |

| Key Pairs | USD/JPY, EUR/JPY, AUD/JPY, GBP/JPY |

| Volatility | Low to Moderate |

The Tokyo session often sets the tone for the day. Key economic releases from Japan, Australia, and China can trigger sharp moves in yen and commodity currency pairs. Liquidity is moderate, and many breakout strategies target the ranges established during this session.

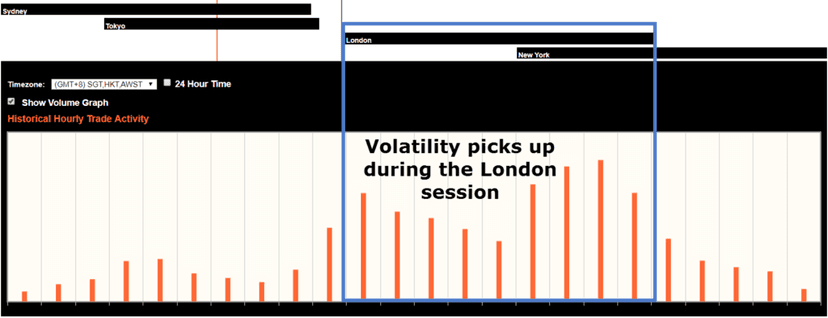

London Session

London is the heavyweight. It accounts for roughly 38% of all daily forex volume, making it the single most important session for currency traders. When London opens, volatility spikes across nearly every major pair.

| Detail | Value |

|---|---|

| Hours (UTC) | 8:00 AM – 4:00 PM |

| Hours (ET) | 3:00 AM – 11:00 AM |

| Key Pairs | EUR/USD, GBP/USD, EUR/GBP, USD/CHF |

| Volatility | High |

The London open is one of the most-watched events of the trading day. Institutional orders flood in, and the moves that start here often set the direction for the rest of the day. If you only have time to trade one session, this is the one.

New York Session

The New York session is the second-largest by volume and overlaps with London for several hours. Major US economic data releases land during this session, and the US dollar is involved in roughly 88% of all forex transactions.

| Detail | Value |

|---|---|

| Hours (UTC) | 1:00 PM – 10:00 PM |

| Hours (ET) | 8:00 AM – 5:00 PM |

| Key Pairs | EUR/USD, GBP/USD, USD/CAD, USD/JPY |

| Volatility | High |

The first few hours of the New York session are typically the most active, especially when they coincide with the final hours of London trading. After London closes, New York volume tapers off, and price action becomes more subdued heading into the Sydney open.

Session Overlaps: Where the Action Is

Session overlaps are the golden windows of forex trading. When two major sessions are open simultaneously, you get a surge in trading volume, tighter spreads, and stronger directional moves. These are the periods where breakout and momentum strategies perform best.

Sydney-Tokyo Overlap

| Detail | Value |

|---|---|

| Hours (UTC) | 12:00 AM – 7:00 AM |

| Hours (ET) | 7:00 PM – 2:00 AM |

| Duration | ~7 hours |

| Best Pairs | AUD/JPY, NZD/JPY, AUD/USD |

This overlap sees moderate activity. It’s most relevant for traders working with yen crosses and commodity currencies. Volatility picks up compared to the Sydney session alone, but it still doesn’t match the intensity of the European overlaps. Economic data from Japan, Australia, and China can produce sharp moves during this window.

Tokyo-London Overlap

| Detail | Value |

|---|---|

| Hours (UTC) | 8:00 AM – 9:00 AM |

| Hours (ET) | 3:00 AM – 4:00 AM |

| Duration | ~1 hour |

| Best Pairs | EUR/JPY, GBP/JPY, EUR/USD |

This is a brief but significant overlap. The final hour of the Tokyo session coincides with the London open, creating a burst of activity. The Tokyo session’s established ranges often get broken during this crossover as European liquidity floods in. It’s a prime window for breakout traders targeting yen pairs.

London-New York Overlap (The Most Important)

| Detail | Value |

|---|---|

| Hours (UTC) | 1:00 PM – 4:00 PM |

| Hours (ET) | 8:00 AM – 11:00 AM |

| Duration | ~3-4 hours |

| Best Pairs | EUR/USD, GBP/USD, USD/CHF, USD/CAD |

This is the single most active period in forex. More than 50% of total daily trading volume occurs when London and New York are both open. Spreads are at their tightest, liquidity is at its deepest, and price moves are at their strongest.

For EUR/USD alone, the average pip range during the London-New York overlap can be 30-50% larger than during any single session. Major US economic data releases — non-farm payrolls, CPI, FOMC announcements — typically drop during this window, creating the biggest moves of the day.

If you’re a day trader or scalper, this is your bread and butter. If you’re running automated strategies, this is when your EAs need to be executing at full speed.

Peak Volatility Hours by Currency Pair

Not every pair moves at the same time. Here’s a breakdown of when the most popular pairs see their highest volatility.

| Currency Pair | Peak Hours (UTC) | Peak Session | Average Daily Range |

|---|---|---|---|

| EUR/USD | 8:00 AM – 4:00 PM | London + NY Overlap | 70-90 pips |

| GBP/USD | 8:00 AM – 4:00 PM | London + NY Overlap | 90-120 pips |

| USD/JPY | 12:00 AM – 4:00 PM | Tokyo + London | 60-80 pips |

| AUD/USD | 10:00 PM – 9:00 AM | Sydney + Tokyo | 50-70 pips |

| USD/CAD | 1:00 PM – 9:00 PM | New York | 60-80 pips |

| EUR/GBP | 8:00 AM – 4:00 PM | London | 40-60 pips |

| GBP/JPY | 8:00 AM – 4:00 PM | London + Tokyo/NY | 100-150 pips |

GBP/JPY stands out as one of the most volatile pairs in forex. It’s nicknamed “the dragon” for a reason. During the London session, this cross can move 100+ pips in a single move. It demands wider stops and careful risk management, but it offers outsized profit potential for traders who can handle the swings.

Best Days of the Week to Trade

Volatility and volume aren’t constant throughout the week either. Here’s the general pattern most traders observe.

Tuesday through Thursday are typically the most active trading days. Liquidity is at its peak, economic releases are concentrated, and institutional flows are strongest.

- Monday: Slow start as the market finds its footing after the weekend. Gaps can occur from weekend news. Asian session liquidity is often thin.

- Tuesday: Full liquidity kicks in. Many economic reports are released. Strong directional moves are common.

- Wednesday: Typically the highest-volume day of the week. Central bank announcements and mid-week data releases drive volatility.

- Thursday: Continued strong activity. US jobless claims come out weekly. European data releases are frequent.

- Friday: Active in the morning sessions, especially around non-farm payrolls (first Friday of each month). Volume drops in the afternoon as traders close positions before the weekend.

Avoid trading during major holidays when banks in one or more financial centres are closed. Thin liquidity during Christmas week, US Thanksgiving, and Japanese Golden Week can produce erratic, unpredictable moves.

When NOT to Trade

Knowing when to stay out of the market is just as important as knowing when to jump in.

- Sunday evening open: Spreads are often 3-5x wider than normal. Gaps are common. Wait for the Asian session to fully establish before entering.

- Friday afternoon (after London close): Liquidity drops fast. Spreads widen. Position squaring can cause erratic moves that don’t follow technical or fundamental logic.

- Major holiday periods: Christmas, New Year, Easter, and local bank holidays create thin markets with unpredictable behaviour.

- Right before major news releases: Spreads often widen 5-10 minutes before high-impact data (NFP, CPI, rate decisions). If you’re not a news trader, step aside and wait for the dust to settle.

How Your Trading Setup Affects Execution During Peak Hours

Peak volatility hours create both opportunity and risk. Prices can move 10-20 pips in seconds during a major data release. If your trading setup has latency issues, you’ll get slippage, requotes, or missed fills at exactly the moment you need precision most.

This is where your infrastructure matters. Traders running EAs or scalping strategies need their platform connected to broker servers with as little latency as possible. A home internet connection might add 50-100ms of delay compared to a trading VPS positioned in the same data centre as your broker.

For session overlap trading, where every millisecond counts during fast moves, a trading VPS in the right location makes a measurable difference. If you’re trading EUR/USD during the London-New York overlap with an EA, your execution speed directly impacts your fill prices.

NYCServers runs infrastructure in three locations that map directly to the major trading sessions: NY4 in New York for the US session, LD4 in London for the European session, and TY3 in Tokyo for the Asian session. This means your trading platform sits physically close to your broker’s matching engine, regardless of which session you trade.

Matching Your Strategy to the Right Session

Different trading styles suit different sessions. Here’s a practical breakdown.

Scalping

Best during: London-New York overlap (1:00 PM – 4:00 PM UTC). Tight spreads and high volume give scalpers the conditions they need. Focus on EUR/USD, GBP/USD, and USD/JPY.

Day Trading

Best during: London session open through New York afternoon (8:00 AM – 8:00 PM UTC). Day traders need intraday trends, and these develop most reliably during the highest-volume sessions.

Swing Trading

Session timing is less critical for swing traders holding positions for days or weeks. However, entering and exiting during high-liquidity windows (London or London-NY overlap) minimizes slippage and gets you better fills.

News Trading

Tied directly to the economic calendar. Most impactful releases happen during the London and New York sessions. Non-farm payrolls (8:30 AM ET on the first Friday), ECB and Fed rate decisions, and CPI data are the biggest volatility triggers.

Automated Trading

EAs and algorithmic trading strategies need reliable, fast execution around the clock. But they perform best during sessions that match their logic. A scalping EA designed for tight ranges works better in the Asian session. A momentum-based EA thrives during the London-New York overlap.

The key advantage of automated trading is that your strategy runs even when you’re asleep. But that only works if your platform is online 24/7 with stable connections.

Frequently Asked Questions

What is the single best time to trade forex?

The London-New York overlap from 1:00 PM to 4:00 PM UTC (8:00 AM to 11:00 AM ET) is widely considered the best trading window. It combines the highest volume, tightest spreads, and strongest price movements of any period in the 24-hour forex cycle.

Does the best trading time change with daylight saving time?

Yes. The US and UK switch to daylight saving time on different dates, which shifts the overlap window by one hour for a few weeks in spring and autumn. Always check current UTC offsets for your broker’s server time to avoid confusion.

Is it worth trading the Asian session?

It depends on your strategy and the pairs you trade. The Asian session suits range-bound strategies and yen crosses like USD/JPY, EUR/JPY, and AUD/JPY. Volatility is lower, but that also means more predictable price action for certain approaches.

Why are spreads wider during certain hours?

Spreads reflect liquidity. When fewer banks and institutions are active (Sunday open, holiday periods, late Friday), there are fewer market makers quoting prices. Less competition among liquidity providers means wider bid-ask spreads for you.

Can I trade forex profitably outside of peak hours?

Absolutely. Some strategies are specifically designed for low-volatility environments. Grid trading, range trading, and certain mean-reversion EAs perform better during quieter sessions when prices oscillate within predictable boundaries. The key is matching your strategy to the conditions.

How does my VPS location affect trading during session overlaps?

A VPS located in the same data centre as your broker’s servers reduces execution latency to 1ms or less. During peak volatility, this minimizes slippage and ensures your orders fill at the price you see on screen. Choose a VPS location that matches the session you trade most: New York for US hours, London for European hours, or Tokyo for Asian hours.

What currency pairs should I avoid during low-volume hours?

Exotic pairs and crosses like GBP/NZD, EUR/TRY, or USD/ZAR can have extremely wide spreads outside of their home sessions. Stick to majors during off-peak hours, and save exotic pairs for when their home markets are open and liquidity is adequate.

About the Author

Thomas Vasilyev

Writer & Full Time EA Developer

Tom is our associate writer, and has advanced knowledge with the technical side of things, like VPS management. Additionally Tom is a coder, and develops EAs and algorithms.