In today’s fast-paced forex market, milliseconds can mean the difference between profitable trades and missed opportunities. For traders utilizing automated trading systems and Expert Advisors (EAs), execution speed isn’t just a technical metric—it’s a crucial factor that directly impacts their bottom line.

Through extensive testing, NYCServers has demonstrated how switching from a traditional PC setup to our specialized forex VPS service can dramatically improve trade execution times, with observed reductions of up to 50%. This significant improvement in performance isn’t just about numbers; it represents real advantages in trade execution, reduced slippage, and ultimately, enhanced potential for profitability in automated trading strategies.

Table of Contents

The Challenge: Trading Latency in Forex Automation

Retail forex traders running Expert Advisors (EAs) from their home computers face a significant disadvantage in today’s markets. While institutional traders benefit from sophisticated infrastructure and direct market connections, home-based traders often struggle with slower internet connections, variable network quality, and physical distance from trading servers. These limitations create noticeable delays in order execution, leading to slippage, missed opportunities, and reduced profitability. The impact is particularly severe during high-impact news events or periods of market volatility, precisely when execution speed becomes most crucial.

Traditional home setups, even with powerful hardware, cannot overcome the fundamental issue of network latency between their location and their broker’s servers.

Trade Execution Time Analysis: Desktop Trading vs NYCServers Forex VPS

To understand the real impact of VPS hosting on forex trading performance, we set out to compare the difference in order execution speeds between a standard PC setup and NYCServers’ VPS service. Using the MetaTrader 4 platform and a specialized Expert Advisor, we measured the exact time it takes for trades to execute in both environments

Methodology

To ensure a fair and accurate comparison, we maintained identical conditions across both testing environments. We used the exact same setup parameters, including:

- MetaTrader 4 platform version

- Expert Advisor

- Trading Account Number

- Broker Server Location

- Trading Pair (NAS100)

About The Expert Advisor

The Expert Advisor used in our testing was specifically designed to provide accurate execution speed measurements through repeated market orders.

Here’s how it works:

The EA executes a cycle of 25 market orders on the trading account. For each order, it precisely measures two critical time intervals:

- The time taken to open the position

- The time taken to close the position

After each order is completed, the EA records these execution times and moves on to the next order in the cycle. This process continues until all 25 market orders have been executed and their respective execution times documented. This systematic approach ensures we gather a comprehensive dataset of execution speeds, providing a reliable average that accurately represents real-world trading conditions.

Test Results Comparison:

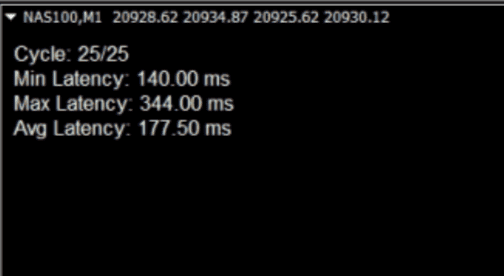

PC Results:

Minimum order latency: 140.00 ms

Maximum order latency: 344.00 ms

Average order latency: 177.50 ms

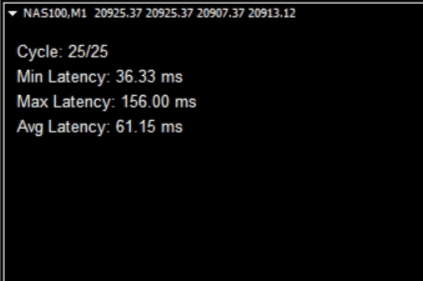

VPS Results

Minimum order latency: 36.33ms

Maximum order latency: 156.00ms

Average order latency: 61.15ms

When using the same EA with our VPS service you can see that the order latency time is cut down nearly in half, with the new average latency time being just 61ms

Testing Video

A video showing our testing can be found above.

Comparing The Results

Looking at the results we see that there is a significant reduction in order latency when using our VPS service:

- The average order latency on the VPS (61.15ms) is almost 3x faster than the desktop (177.50ms).

- Even the slowest VPS order executes much faster than the desktop average.

These improvements translate into substantial real-world advantages for traders, particularly those employing automated strategies or high-frequency trading approaches. The reduced latency directly contributes to better price fills, minimized slippage during volatile market conditions, and more precise execution of entry and exit points. The VPS also demonstrated remarkably more stable performance in terms of order latency execution range. For traders running Expert Advisors or implementing time-sensitive strategies, especially during high-impact news events or rapid market movements, these performance gains can make the difference between profitable trades and missed opportunities. The data clearly shows that upgrading to a VPS solution isn’t just about faster speeds – it’s about achieving a more reliable, consistent, and professional trading environment that can directly impact bottom-line results.

Factors To Consider

While our testing demonstrates significant performance improvements with VPS hosting, it’s important to understand that actual results can vary based on several critical factors. Broker selection plays a fundamental role in execution speed – different brokers employ varying types of execution models, server infrastructure, and processing systems, which can result in notably different base execution times even before considering VPS optimization. Some brokers may consistently execute orders in under 50ms, while others might average 200ms or more, regardless of your trading setup.

Market conditions have a substantial impact on order execution speeds. During peak trading hours when market liquidity is highest (such as the London-New York overlap), execution tends to be faster and more consistent. However, during off-hours, holidays, or major economic news events (like NFP releases or central bank announcements), execution times can increase significantly as market volatility and order volume spike. Even the most optimized VPS setup may experience slower execution during these challenging market conditions.

Perhaps most critically, the network latency between your VPS and your broker’s trading servers remains a key determinant of overall performance. A VPS located in New York connecting to a broker’s servers in London will naturally experience higher latency than one connecting to servers in the same city. This physical distance factor creates a baseline minimum latency that even the most powerful VPS cannot overcome. For optimal results, traders should select a VPS location that minimizes the geographic distance to their broker’s servers, ensuring the lowest possible network latency and fastest execution speeds.

Case Study Conclusion

The results of our testing clearly demonstrate that NYCServers’ VPS solution offered a significant competitive advantage for forex traders. The results showed a more than 50% faster order latency when using our VPS service, compared to a regular desktop trading setup.

This improvement in performance can translate directly into better trade execution, reduced slippage, and potentially increased profitability, particularly for traders using automated strategies or Expert Advisors. By choosing NYCServers’ VPS service and optimizing these key variables, traders can create a robust, professional-grade trading environment that maximizes their potential for success in the dynamic forex market. Whether you’re a seasoned algorithmic trader or just starting with automated trading strategies, the performance advantages offered by our VPS service provide a solid foundation for more efficient and reliable forex trading operations.