Best Scalping EAs for Forex: Top 5 MT4/MT5 Forex Robots Reviewed

Compare the best scalping EAs for MT4 & MT5. Night Hunter Pro, Evening Scalper Pro, Waka Waka & more with verified Myfxbook results.

Scalping EAs are the most demanding type of forex robot. They target small price movements — often just 5-15 pips — which means execution speed, spread costs, and broker quality matter enormously. A 50ms delay or an extra pip of spread can turn a profitable strategy into a losing one.

We’ve analyzed the top scalping EAs for 2025, focusing on verified Myfxbook results, realistic risk profiles, and VPS requirements. Whether you prefer night scalping during quiet markets or evening sessions with moderate volatility, this guide covers the best options for MT4 and MT5.

Quick Comparison: Best Scalping EAs for 2025

| EA Name | Price | Strategy | Verified Gain | Max Drawdown | Best For |

|---|---|---|---|---|---|

| Night Hunter Pro | $2,340 | Night Scalping | +215% | ~30% | Safe scalping, prop firms |

| Evening Scalper Pro | $2,340 | Evening Mean-Reversion | +144% | ~25% | Cross-pair scalping |

| Waka Waka EA | $2,520 | Grid + RSI/Bollinger | +700%+ | ~30% | Aggressive traders |

| Forex Fury | $229 | Range Scalping | +85% | ~42% | Budget-conscious traders |

| Happy Market Hours | €699 (pack) | Trend + Scalping | Verified | Low | Multi-EA portfolio |

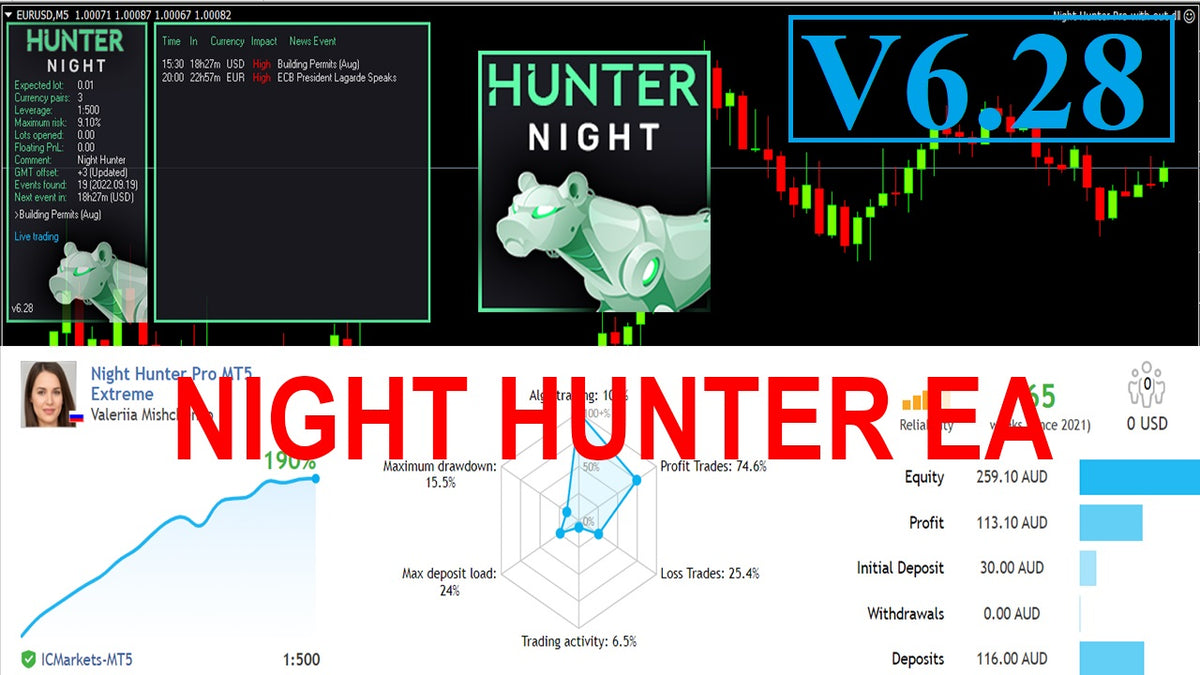

1. Night Hunter Pro — Best Overall Scalping EA

Price: $2,340 | Platform: MT4/MT5 | Timeframe: M5

Night Hunter Pro is the highest-rated scalping EA from Valeriia Mishchenko, one of the most respected developers in the MQL marketplace. It exploits low-volatility conditions during the Asian session when price movements are more predictable.

Verified Performance

The Myfxbook-verified account shows +215% gains since October 2020, with approximately 30% maximum drawdown. The EA started with just $285 and has maintained consistency over 4+ years of live trading on multiple currency pairs.

Trading Strategy

Night Hunter Pro uses smart entry/exit algorithms during calm market hours, typically between 21:00-01:00 broker time. It identifies high-probability setups using advanced filtering — including news filters, stock market crash protection, and negative swap filters.

Key Features

- No martingale or grid — each trade has a fixed stop loss

- Trades 12 pairs: GBPUSD, EURUSD, EURCHF, USDCAD, USDCHF, CHFJPY, AUDCAD, EURCAD, EURAUD, EURGBP, EURJPY, AUDJPY

- FTMO/FIFO compatible with prop firm settings included

- One-chart setup to trade all symbols

- Auto GMT detection and self-diagnostic system

- 14-day free trial and 30-day money-back guarantee

Pros & Cons

Pros: 4+ years verified track record, no dangerous strategies, prop firm ready, excellent developer support, comprehensive filtering.

Cons: $2,340 price point is high, requires quality ECN broker, Asian session timing may not suit all schedules, ~30% drawdown is notable.

Verdict

Night Hunter Pro sets the standard for professional scalping EAs. The combination of verified long-term results, no-martingale approach, and prop firm compatibility makes it the top choice for serious traders. Worth the investment if you’re committed to automated scalping.

2. Evening Scalper Pro — Best for Cross-Pair Scalping

Price: $2,340 | Platform: MT4/MT5 | Timeframe: M5

Evening Scalper Pro is another top-tier EA from Valeriia Mishchenko, focusing on evening trading sessions (19:00-23:00 GMT) with cross-currency pairs. It uses mean-reversion strategies that capitalize on pairs returning to average values after short-term deviations.

Verified Performance

The Myfxbook account shows +144% gains since December 2021 on an IC Markets live account. The EA recently hit all-time highs and maintains approximately 25% maximum drawdown with default settings.

Trading Strategy

Evening Scalper Pro trades exclusively during evening hours, avoiding low-liquidity rollover periods (0:00-1:00 GMT). It uses mean-reversion logic on cross pairs where correlations create predictable reversion patterns.

Key Features

- Trades 8 cross pairs: EURNZD, EURAUD, AUDNZD, NZDCAD, AUDCAD, EURGBP, GBPAUD, GBPCAD

- No martingale or hedging — market orders with fixed stop losses

- Advanced news filter and crash protection

- FIFO compatible for US brokers and prop firms

- Auto GMT detection

- 10 live account activations included

Pros & Cons

Pros: Strong verified results, different timing than Night Hunter (portfolio diversification), lower drawdown than competitors, regular updates (v2.64 as of 2025).

Cons: Cross pairs have wider spreads, evening-only trading limits opportunities, same high price as Night Hunter Pro.

Verdict

Evening Scalper Pro complements Night Hunter Pro perfectly — different trading hours and different pairs. If you’re building a portfolio of scalping EAs, running both provides diversification. Standalone, it’s an excellent choice for traders who prefer evening session activity.

3. Waka Waka EA — Best Long-Term Track Record

Price: $2,520 | Platform: MT4/MT5 | Timeframe: M15

Waka Waka is a legend in the EA space with 59+ consecutive profitable months and one of the longest verified track records available. It combines RSI and Bollinger Bands with a grid system for recovery, creating a strategy that’s proven remarkably resilient.

Verified Performance

Backtested from 2021-2025 with 70+ consecutive profitable months. Live accounts show 4.5+ years of stable trading with drawdowns around 30%. Multiple third-party reviews confirm the EA’s consistency, though exact returns vary by risk settings.

Trading Strategy

Waka Waka uses RSI to identify overbought/oversold conditions and Bollinger Bands to confirm entries. When trades go against position, a grid system opens additional orders at predetermined levels. This isn’t martingale (lot sizes don’t increase), but it does add exposure during drawdowns.

Key Features

- Trades AUDCAD, AUDNZD, NZDCAD on M15

- Grid system without martingale lot increases

- RSI + Bollinger Bands entry logic

- Works on most ECN brokers with spreads up to 4 pips

- Telegram community and strategy sharing

- 14-day trial and 30-day refund

Pros & Cons

Pros: 59+ months profitable, proven resilience through multiple market conditions, easy setup with profitable defaults, strong community.

Cons: Grid system can cause significant drawdowns in trending markets, not suitable for prop firms with drawdown limits, requires patience during recovery phases.

Verdict

Waka Waka isn’t a pure scalper — it’s more of a grid-based swing system. But its track record speaks for itself. If you can tolerate 30% drawdowns and understand grid dynamics, this EA has proven it can deliver consistent returns over years, not months.

4. Forex Fury — Best Budget Scalping EA

Price: $229 | Platform: MT4/MT5 | Timeframe: M15

Forex Fury is the most affordable serious scalping EA on the market. It trades during low-volatility windows (4-5 PM EST) using range-bound strategies. The vendor claims 93% win rate, though independent analysis shows more modest results.

Verified Performance

The vendor provides multiple Myfxbook accounts. Independent analysis shows approximately +85% gains over 48 months on the GBPUSD account, with 41.9% maximum drawdown. Monthly returns average around 1.4%, which is lower than premium alternatives but achieved at 1/10th the price.

Trading Strategy

Forex Fury scalps during quiet hours when price typically ranges between support and resistance. It uses tight take-profits (around 5 pips) with wider stop losses (up to 60 pips), creating a high win rate but unfavorable risk/reward on individual trades.

Key Features

- Time-restricted trading during low volatility

- Works on any pair or asset

- NFA, FIFO, and ECN compatible

- High-performance settings included

- Lifetime membership with free updates

- Multiple package options available

Pros & Cons

Pros: Affordable at $229, trades any instrument, long history since 2017, lifetime license, works on demo accounts for testing.

Cons: Unfavorable risk/reward ratio, mixed user reviews, 42% drawdown is high, some verified accounts are demo not live, vendor marketing is aggressive.

Verdict

Forex Fury is controversial. The $229 price is attractive, but the wide stop losses mean one bad trade can wipe out many winners. Test thoroughly on demo before committing real capital. It’s best suited for traders who want affordable exposure to automated scalping with realistic expectations.

5. Happy Market Hours — Best for Portfolio Diversification

Price: €699 (Full Pack with 10 EAs) | Platform: MT4/MT5 | Timeframe: Various

Happy Market Hours is part of the Happy Forex suite, which includes 10 EAs for one price. The Market Hours EA specifically focuses on trend-following and scalping during optimal trading sessions.

Verified Performance

The Happy Forex Full Pack has verified Myfxbook accounts trading since August 2022 with consistent equity curves. Individual EAs show low drawdowns and steady growth, though specific returns vary by EA and settings.

Trading Strategy

Happy Market Hours combines trend trading with scalping elements. It uses technical indicators to identify directional moves, then executes quick entries and exits during favorable market hours. The grid component uses reinsurance positions without martingale lot increases.

Key Features

- 10 EAs included in Full Pack

- Works with brokers offering up to 4 pip spreads

- Adjustable SL, TP, spread limits, and risk settings

- News filtering during high-impact events

- Multi-currency support

- 2 or 5 license packages available

Pros & Cons

Pros: 10 EAs for price of one, portfolio diversification built-in, verified results, works on wider spreads than competitors.

Cons: Individual EA performance varies, grid elements add risk, requires more capital to run multiple EAs, less focused than single-purpose robots.

Verdict

Happy Forex Full Pack offers value through diversification. Instead of betting everything on one EA, you get 10 strategies that can smooth out returns. Best for traders with larger accounts who want portfolio-level automation without managing multiple vendors.

Why VPS Hosting is Critical for Scalping EAs

Scalping EAs are more sensitive to execution quality than any other type of forex robot. Here’s why a forex VPS isn’t optional — it’s essential:

Latency Kills Scalping Profits

Scalping targets small moves. A 5-pip take-profit needs sub-millisecond execution to capture consistently. Trading from home adds 50-200ms of latency, which can turn winners into losers. A VPS in the same data center as your broker delivers under 1ms execution.

Uptime During Trading Hours

Night scalping EAs trade while you sleep. Evening scalpers run during dinner. If your home computer crashes, reboots for Windows updates, or loses internet — you miss trades or worse, can’t close positions. VPS servers run 24/5 with enterprise-grade reliability.

Broker Proximity Matters

Most major brokers run servers in New York (Equinix NY4) or London (LD4). NYCServers offers NY4 VPS and LD4 VPS options that put your EA right next to broker infrastructure.

Our MT4 VPS plans start at $25/month with pre-installed platforms and sub-1ms latency to IC Markets, OANDA, and other popular brokers for scalping.

Choosing the Right Broker for Scalping EAs

Your broker matters as much as your EA. Scalping requires:

- Raw spreads: Look for 0.0-0.5 pip spreads on majors

- Fast execution: Under 50ms average execution speed

- No scalping restrictions: Some brokers prohibit or limit scalping

- ECN/STP model: Avoid dealing desk brokers that may trade against you

IC Markets, Pepperstone, and OANDA are popular choices for scalping EAs. Check our IC Markets VPS page for optimized hosting.

Frequently Asked Questions

What is the best scalping EA for forex?

Night Hunter Pro and Evening Scalper Pro are the top-rated scalping EAs in 2025, both from developer Valeriia Mishchenko with 4+ years of verified results. Night Hunter Pro focuses on Asian session with +215% gains, while Evening Scalper Pro targets evening hours with +144% returns.

Do I need a VPS to run a scalping EA?

Yes, a VPS is essential. Scalping strategies depend on millisecond execution — a 50-100ms delay can turn winning trades into losers. A forex VPS provides sub-1ms latency, 24/5 uptime, and eliminates internet outages that could miss critical trades.

Why do scalping EAs need low spreads?

Scalping EAs target small moves, often just 5-15 pips. If your broker charges 2-3 pip spreads, a significant portion of profit goes to costs. ECN brokers with raw spreads (0.0-0.5 pips) plus commission are ideal.

Can I use scalping EAs on prop firm accounts?

Some scalping EAs are prop firm compatible. Night Hunter Pro and Evening Scalper Pro include FTMO-ready settings and are FIFO compliant. Check your prop firm’s rules on holding times and lot sizes.

What’s the difference between night scalping and regular scalping?

Night scalping EAs trade during quiet market hours (Asian session) when volatility is low and moves are more predictable. Regular scalping EAs trade during active sessions. Night scalpers typically have higher win rates but smaller profits per trade.

How much money do I need to run a scalping EA?

Most scalping EAs recommend $500-1,000 minimum. Night Hunter Pro’s verified account started with $285. Larger accounts ($2,000+) provide better risk management and can survive losing streaks.

Final Thoughts

Scalping EAs demand more from infrastructure than any other automated strategy. The difference between profit and loss often comes down to milliseconds and fractions of pips.

Night Hunter Pro leads the pack for verified results and professional-grade features. Evening Scalper Pro offers complementary timing for portfolio diversification. Waka Waka delivers the longest track record if you can handle grid dynamics. Forex Fury provides budget entry into scalping.

Whichever EA you choose, run it on a forex VPS with low-latency broker access. Scalping success requires the full stack — strategy, execution, and infrastructure working together.

About the Author

Thomas Vasilyev

Writer & Full Time EA Developer

Tom is our associate writer, and has advanced knowledge with the technical side of things, like VPS management. Additionally Tom is a coder, and develops EAs and algorithms.