How to Build Your Own Trade Copier Using the MetaTrader API

For serious traders managing multiple accounts, brokers, or platforms, a trade copier is a must-have tool. While there are many […]

For serious traders managing multiple accounts, brokers, or platforms, a trade copier is a must-have tool. While there are many off-the-shelf solutions available, building your own custom trade copier with the MetaTrader API gives you full control, lower latency, and the ability to tailor it to your specific needs.

In this guide, we’ll walk through how to build a basic trade copier using MetaTrader (MT4/MT5), MQL, and external APIs. Whether you’re a developer, prop firm operator, or algo trader, this will serve as a practical starting point.

Table of Contents

What Is a Trade Copier?

A trade copier replicates trades from one account (the master) to one or more other accounts (the slaves). It’s used to:

-

Mirror trades across brokers or platforms

-

Manage multiple trading accounts from one central EA

-

Offer trade signals or manage investor accounts

-

Split execution across regulated vs. offshore brokers

By building your own trade copier, you avoid third-party fees, gain full transparency, and can optimize for speed and customization.

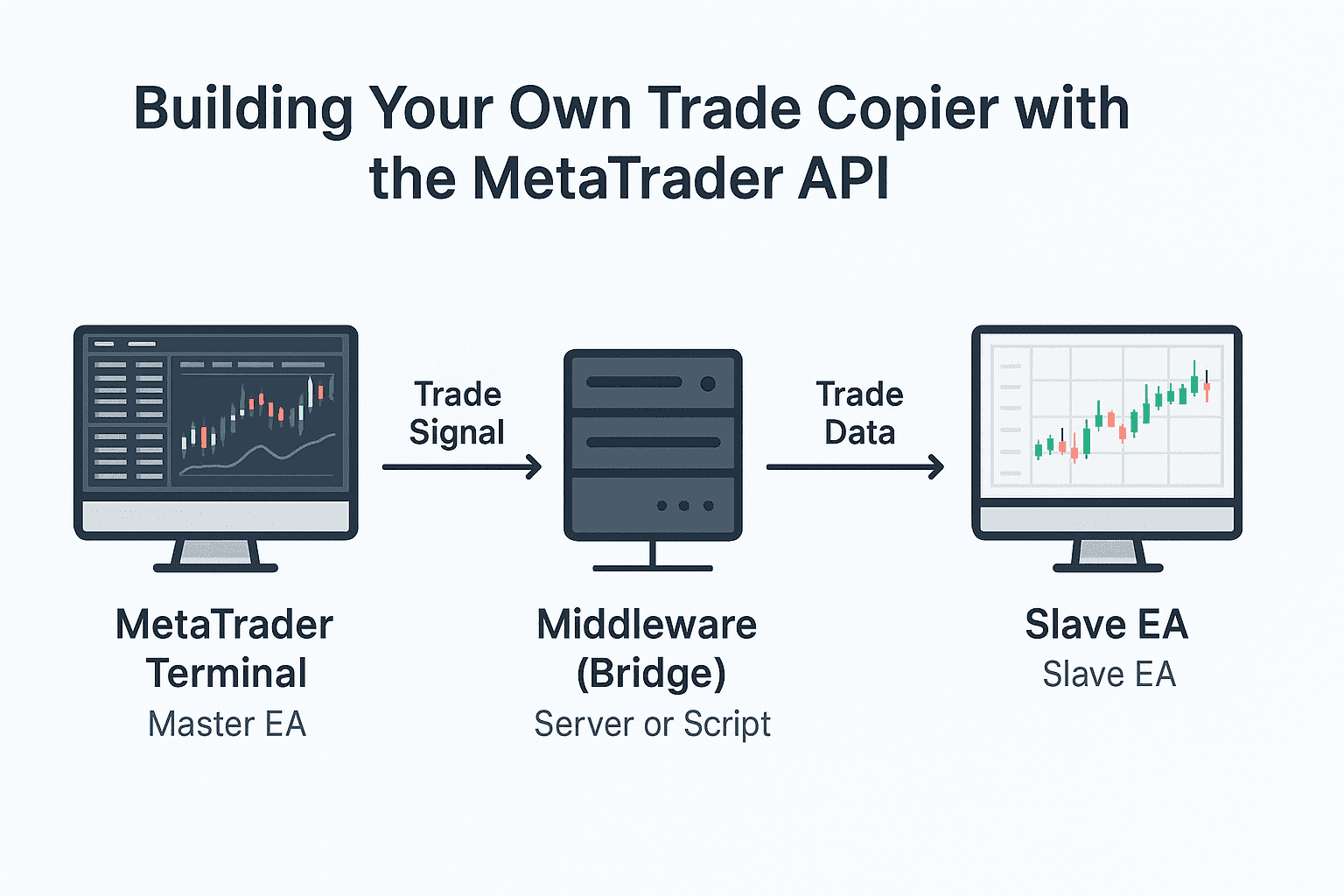

How a Custom Trade Copier Works

A typical MetaTrader-based copier includes:

-

Master EA (MetaTrader)

Detects trade actions (open, close, modify) and sends data via WebHook, file, or socket. -

Middleware (Bridge)

Receives trade signals and relays them to the target account/platform. -

Slave EA or API Target

Executes trades in the receiver account based on the received signal.

Tools and Technologies You’ll Need

-

MetaTrader 4 or MetaTrader 5 (preferably MT5 for better API support)

-

MQL5 or MQL4 for writing the EA

-

A VPS to host the master and slave terminals

-

Web server or middleware (Python, Node.js, or n8n for routing)

-

Optional: Database for logging signals and errors

-

Broker API credentials if targeting non-MetaTrader platforms

Step-by-Step: Build Your Own MetaTrader Trade Copier

Step 1: Create the Master EA

Your EA will monitor orders on the master account and send trade data when a new position is opened, modified, or closed.

Basic Logic in MQL5:

Step 2: Build the Middleware (Server or Script)

Your bridge or server receives trade data and relays it to the slave account.

Common tech stack:

-

Python Flask app to receive JSON

-

Node.js + Express for faster async handling

-

n8n for no-code/low-code workflows

Example pseudo-code in Python:

Step 3: Implement Slave Execution

You can write a Slave EA that reads trade instructions from:

-

A local file

-

Socket or TCP listener

-

HTTP request

-

Shared memory (advanced)

Sample logic (MQL5 pseudocode):

Optional: Cross-Platform Copying

If you want to copy trades from MetaTrader to cTrader, IBKR, or another platform, your middleware needs to:

-

Parse the MetaTrader trade

-

Format the order for the target platform’s API

-

Handle authentication and response validation

For example, you could:

-

Receive the MT5 trade via WebHook

-

Convert to cTrader Open API format

-

Place a REST API call from your VPS to the cTrader account

Tips for Building a Fast and Reliable Trade Copier

-

Use a VPS with low latency to both master and slave brokers

-

Minimize polling intervals (use event-based triggers where possible)

-

Use structured JSON for all trade data

-

Log all events for auditing and debugging

-

Match trading conditions (e.g., leverage, symbols, lot sizing)

Pros and Cons of Building Your Own Trade Copier

| Pros | Cons |

|---|---|

| Full customization | Requires programming knowledge |

| No monthly subscription fees | Maintenance and testing required |

| Low latency and private infrastructure | No support unless you build it |

| Cross-broker and cross-platform support | Complexity increases with scale |

Who Should Build Their Own Copier?

This solution is ideal for:

-

Prop firms managing trader accounts

-

Algo traders executing across multiple brokers

-

Signal providers distributing trades to clients

-

Traders needing custom risk filters or logic

Hosting Your Trade Copier on a VPS

You’ll need a fast and reliable VPS to:

-

Run your master and slave MetaTrader terminals

-

Host your WebHook or bridge server

-

Maintain 24/7 uptime with low-latency execution

Explore NYCServers VPS Plans →

We offer optimized locations (LD4, NY4, TY3) for cross-broker low-latency hosting — ideal for copier setups.

Final Thoughts

Building your own MetaTrader trade copier gives you unmatched control, speed, and flexibility. With the right VPS and codebase, you can create a system tailored to your exact trading needs — and scale it across accounts, brokers, or even platforms.

If you’re ready to go beyond one-size-fits-all solutions, this is the way to do it.

Need Help Setting It Up?

Our team can help you build and deploy a MetaTrader trade copier on your VPS — custom-configured, secure, and optimized.

About the Author

NYC Servers Team

Editorial Team

Our editorial team brings together expertise in forex trading, VPS hosting, and financial technology to deliver comprehensive guides and insights for traders.