Forex God: What It Means and How Elite Traders Achieve Mastery

Discover what a “forex god” really means. Learn the strategies, traits, and disciplines of legendary traders like George Soros and Paul Tudor Jones.

What Is a Forex God?

The term “forex god” refers to traders who have achieved exceptional, almost mythical success in currency markets. These are individuals who consistently generate substantial profits, navigate market turbulence with apparent ease, and seem to possess an almost supernatural ability to read market movements.

In trading communities, calling someone a forex god is the highest compliment. It acknowledges mastery over a market that humbles most participants—a market where 70-80% of retail traders lose money. The forex gods are the ones who’ve figured out what others haven’t.

But here’s what separates reality from myth: forex gods aren’t born with special powers. They’ve developed specific skills, habits, and mental frameworks through years of disciplined practice. Understanding what makes them different is the first step toward improving your own trading.

Legendary Forex Gods: The Traders Who Shaped Markets

Several traders have earned the forex god title through documented, verifiable success. Their stories reveal what’s actually possible—and what it takes to get there.

George Soros: The Man Who Broke the Bank of England

George Soros is arguably the most famous forex trader in history. On September 16, 1992—a day now known as “Black Wednesday”—Soros made over $1 billion in a single day by betting against the British pound.

Soros recognized that the British government couldn’t maintain the pound’s artificially high exchange rate within the European Exchange Rate Mechanism. While others saw stability, Soros saw an inevitable collapse. His Quantum Fund took a massive short position, and when the Bank of England finally abandoned its currency peg, Soros collected his billion-dollar payday.

What made Soros exceptional wasn’t luck—it was his “reflexivity theory,” which explained how market participants’ biased perceptions can create self-fulfilling prophecies. He understood that markets aren’t just about fundamentals; they’re about how people perceive and react to fundamentals.

Stanley Druckenmiller: The Strategist Behind the Trade

Stanley Druckenmiller worked alongside Soros at the Quantum Fund and was instrumental in executing the famous pound trade. But his track record extends far beyond that single event.

Druckenmiller averaged approximately 30% annual returns over 30 years—without a single losing year. His approach combined aggressive position sizing when conviction was high with strict discipline to cut losses quickly when wrong.

“The way to build long-term returns is through preservation of capital and home runs,” Druckenmiller once explained. He’d wait patiently for high-conviction setups, then bet big. Most of the time, he protected capital. When opportunity struck, he maximized it.

Paul Tudor Jones: The Market Timer

Paul Tudor Jones predicted and profited from the 1987 Black Monday crash, one of the most dramatic market collapses in history. His documentary “Trader” captured his process leading up to the crash prediction, cementing his legendary status.

Jones is known for technical analysis and understanding market psychology. He focuses on price action and market structure rather than fundamental analysis, believing that price tells you everything you need to know about supply and demand.

His risk management philosophy is often quoted: “Don’t focus on making money; focus on protecting what you have.” Jones never risks more than he can afford to lose on any single trade, preserving capital for opportunities that matter.

Andrew Krieger: The Kiwi Crusher

In 1987, Andrew Krieger identified that the New Zealand dollar was significantly overvalued following the Black Monday crash. Working at Bankers Trust, he took a short position reportedly larger than New Zealand’s entire money supply.

When the kiwi collapsed, Krieger made approximately $300 million for his bank in a single trade. The New Zealand government reportedly complained to Bankers Trust about the trade’s size—an indication of just how impactful one trader’s conviction can be.

Bill Lipschutz: The Sultan of Currencies

Bill Lipschutz transformed a $12,000 inheritance into $250,000 during college, lost it all, then went on to generate hundreds of millions in forex profits at Salomon Brothers. His career demonstrates both the risks of trading and the possibility of comeback after catastrophic failure.

Lipschutz emphasizes that missing profitable trades hurts more than taking small losses. He’s willing to be wrong frequently as long as his winners significantly outpace his losers—a risk-reward discipline that defines professional trading.

The Seven Traits of Forex Gods

Studying these legendary traders reveals common characteristics. These aren’t secrets—they’re well-documented disciplines that separate consistent winners from the majority who lose.

1. Emotional Control Under Pressure

Forex gods don’t panic. When markets move against them, they follow their plan rather than reacting emotionally. They accept that losses are part of trading and don’t let losing streaks affect their decision-making.

This emotional stability isn’t natural—it’s trained. Through experience and deliberate practice, elite traders develop the ability to detach their ego from individual trade outcomes.

2. Exceptional Risk Management

No forex god risks their entire account on a single trade. Most limit risk to 1-2% of capital per position, ensuring that even a string of losses won’t destroy their ability to trade.

Position sizing, stop losses, and portfolio diversification aren’t optional—they’re foundational. The goal isn’t to win every trade; it’s to survive long enough for edge to compound.

3. Patience and Selectivity

Elite traders wait for high-probability setups rather than forcing trades out of boredom or FOMO. They might only take a few significant positions per month, but those positions are backed by thorough analysis and conviction.

As Jesse Livermore said: “Money is made by sitting, not trading.” Forex gods understand that doing nothing is often the most profitable decision.

4. Continuous Learning and Adaptation

Markets change. Strategies that worked in 2010 may fail in 2025. Forex gods constantly study, test, and refine their approaches. They analyze their losses to understand what went wrong and their wins to understand what went right.

This commitment to learning extends beyond trading—elite traders study economics, geopolitics, market structure, and psychology to gain comprehensive market understanding.

5. Simplicity Over Complexity

Contrary to what many expect, most successful traders use relatively simple strategies. They might focus on one or two setups that they understand deeply rather than juggling dozens of indicators and patterns.

Complexity creates confusion. Simplicity creates clarity. Forex gods know exactly what they’re looking for and exactly what they’ll do when they see it.

6. Focus on Process Over Outcome

Elite traders judge themselves by whether they followed their system, not by whether individual trades made money. A losing trade executed according to plan is a success; a winning trade that violated rules is a failure.

This process focus creates consistency. Over hundreds of trades, following a proven process generates results regardless of short-term variance.

7. Independent Thinking

Forex gods don’t follow the crowd. They form independent opinions based on their own analysis and are willing to take contrarian positions when their research supports it.

Soros didn’t short the pound because everyone else was doing it—he shorted it because his analysis showed the peg was unsustainable while markets priced in stability. The ability to see what others miss is fundamental to exceptional returns.

Common Myths About Forex Gods—Debunked

The forex god concept has spawned numerous misconceptions. Understanding what elite trading isn’t helps clarify what it actually is.

Myth: Forex Gods Never Lose

Even the best traders lose frequently. George Soros has said he’s right only about 50% of the time. The difference is that his wins are larger than his losses, and he cuts losing positions quickly.

Expecting to never lose is unrealistic and dangerous. It leads to holding losers too long, hoping they’ll recover, and refusing to accept valid stop losses.

Myth: They Use Secret Strategies

There are no magic indicators or secret formulas. Most successful traders use well-known trading strategies—trend following, mean reversion, breakouts—applied with discipline and proper risk management.

The “secret” is execution and psychology, not strategy. A simple strategy applied consistently beats a complex strategy applied inconsistently every time.

Myth: They’re Always Trading

Many retail traders assume professionals are constantly in the market. In reality, elite traders often spend more time waiting than trading. They preserve capital during unfavorable conditions and deploy it aggressively during favorable ones.

Overtrading is a common retail mistake. Forex gods understand that not trading is a position.

Myth: They Predict the Future

Forex gods don’t predict—they react to probabilities. They identify situations where the risk-reward is favorable and position accordingly, fully accepting they might be wrong.

The difference between prediction and probability is crucial. Prediction implies certainty; probability acknowledges uncertainty while still allowing profitable decision-making.

Developing Forex God-Level Skills

While few will match Soros or Druckenmiller, any trader can improve by adopting their principles. Here’s a practical framework for development.

Start With Risk Management

Before focusing on entries and exits, establish strict risk parameters. Decide the maximum percentage you’ll risk per trade (1-2% is standard) and never violate this rule regardless of how confident you feel.

Risk management isn’t exciting, but it’s what keeps you in the game long enough to develop real skill.

Specialize Rather Than Generalize

Choose one or two currency pairs and learn them deeply. Understand what drives their movements, how they behave during different market conditions, and what your edge looks like in those specific markets.

Trying to trade everything results in mastering nothing. Forex gods typically have areas of specialization where their knowledge is genuinely deep.

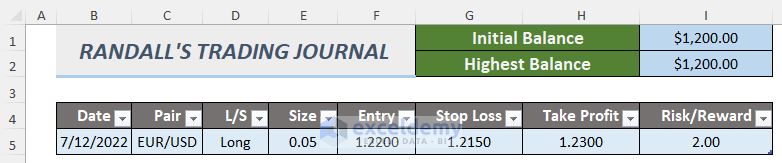

Keep a Trading Journal

Document every trade: why you entered, where your stop was, what happened, and what you learned. Review this journal regularly to identify patterns in your behavior and results.

Improvement requires feedback. A trading journal provides the data necessary for genuine self-assessment.

Practice Emotional Awareness

Notice when you’re feeling emotional about trades. Fear, greed, hope, and frustration are all signals to pause and return to your plan. If you can’t execute your plan objectively, you shouldn’t be trading.

Emotional awareness is a skill that develops with practice. The goal isn’t to eliminate emotions but to recognize and manage them.

Accept That Mastery Takes Time

No one becomes a forex god in months. Expect years of practice, losses, and learning before consistent profitability. The traders who succeed are the ones who persist through the difficult learning period.

Shortcuts don’t exist. Anyone promising quick mastery is selling something—probably something you shouldn’t buy.

The Infrastructure of Elite Trading

Forex gods don’t just have better strategies—they have better infrastructure. Execution quality, speed, and reliability all contribute to trading performance.

Why Execution Speed Matters

In fast-moving markets, milliseconds matter. A delayed order fill can mean the difference between capturing a move and missing it entirely. This is especially true for traders using technical setups with tight entry criteria.

Retail traders trading from home computers often experience latency of 100-500ms to broker servers. This delay introduces slippage and missed opportunities that compound over time.

The VPS Advantage

Serious traders run their platforms on Virtual Private Servers positioned near broker infrastructure. A forex VPS with 1ms latency executes orders 100x faster than a typical home connection.

Beyond speed, VPS hosting provides:

- 24/7 uptime—your platform never sleeps even when you do

- Stability—no interruptions from home internet issues or computer problems

- Consistency—same execution quality regardless of where you are

Infrastructure won’t make you a forex god, but poor infrastructure will certainly hold you back. Elite traders eliminate every preventable disadvantage.

The Reality Check

Becoming a forex god in the legendary sense—consistently generating millions in profits—is exceptionally rare. Most traders who achieve long-term success aim for more modest but still meaningful goals: consistent profitability, capital preservation, and gradual account growth.

The principles that create forex gods also create competent, profitable retail traders. Risk management, emotional control, continuous learning, and disciplined execution work at any scale.

Don’t measure yourself against Soros. Measure yourself against who you were last month. Improvement is the goal; legendary status is just a byproduct of sustained improvement over decades.

Frequently Asked Questions

Is becoming a forex god realistic for retail traders?

Achieving Soros-level success is extremely rare. However, the principles that make someone a forex god—risk management, emotional discipline, continuous learning—can help any trader become consistently profitable at their own scale.

How long does it take to become a successful forex trader?

Most traders who achieve consistent profitability report it took 2-5 years of active trading and learning. There are no shortcuts—mastery requires substantial screen time and deliberate practice.

Do forex gods use automated trading systems?

Some do, some don’t. Many successful traders use a combination of discretionary and systematic approaches. The key is using whatever method you can execute consistently and understand completely.

What’s the most important trait of a forex god?

Risk management. Every legendary trader emphasizes capital preservation. You can’t compound returns if you’ve blown your account. Protecting downside is more important than maximizing upside.

Can you become a forex god trading part-time?

You can become a profitable trader part-time, though reaching elite levels typically requires significant time commitment. Part-time traders often focus on longer timeframes (daily or weekly charts) where constant monitoring isn’t required.

How much capital do you need to trade like a forex god?

You don’t need large capital to apply the same principles. Risk management percentages scale—risking 1% of $10,000 uses the same discipline as risking 1% of $10 million. Start with what you can afford to lose while you learn.

Conclusion

The term “forex god” represents the pinnacle of currency trading achievement. Traders like George Soros, Stanley Druckenmiller, and Paul Tudor Jones earned this title through exceptional skill, discipline, and psychological control—not magic or luck.

While few will reach their level, every trader can benefit from studying their approach. Focus on risk management before profit. Develop emotional control. Keep learning and adapting. Simplify rather than complicate.

The path to trading mastery is available to anyone willing to put in the work. It’s not about becoming the next Soros—it’s about becoming the best trader you’re capable of being.

About the Author

Matthew Hinkle

Lead Writer & Full Time Retail Trader

Matthew is NYCServers' lead writer. In addition to being passionate about forex trading, he is also an active trader himself. Matt has advanced knowledge of useful indicators, trading systems, and analysis.