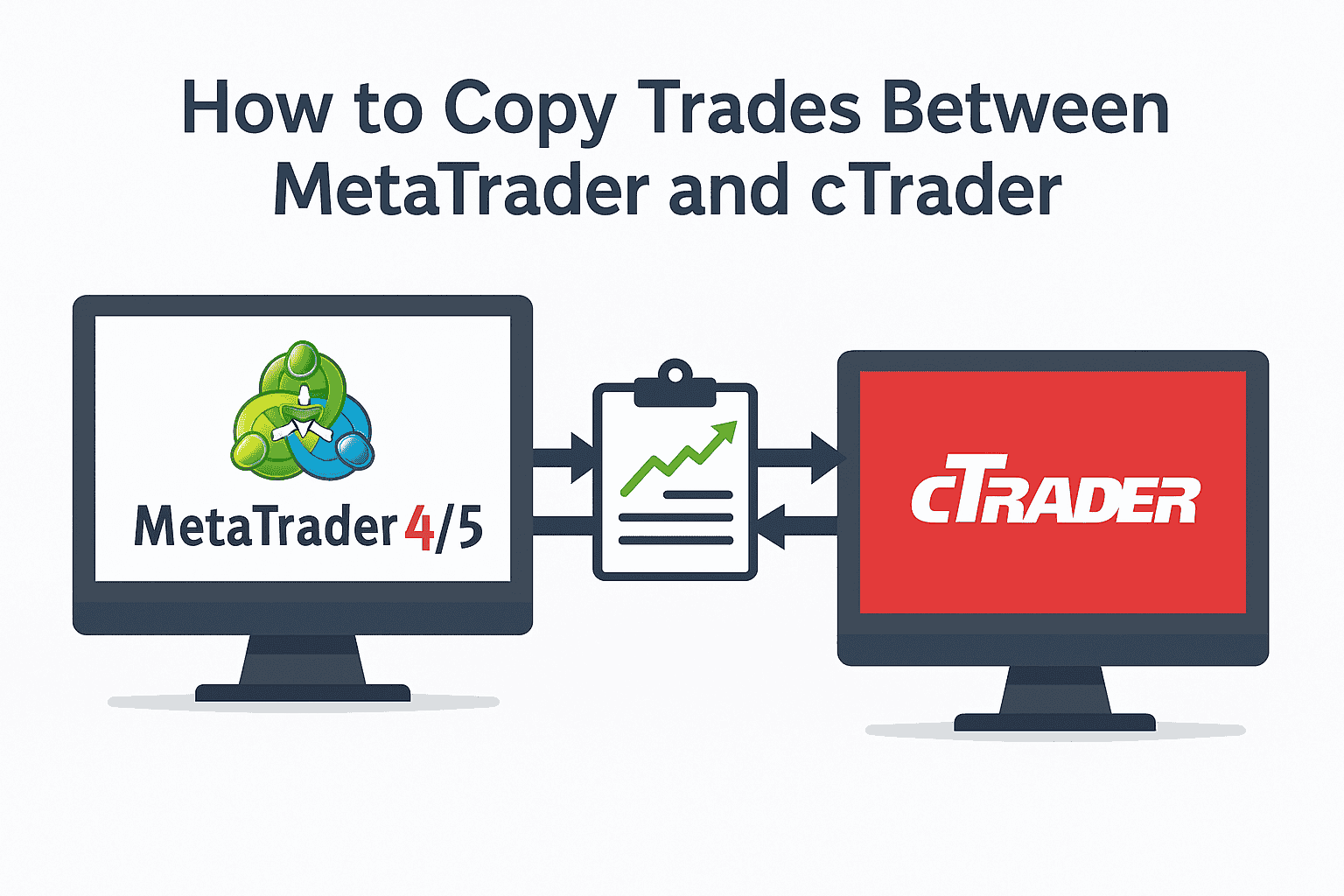

How to Copy Trades Between MetaTrader and cTrader (Full Guide)

Want to copy trades between MetaTrader and cTrader? Whether you’re bridging strategies across brokers, automating prop firm setups, or syncing […]

Want to copy trades between MetaTrader and cTrader? Whether you’re bridging strategies across brokers, automating prop firm setups, or syncing platforms for redundancy, this guide covers the best methods — from ready-made tools to custom API bridges.

Table of Contents

Why Copy Trades Between MetaTrader and cTrader?

Many traders use both MetaTrader (MT4/MT5) and cTrader across different brokers or strategies. Copying trades between them enables:

-

Running an EA on MetaTrader and mirroring trades to cTrader

-

Backtesting in MT5 while executing in cTrader’s modern interface

-

Trading across prop firms using different platforms

-

Splitting execution across brokers to reduce risk and downtime

Platform Compatibility: The Challenge

MetaTrader and cTrader are not natively compatible. They use different programming languages, order management systems, and APIs:

| Feature | MetaTrader (MT4/MT5) | cTrader |

|---|---|---|

| Language | MQL4 / MQL5 | C# / cAlgo |

| Trade Access | EA scripts (local client) | Open API (REST-based) |

| Automation Type | Desktop-based scripting | Cloud or API-based bots |

To connect them, you need a trade copying solution that acts as a bridge.

Method 1: Use a Trade Copier That Supports Both Platforms

The simplest solution is using a commercial trade copier that supports MetaTrader and cTrader out of the box.

Recommended Trade Copier Tools

1. Duplikium

Supports MT4, MT5, and cTrader using local plugins and cloud-based infrastructure. Ideal for running multiple accounts and brokers.

2. Social Trader Tools

Offers web-based trade copying with advanced filters, latency monitoring, and cross-platform compatibility.

3. FX Blue Trade Copier (with customization)

Widely used for MT4/MT5. Can be integrated with cTrader using additional scripts or middleware.

Advantages:

-

Minimal setup

-

Cloud-based reliability

-

No programming needed

Considerations:

-

Monthly or per-account fees

-

May introduce slight latency depending on provider location

Hosting your copier and platforms on a low-latency Forex VPS near your broker’s servers (e.g. LD4 or NY4) will significantly improve execution speed and reliability.

Method 2: Build a Custom Bridge Using APIs

For advanced users, building a custom trade bridge gives you full control.

Basic Architecture

MetaTrader Side

An EA or script detects trade actions and sends data to a server using HTTP or WebSocket.

Bridge Server (on a VPS)

Parses the trade signal, converts it into cTrader-compatible format, and calls the cTrader Open API to place or close trades.

cTrader Side

Executes trades via REST API. You’ll need to manage authentication, error handling, and order monitoring.

This method is suitable for developers comfortable with Python, Node.js, or using tools like n8n.

Key Benefits:

-

Full customization

-

No subscription costs

-

Precise risk and strategy control

Requirements:

-

VPS hosting

-

Secure storage for API keys

-

Solid monitoring and logging setup

Method 3: Signal-Based Copying via Telegram or Discord

This semi-automated approach works well for simple strategies:

-

MetaTrader sends trade alerts via Telegram or Discord

-

A bot listens for these alerts and places trades on cTrader using its API

This is useful for traders sending out manual or rule-based signals but doesn’t replace full automation.

VPS Recommendations

Trade copying relies on speed and uptime. A reliable VPS helps ensure:

-

Continuous platform uptime with no disconnects

-

Minimal latency to your brokers for faster execution

-

Secure and isolated environment for running trade copiers or APIs

Choose a VPS located in the same data center or region as your broker. NYCServers offers VPS plans optimized for LD4, NY4, and TY3 with sub-millisecond latency.

Best Practices for Cross-Platform Trade Copying

-

Thoroughly test in demo before going live

-

Match leverage, risk, and lot sizing rules across platforms

-

Log all trade activity and errors for transparency

-

Use dedicated VPS resources for trade copying to reduce conflicts

Conclusion

Copying trades between MetaTrader and cTrader is entirely possible with the right tools or custom setup. Whether you’re a prop trader, EA developer, or multi-platform investor, choosing the right solution depends on your technical skill, budget, and latency requirements.

If you’re looking to deploy a trade copier or build a custom integration, NYCServers can help you set it up on a low-latency VPS environment tailored for professional trading.

Need Help With Setup?

Our team can help you configure trade copying between MetaTrader and cTrader on our ultra-fast infrastructure.

About the Author

Thomas Vasilyev

Writer & Full Time EA Developer

Tom is our associate writer, and has advanced knowledge with the technical side of things, like VPS management. Additionally Tom is a coder, and develops EAs and algorithms.