In the fast-paced world of forex trading, network speed isn’t just a technical metric—it’s the difference between profit and loss. That’s why we’ve engineered our network infrastructure specifically for traders who understand that milliseconds matter. Our proprietary network optimization delivers consistent sub-millisecond latency to major forex exchanges, ensuring your trades execute precisely when market opportunities arise. In this technical analysis, we’ll examine the sophisticated infrastructure and strategic optimizations that give our clients a decisive edge in today’s competitive forex markets.

Table of Contents

Strategic Locations: The Foundation of Low-Latency Forex Trading

Location plays a fundamental role in forex trading performance, particularly in the relationship between your VPS / server and your broker’s trading servers. When executing trades, every kilometer between these two points introduces latency that can impact your trading outcomes—typically adding about 3.3 microseconds of delay for each kilometer of fiber optic cable. This physical distance creates a measurable delay in both receiving market data and executing trades, which can significantly affect your ability to capitalize on market movements.

Professional traders understand that even a few extra milliseconds of latency can result in substantial slippage or missed opportunities, especially during volatile market conditions or high-impact economic events like NFP releases or central bank announcements. For instance, a VPS located 1,000 kilometers from your broker’s servers could add over 3 milliseconds of round-trip latency to every trade—an eternity in modern forex markets where prices can change multiple times per millisecond.

This is why we’ve made the strategic decision to host our infrastructure within and around Equinix’s data centers, precisely where the majority of forex brokers locate their trading servers. This co-location approach provides our clients with an unparalleled advantage: direct, near-instantaneous connections to their brokers’ trading infrastructure that no external hosting solution can match.

Equinix NY4

Equinix NY4, located in Secaucus, New Jersey, stands as one of the most significant financial data centers in North America. This state-of-the-art facility serves as a crucial hub in the global forex trading ecosystem, housing the matching engines and trading infrastructure of major forex brokers and liquidity providers. The strategic importance of NY4 stems from its proximity to Wall Street—just 11 miles from Manhattan’s financial district—and its role as a key cross-connect point for major financial institutions.

By maintaining our infrastructure in and around NY4, we provide our clients with direct access to the same low-latency environment where their trades are ultimately executed. This colocation approach eliminates the additional network hops and potential points of failure that could otherwise introduce delays in trade execution.

Equinix LD4

Equinix LD4, situated in Slough’s trading estate just 27 miles west of central London, represents one of Europe’s most critical financial data centers. This facility serves as the primary hub for forex trading infrastructure in Europe, hosting the trading servers and matching engines of major forex brokers, banks, and financial institutions. Its strategic location within London’s financial ecosystem makes it an essential component of the global forex market, particularly during London trading sessions which account for approximately 35% of daily forex trading volume.

Our presence within and around LD4 ensures that traders can execute their orders with minimal latency to the heart of European forex liquidity, delivering consistent sub-millisecond connections to major brokers’ infrastructure housed within the same facility.

Equinix TKY3

Equinix TY3, located in the heart of Tokyo’s financial district, represents one of Asia’s premier financial data centers and a crucial hub for forex trading in the Asia-Pacific region. This advanced facility hosts the trading infrastructure of major Asian financial institutions and global forex brokers, making it indispensable during Asian trading sessions. TY3’s strategic position in Tokyo’s financial ecosystem provides direct access to Japanese liquidity providers and major regional banks.

Our infrastructure within and around TY3 ensures traders can execute with minimal latency during Asian market hours, particularly crucial for trading Japanese Yen pairs and capturing opportunities during major Asian economic releases. The facility’s robust connectivity to other major financial centers helps maintain consistent performance across global trading sessions.

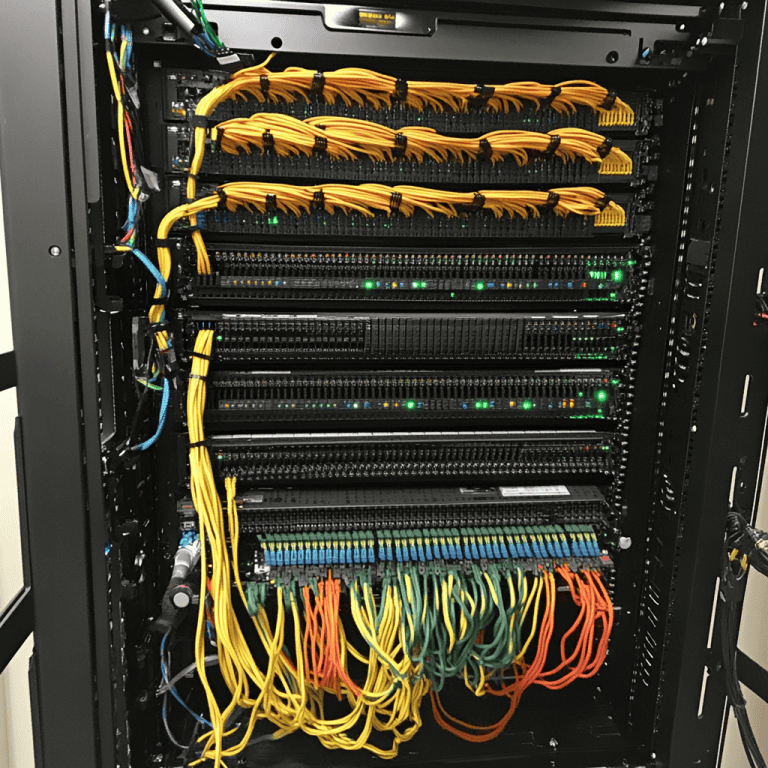

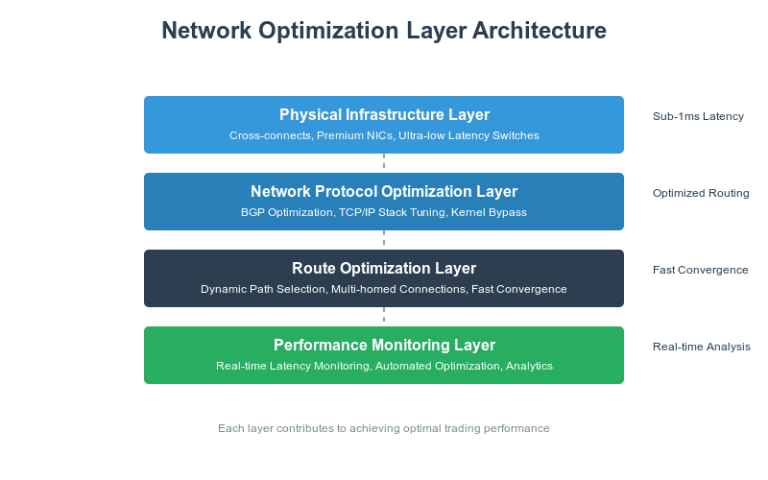

Network Architecture: Engineering the Fastest Path to Markets

Our network architecture within and around these premier Equinix facilities is meticulously engineered to deliver consistent, ultra-low latency performance for forex traders. At the core of our infrastructure lies a sophisticated cross-connect framework that provides direct fiber connectivity to major forex brokers’ trading servers and network providers. This direct physical connection eliminates multiple network hops that typically introduce latency in traditional hosting environments.

To ensure optimal performance, we implement a multi-layered approach to network design. Our primary connections utilize dedicated cross-connects, providing a straight path to broker infrastructure within the same facility. These connections are supplemented by redundant tier-1 network provider links, each carefully selected for their proven performance in handling financial data. This redundancy ensures continuous trading capability even in the unlikely event of a primary connection failure.

Advanced Network Optimization: BGP Routing Excellence

Our BGP optimization strategy represents the cutting edge of network routing technology for forex trading. At its core, BGP (Border Gateway Protocol) determines how data travels between your trading platform and your broker’s servers. We’ve enhanced standard BGP implementations with sophisticated optimizations specifically designed for forex trading requirements.

Our proprietary BGP configuration employs advanced path selection algorithms that consider multiple metrics beyond traditional routing parameters. These algorithms continuously analyze factors such as path latency, historical performance data, and current network conditions to determine the optimal route for your trading data. By monitoring these metrics in real-time, our system can detect and respond to network congestion or degradation before it impacts your trading performance.

We maintain multiple BGP peers with diverse tier-1 providers, enabling us to dynamically select the most efficient path for each trading session. This multi-homed approach, combined with our custom BGP attributes, ensures that your trading data always travels the fastest possible route to your broker’s infrastructure. During high-volatility market events, when traditional networks often experience congestion, our BGP optimization becomes particularly valuable, maintaining consistent low-latency performance when it matters most.

Furthermore, our BGP implementation includes advanced convergence optimizations that minimize route update times. Traditional BGP configurations can take several seconds to converge after a network change, but our optimized setup achieves convergence in milliseconds, ensuring continuous trading capability even during network path transitions.

High-Performance Hardware

Our network backbone is built on ultra-low latency switches from Arista Networks, renowned for their superior performance in financial applications. These switches feature application-specific integrated circuits (ASICs) optimized for minimal port-to-port latency, typically achieving switching times under 300 nanoseconds. Their advanced buffer management and traffic prioritization capabilities ensure that trading data receives immediate priority, even during periods of high network utilization.

To maximize performance, we’ve implemented a flat network topology that minimizes the number of hops between your VPS and broker infrastructure. This design, combined with our premium hardware, delivers consistent sub-millisecond latency that professional traders require. Each network component undergoes rigorous performance testing and regular maintenance to ensure optimal operation at all times.

Continuous Monitoring: Ensuring Peak Performance

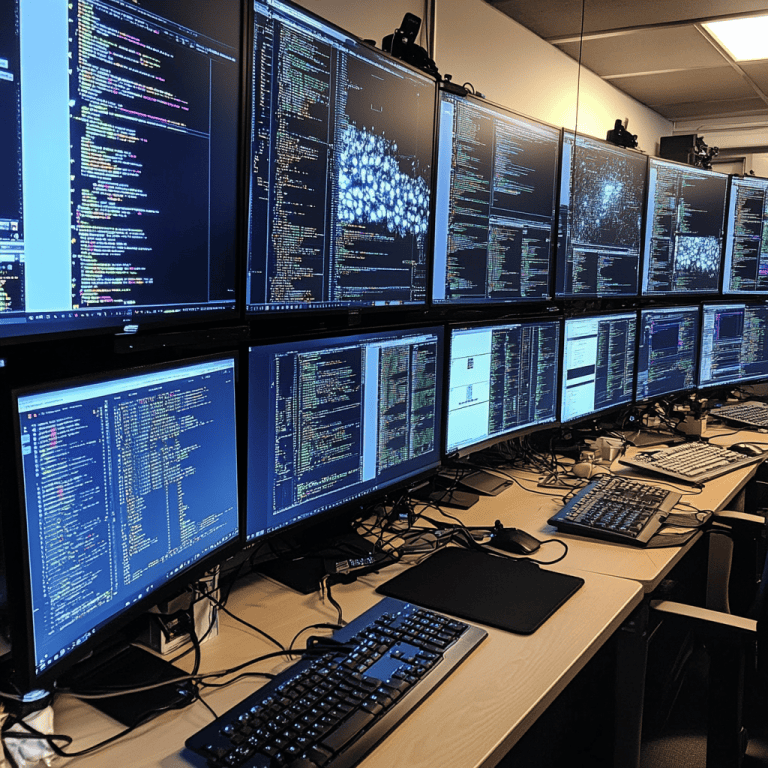

Our commitment to delivering superior trading performance extends beyond infrastructure to include comprehensive latency monitoring and quality assurance systems. We maintain a sophisticated network operations center that operates 24/7, utilizing advanced monitoring tools to track and optimize network performance in real-time.

Under The Hood Of Our Monitoring Software

At the core of our monitoring system is a proprietary latency measurement framework that continuously tracks network performance to major forex brokers. This system captures detailed metrics including round-trip latency, jitter, and packet loss statistics at microsecond resolution. Our monitoring nodes are strategically placed throughout our network to provide granular visibility into every critical network path.

We’ve implemented automated alerting systems that can detect even minor deviations from optimal performance thresholds. When our systems identify potential issues, our network engineers receive immediate notifications, allowing them to address concerns before they impact trading operations. This proactive approach helps maintain consistent low-latency performance during critical trading periods.

Gaining The Edge During Major Market Events

Our comprehensive monitoring and infrastructure optimization becomes particularly valuable during high-impact news events when market volatility can push standard trading infrastructure to its limits. During releases like Non-Farm Payrolls, FOMC decisions, or other major economic announcements, many traders experience platform freezes and significant slippage due to infrastructure limitations. Our system is specifically engineered to maintain peak performance during these crucial moments.

When major news hits the market, standard VPS solutions often struggle with the sudden surge in data flow and trade execution requests. This leads to the all-too-familiar scenario of platforms freezing or trades executing at prices far from intended levels. Our infrastructure is designed differently. We maintain substantial excess capacity in both our network and server resources, allowing us to handle sudden spikes in market data and trading activity without degradation in performance.

Our network architecture includes dedicated bandwidth allocations for critical trading traffic, ensuring that your trade execution commands and market data updates receive priority treatment even during peak load. The direct cross-connects to broker infrastructure within Equinix facilities prove invaluable during these moments, as they bypass the internet congestion that typically causes platform freezes and delayed executions.

We’ve implemented sophisticated queue management systems that prioritize trade execution packets during high-volume periods. This means that when you need to execute or modify positions during news events, your commands reach the broker’s servers with minimal delay. Our internal testing shows that during major news events, clients on our infrastructure consistently achieve execution speeds within 1-2 milliseconds of their intended entry points, compared to delays of hundreds of milliseconds or even seconds on standard hosting solutions.

For clients running automated trading strategies during news events, our infrastructure provides an additional layer of reliability. The combination of premium hardware, optimized network paths, and excess capacity ensures that your algorithms can continue executing trades according to their strategy, without the disruptions that often plague standard hosting environments during volatile market conditions.

Real-World Performance Metrics: Delivering Measurable Trading Advantages

We believe in transparency and letting our performance data speak for itself. Through extensive monitoring and testing across our global infrastructure, we’ve documented consistent, industry-leading network performance that directly impacts trading success.

Our cross-connect configurations within Equinix facilities consistently deliver round-trip latency under 1 millisecond to major forex brokers. During typical trading conditions, clients experience average execution speeds of 0.3 to 0.5 milliseconds from our NY4 facility to major US-based brokers. Similar performance is achieved in our LD4 and TY3 locations, with average latencies remaining under 0.7 milliseconds to local brokers.

These performance metrics remain remarkably stable even during periods of market volatility. During recent high-impact news events, our infrastructure maintained consistent sub-millisecond execution speeds while many traditional hosting solutions experienced significant degradation. Our internal analysis shows that traders using our optimized infrastructure experienced up to 85% less slippage during major market moves compared to standard VPS solutions.

Network stability is equally impressive, with our infrastructure maintaining 100% uptime across all locations during market hours. Over the past 12 months, our network has processed millions of trades with zero packet loss between our infrastructure and broker servers. This combination of speed and reliability has translated into measurable advantages for our clients, with many reporting significant improvements in their execution quality after migrating to our infrastructure.

The real-world impact of these performance metrics becomes particularly apparent during algorithmic trading operations. Clients running high-frequency strategies have reported consistent execution of their intended entry and exit points, with deviation from intended prices averaging less than 0.1 pips during normal market conditions.

Setting the Standard in Network Trading Infrastructure

In the ever-evolving world of forex trading, the quality of your infrastructure can make the difference between success and failure. Our commitment to excellence in network optimization, from strategic data center locations to advanced BGP routing and enterprise-grade hardware, delivers measurable advantages for traders who understand that every millisecond matters. By maintaining our presence in premier Equinix facilities NY4, LD4, and TY3, coupled with continuous performance monitoring and proactive optimization, we provide traders with the technical foundation they need to execute their strategies with precision and confidence.

The real-world performance metrics speak for themselves: consistent sub-millisecond latency, minimal slippage during high-impact events, and reliable execution when markets move. In an industry where speed and reliability are paramount, our infrastructure continues to set the standard for professional forex trading operations. Partner with us to experience the difference that truly optimized trading infrastructure can make for your trading success.