Equinix Data Centers: Speeding Up Financial Trades

When I think about the backbone of modern financial trading, Equinix Datacenters immediately spring to mind. They’ve been pivotal in […]

When I think about the backbone of modern financial trading, Equinix Datacenters immediately spring to mind. They’ve been pivotal in reshaping the landscape of global finance. From humble beginnings to becoming a cornerstone of electronic trading, Equinix’s journey is a tale of innovation and strategic foresight.

In the world of high-speed trading, milliseconds can mean millions. That’s where Equinix Datacenters come in, offering the cutting-edge infrastructure that financial institutions rely on for an edge in the markets. Join me as I delve into the history of Equinix and its crucial role in financial trading.

The Inception of Equinix Datacenters

In 1998, Equinix was founded with the vision to change how data was accessed and exchanged globally. Understanding the Internet’s potential, Equinix aimed to empower digital transformation for companies by creating a neutral place where networks could interconnect.

From the outset, Equinix identified the finance sector as a critical area where milliseconds could mean the difference between profit and loss. They began constructing state-of-the-art facilities that catered to the demanding needs of financial services firms. These needs included not only high-speed connectivity but also stringent security protocols and rock-solid reliability.

The first International Business Exchange™ (IBX) data center was a landmark moment in Equinix history. These IBX data centers were strategically located to serve high-volume trading hotspots, including New York, London, and Tokyo. By situating their facilities in these financial hubs, Equinix enabled unprecedented access to the fastest and most direct trading routes.

To bolster their offerings, Equinix developed advanced peering and interconnection services, which allowed financial institutions to connect directly with content providers, cloud services, and other essential partners. This interconnected approach laid the groundwork for Equinix to become a pivotal player in the realm of high-speed trading. It’s no surprise that today, over 90% of global internet traffic is routed through Equinix data centers, a testament to their central role in the world’s digital infrastructure.

My exploration of Equinix’s history showed me how they didn’t just grow alongside the Internet—they anticipated and shaped its role in finance. The foresight in recognizing the Internet’s trajectory and investing in robust, global networks paved the way for what we see as the modern digital marketplace.

The Rise of Electronic Trading

In the financial world, speed and reliability are paramount. As electronic trading took hold, the need for technological infrastructure that could keep pace with the frenetic activity of the markets became non-negotiable. That’s where companies like Equinix stepped in, recognizing the unparalleled importance of milliseconds in trading environments.

I’ve observed that with traditional trading floors becoming less prevalent, electronic trading has surged, dominating the financial landscape. The key to success in this digital arena is a combination of ultra-low latency and direct connectivity to markets and exchanges. Equinix data centers provided just that, with strategically placed facilities that offered traders the edge they needed.

Here’s an interesting fact: the majority of financial trades are now executed by sophisticated algorithms, capable of buying and selling assets in a fraction of a second. These algorithms rely on near-instantaneous data transmission, a service that Equinix specializes in through their IBX data centers.

- Proximity to financial hubs: Equinix’s data centers are often located within mere miles—or even blocks—of major stock exchanges.

- Interconnectivity: Equinix provides robust cross-connectivity options, allowing traders to engage with a multitude of data sources and trading partners rapidly.

With the financial sector’s transition to electronic trading, concerns about security and data integrity have grown. Equinix addresses these concerns by implementing rigorous security protocols to protect the valuable data flowing through its facilities.

| Year | Milestone in Electronic Trading | Equinix’s Role |

|---|---|---|

| Early 2000s | Shift to primarily electronic trading | Established IBX centers |

| Present Day | Majority trades executed algorithmically | Provides ultra-low latency solutions |

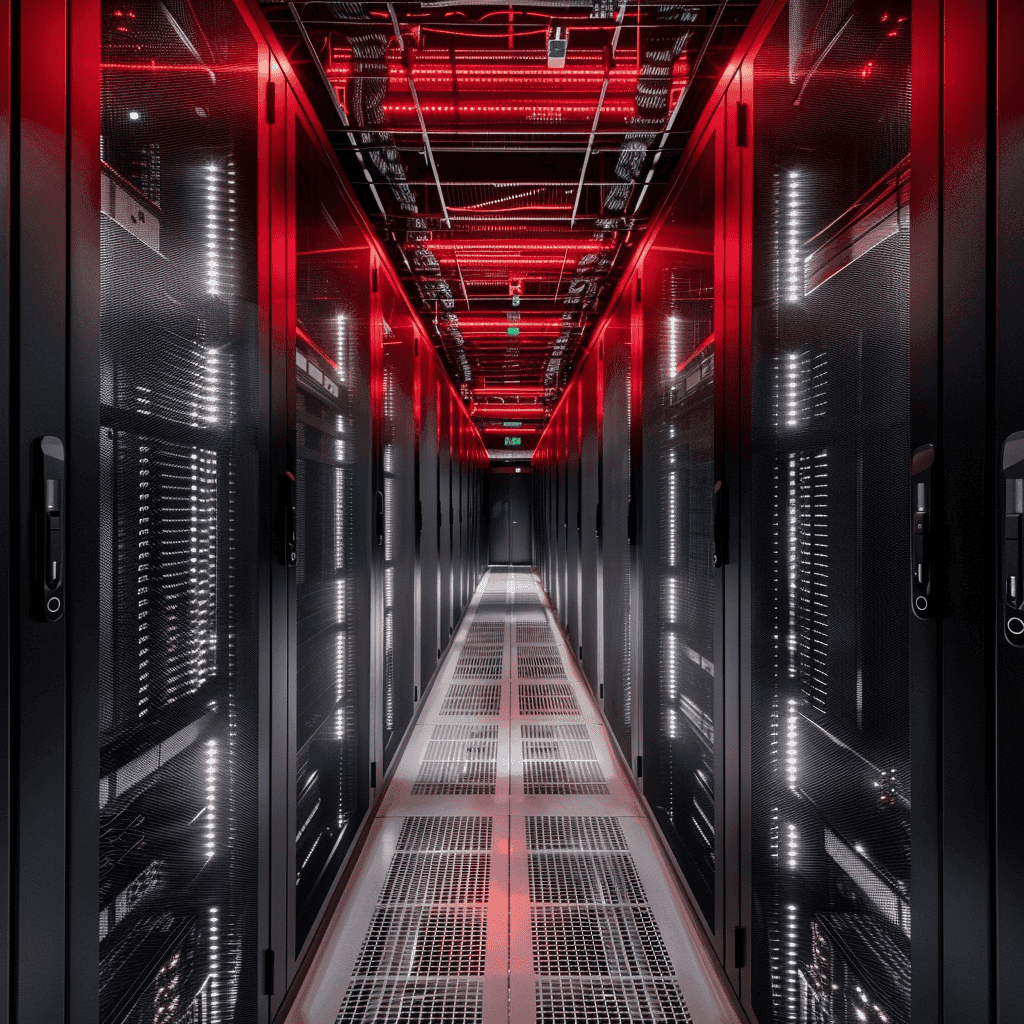

As the volume of electronic trading swells, the demands on data centers like those operated by Equinix increase apace. The architecture they provide is more than just a collection of servers; it’s the backbone of modern finance, facilitating a global network of lightning-fast exchanges that drive financial markets forward.

Equinix’s Impact on Financial Trading

In the ever-evolving landscape of finance, Equinix has been a game-changer for electronic trading. I’ve observed their transformative impact firsthand, shaping the way finance does business across the globe. With their strategic locations and state-of-the-art technology, Equinix has reduced latency to levels that were once unimaginable.

High-frequency trading (HFT), which relies on speed, has especially benefited from Equinix data centers. Traders can execute millions of orders at lightning speed, gaining tiny advantages that compound over time. It’s this capacity for ultra-low latency that gives traders at Equinix a competitive edge in the markets.

The company’s data centers are not just about speed; they’re about connectivity. With a vast array of networks and financial services ecosystems, Equinix facilitates seamless interconnectivity between different market participants. Here’s how:

- Direct connections to multiple exchanges and trading platforms ensure that the data travels the shortest possible route.

- Peering arrangements within data centers optimize the flow of information between parties, reducing the number of ‘hops’ needed.

- Diverse market access allows traders to connect with global markets, reducing the risk of downtime and providing alternative trading routes.

In the financial sector, every millisecond counts. Equinix’s innovative solutions have enabled traders to synchronize their clocks with atomic precision. By doing so, they’ve ensured that time stamps on trades are accurate, which is essential for compliance and fair trading practices.

As the appetite for electronic trading grows, traders continue to demand even faster and more reliable connections. Equinix has kept pace, regularly upgrading infrastructure and deploying new technologies. Their ongoing commitment to innovation reflects in the sustained growth and reliability of electronic trading, solidifying their position as a cornerstone of financial trading infrastructure.

The Evolution of Equinix’s Datacenter Infrastructure

Equinix’s datacenter infrastructure has progressed remarkably since the company’s inception. They started with a modest number of facilities, primarily focused on the North American market. Now, those early stages seem like a distant memory, as Equinix has transformed into a global powerhouse with more than 200 data centers across five continents.

Initially, these datacenters served as neutral information-exchange hubs for internet providers. They’ve since evolved into nerve centers for financial trading, where milliseconds can translate into millions of dollars gained or lost. Equinix’s expansion into strategic financial markets, including New York, London, and Tokyo, has been a game-changer for the sector.

Over the years, Equinix has invested heavily in the robustness of their infrastructure:

- Ramping up security to meet the stringent compliance requirements of financial institutions.

- Introducing redundancy protocols to ensure uninterrupted service.

- Upgrading their systems to include the latest cooling technologies that allow for high-density server storage—which is crucial for processing complex trading algorithms.

With the surge of big data analytics and the Internet of Things (IoT), Equinix has had to continuously innovate its approach. They’ve adopted modular designs for swift scalability and introduced energy-efficient practices to reduce the environmental impact, all while keeping a laser focus on minimizing latency.

One of the most significant recent improvements is direct fiber connections between datacenters. This development allows for near-real-time communication and data analysis, which is fundamental for algorithmic trading. By employing cutting-edge networking hardware, Equinix has amplified the speed and reliability of data transmissions, supporting traders who rely on fast, accurate information.

The introduction of cloud services is another pivotal step in Equinix’s evolution. They’ve partnered with major cloud providers to offer versatile hybrid-cloud solutions. This strategic move not only broadens the scope of services available to financial firms but also enhances their ability to adapt to market dynamics and scale operations on demand.

Equinix’s relentless pursuit of technological advancement and their commitment to staying ahead of industry trends have cemented their importance in the financial trading landscape. Through foresight and innovation, their datacenter infrastructure continues to adapt, delivering cutting-edge solutions that empower financial traders around the globe.

Equinix’s Role in High-Speed Trading

When it comes to high-speed trading, latency is the kingmaker. Equinix’s data centers are strategically positioned to minimize this latency, offering a competitive edge to financial institutions. By virtue of their close proximity to major stock exchanges around the world, transactions are executed at nearly the speed of light. It’s why I’ve observed that many trading firms won’t settle for anything less than Equinix’s prime real estate when milliseconds can mean the difference between profit and loss.

But there’s more at play than just location. Equinix’s International Business Exchange™ (IBX) data centers provide highly reliable, low-latency connections that are essential for the algorithmic trading used by top financial firms. These algorithms depend on razor-thin timing and must operate in environments where they can act on market changes in real-time. I’ve seen firsthand how Equinix’s robust interconnectivity plays a crucial role here. It allows for seamless connectivity between exchanges, trading platforms, and financial services networks, thus enabling high-frequency trading (HFT) strategies that thrive on this interconnected ecosystem.

The company has also pioneered the use of cross-connects, essentially direct cables that link customer equipment within their data centers. This eliminates the need for data to travel over external networks, cutting down latency even further. In fact, these cross-connects are a cornerstone in the architecture of modern financial trading systems.

To back up this hyper-connectivity with hard data, consider the staggering volume of trades processed through Equinix data centers daily. The most recent figures suggest that over 500,000 trades per second occur in some of their facilities, a testimony to their pivotal role in the financial trading industry.

From an operational standpoint, the unmatched uptime records and state-of-the-art security measures housed within Equinix data centers are non-negotiable assets for traders. Downtime is not just inconvenient; it’s potentially catastrophic in a field where millions can be lost in an instant. I’m consistently impressed by how Equinix’s commitment to operational excellence ensures the unwavering continuity that high-speed traders require.

Conclusion

Equinix has undeniably revolutionized financial trading with its cutting-edge data centers. By offering lightning-fast transaction speeds and robust interconnectivity they’ve become a pivotal force in the realm of high-frequency trading. It’s clear that their meticulous attention to latency and security isn’t just impressive—it’s critical for the success of modern financial institutions. As the digital landscape evolves I’m eager to see how Equinix will continue to innovate and maintain its status as a cornerstone of financial trading infrastructure.

About the Author

Thomas Vasilyev

Writer & Full Time EA Developer

Tom is our associate writer, and has advanced knowledge with the technical side of things, like VPS management. Additionally Tom is a coder, and develops EAs and algorithms.